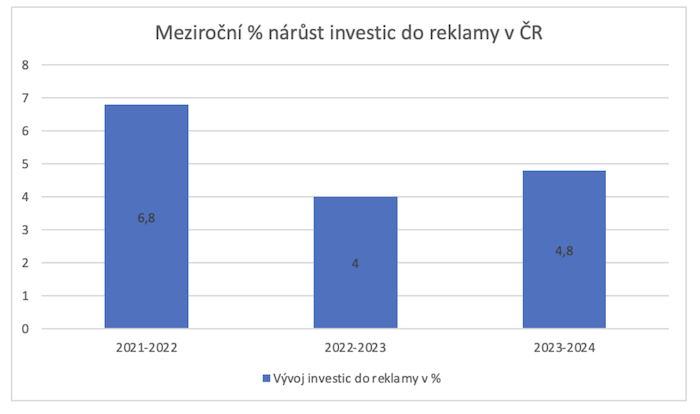

The marketing communications market in the Czech Republic is estimated at 136 billion. This is the expert estimate of the net marketing investment, according to research conducted by Nielsen for the Association of Communication Agencies (AKA). According to the research, investments will continue to grow this year by 4.8% year-on-year. Compared to expectations, this is a slower growth, but there is no question of stagnation.

This year's expected increase in advertising investment by CZK 6.3 billion is higher year-on-year, but a more significant increase was expected. Optimistic marketers expected an increase in the tens of percent compared to the pandemic period. But the situation was complicated by the war in Ukraine and the economic and energy crisis, among other factors.

From the marketing and advertising perspective, the Czech market follows the global situation, where advertising spending is 8.3%. The communications industry is one of the sectors with the largest share of human labour. The cost of professional human labour accounts for up to 50% of the industry's costs.

Source: 2022 Advertising Report, AKA

Source: 2022 Advertising Report, AKA"The total volume of the communications market in the Czech Republic continues to grow. Marketers expect the growth momentum to accelerate faster this year than in the previous year,"

says David Čermák, chairman of AKA's activation agencies section. Rather than slow growth, it is uncertainty in the long-term outlook that is troubling the communications industry.

The biggest increase in investment was in production

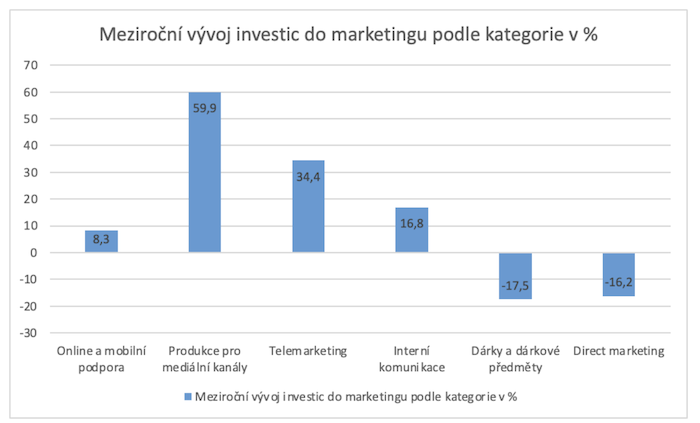

The Advertising Report says that projected marketing investment in 2023 is growing slightly in both media and non-media. The increase in media (6%) is double that of non-media. Most of the investment still flows into online and mobile support. However, the highest year-on-year growth in investment is in production for media channels.

"Growth in non-media channels, i.e. activation channels, is expected to be plus 3%. This growth in non-media channels will be driven primarily by shopper marketing, internal communications, telemarketing and campaign production. This is due to the clear trend of clients focusing primarily on sales promotion in the development of new campaigns," explains David Čermák.

Source: 2022 Advertising Report, AKA

Source: 2022 Advertising Report, AKAThe trend is AI, video content and influencers

Post-covid trends in marketing clearly speak in favour of cheaper and faster online activities, influencers and video content. "Artificial intelligence (AI) is gaining more and more ground. This is also the direction in which the current activities of the AKA will be heading, which will focus primarily on the AI phenomenon," commented Kateřina Hrubešová, Director of the AKA.

Overall media inflation will be 10 to 15%

The media market is stable, and there is also talk of growing investments. "TV inflation has returned to roughly the 2020 level. Given the position of TV in advertising budgets, it is expected that overall media inflation will be at a similar level, or in the range of 10 to 15%. It will not differ too much from market inflation (15.1%)," says Ondřej Novák, Executive Director of ASMEA. His words are confirmed by a comparison of the list value of advertising space between 2019 and 2022, which has increased by more than CZK 20 billion in three years.

The biggest investors remain the same

The ranking of the largest advertisers remains unchanged. Food chains invest the most in advertising by list price, steadily occupying a place in the top ten. The second strongest segment is banking and insurance, electronics and home appliances, pharmaceuticals and, more recently, leisure activities have broken into the top five. The increase in advertising of recreational activities is undoubtedly linked to the period of stagnation during the pandemic.

Lidl is the largest advertiser (28%), followed by Sazka (22%) and Kaufland (15%). Conversely, Alza has seen a decrease in investment among the top advertisers, but still remains in 6th place. The top 10 continues to include Albert, Simply You Pharmacauticals, Mountfield, Billa, HP Tronic Zlín and Henkel.

Source: mediaguru.cz