In 2023, Altman Solon analyzed the complex TV advertising ecosystem, which includes both linear and streaming Total TV, in both the U.S. and several of Europe's largest markets, including the U.K., Germany and France. Through surveys and in-depth interviews with executives at traditional broadcasters, pay-TV companies, streaming platforms, advertising agencies and brands, it has gained insight into investment trends and new revenue-generating opportunities for ad products, ad technology, new inventory and new ad formats.

In the February 2024 webinar, "Total TV Advertising Trends with Altman Solon," Daniel Weinbaum, Managing Director of Altman Solon's New York office, shared key findings from a comprehensive survey outlining the latest trends driving distributors, agencies and marketers, and focused on priority areas for internal investment, potential solutions to TV campaign challenges, criteria for streaming partnerships and other interesting insights.

The European ecosystem

The European TV market research revealed an ecosystem that is adapting to limited measurement and attribution capabilities within fragmented audience and data silos. There is a clear focus on growing advertising revenues through distributor and agency-led solutions that maximise campaign planning efficiency, empower buyers and prioritise innovative approaches to demonstrate ROI.

While European advertisers plan to increase spending on digital TV channels, they are not yet fully convinced when it comes to less traditional advertising formats (e.g. Shoppable TV technology, shorter interactive formats, etc.).

Priorities for advertising products and services

Although US and European distributors' investments in complex TV appear to be highly fragmented and targeted at different capabilities, one thing all distributors have in common is that they place the greatest emphasis on measurement.

In both the U.S. and Europe, a full 68% of respondents said that cross-platform measurement is a top priority for them. While in the US, the ability to better forecast and manage revenue came in second (32%), in Europe, self-service tools for campaign planning, optimization and reporting came in second (34%).

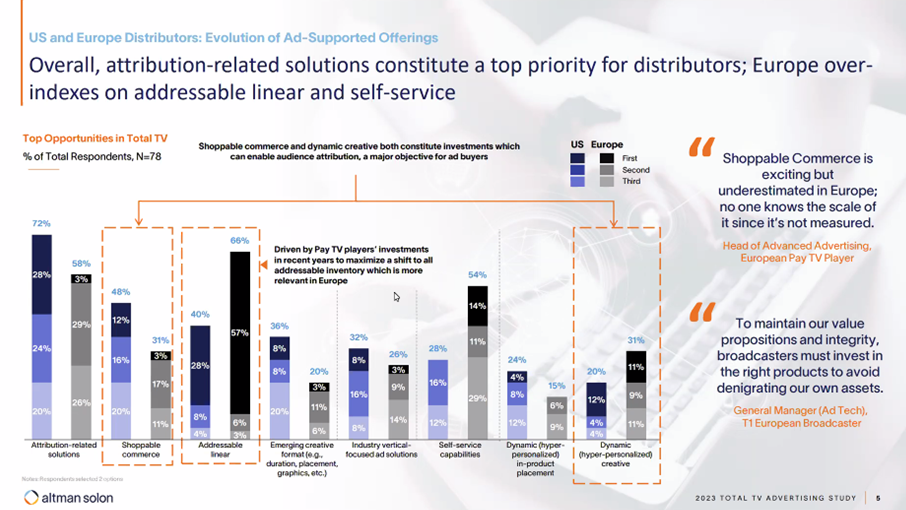

The biggest opportunities

While attribution-related solutions are an absolute priority for distributors in the US (72%), in Europe, addressability dominates linear TV (66%), followed by self-service tools (54%) by a slight margin.

European distributors continue to invest in self-service products to activate agency and SME ad buyers and be able to compete with similar social offerings from giants such as Meta and Google.

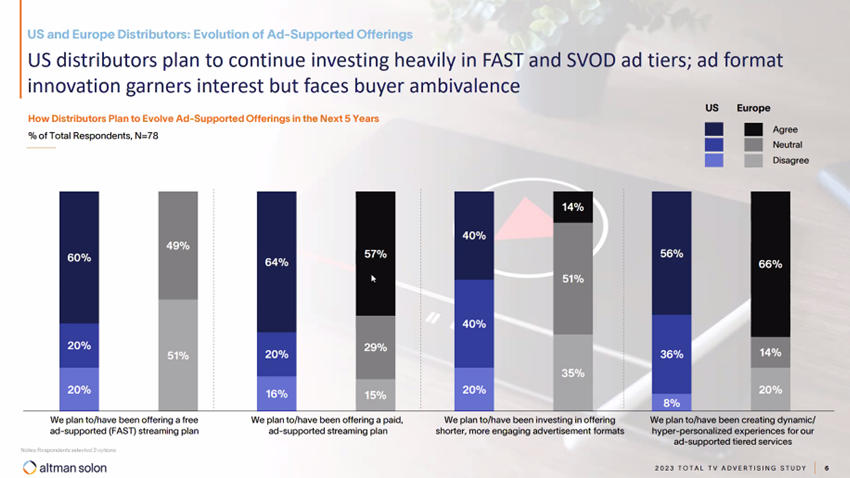

Distributors' plan for the development of ad-supported offers over the next 5 years

U.S. distributors plan to continue to invest heavily in FAST and SVOD at the individual level; ad format innovation, while enjoying some interest, is encountering a rather mixed reception from buyers so far.

European distributors are planning to invest in free ad-supported streaming (FAST). 51% of respondents are neutral, 49% are in favour of investment. 86% also plan to continue investing in paid ad-supported streaming products.

There is slightly less support for investment in offering shorter, more interactive formats that can enable direct response or Shoppable TV (only 14% are fully in favour, 35% are not in favour of such investment, with the remainder of respondents taking a neutral stance). These initiatives are still hampered by ad buyers who prefer more traditional ad formats. European distributors should therefore take an educational role and convince agencies of the value of new ad formats.

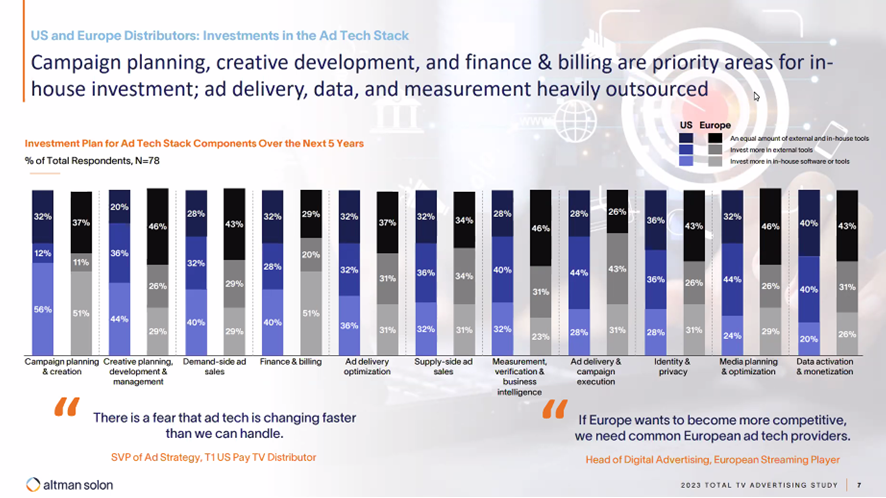

Investment in advertising technology

When it comes to investing in advertising technology, European distributors tend to spend on proprietary software and tools for unified campaign planning, financing and accounting, and ad delivery. In contrast, ad delivery, data and measurement are largely outsourced.

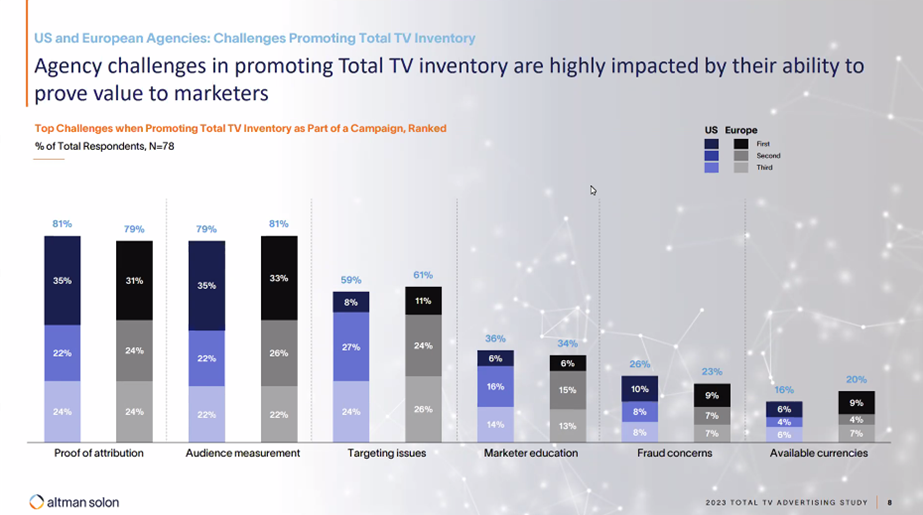

The biggest challenges for agencies in promoting the complex TV inventory as part of a campaign

The biggest challenge for agencies in the US is being able to convince marketers of value, with viewership measurement close behind, while in Europe it's exactly the opposite. The least of the problems for both US and European agencies are available currency, fraud concerns and marketer education.

The biggest opportunities for agencies to invest in complex TV

Dynamic, hyper-personalised ads are seen as the biggest opportunity for investment in complex TV in both the US and Europe. All agencies see new TV ad formats that incorporate dynamic and personalized creative and Shoppable TV features as the biggest opportunity to generate revenue within complex TV.

In the U.S., dynamic, hyper-personalised creative leads the way with 67%, followed by attribution solutions (50%), followed by Shoppable TV features (46%). In Europe, dynamic, hyper-personalised creative also leads the way, although with a slightly lower score (63%), followed by Shoppable TV, and attribution solutions and the new creative format share third and fourth place with identical 46%.

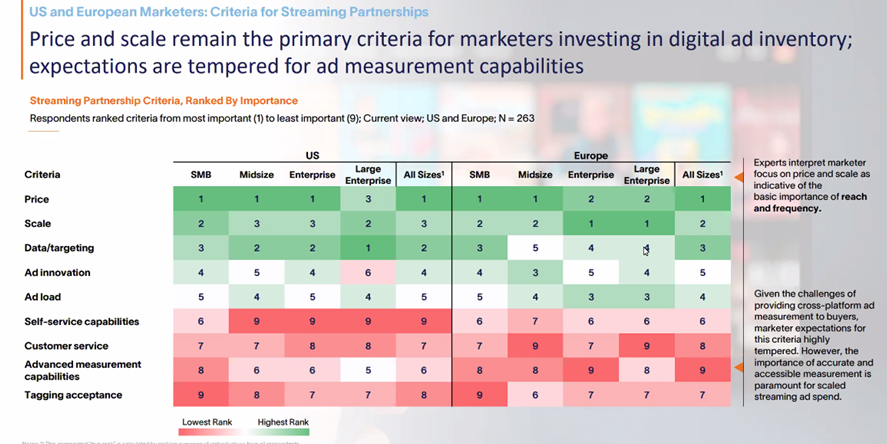

Marketers' criteria for streaming partnerships

The survey results are fairly consistent across businesses of different sizes. The main criteria for marketers investing in digital advertising continues to be price and scale, indicating a desire for cost-effectiveness and impact. Data/targeting and advertising innovation ranked third and fourth. In contrast, advanced measurement capabilities showed a relatively surprising result, finishing at the bottom of the rankings.

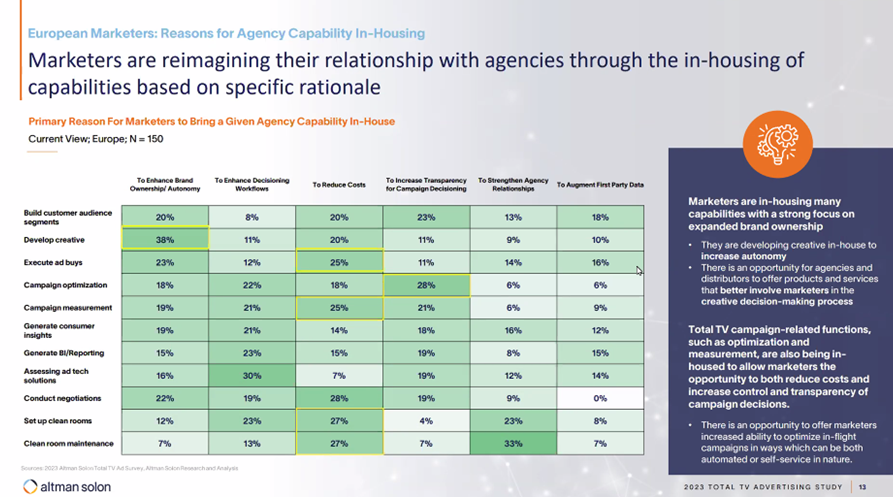

Marketers are changing their relationship with agencies and taking many activities into their own hands

Until now, marketers have worked with advertising agencies primarily to develop creative and buy advertising inventory. However, extensive research among European brands suggests that more and more companies are starting to carry out these activities in-house. In-house execution gives marketers greater autonomy, brand control and cost optimisation. Affordable creative technology licences have made it easier and cheaper for companies to produce broadcast-ready advertising content, which was previously the exclusive preserve of creative agencies.

Agencies and distributors can respond to the situation by offering marketers products and services that make marketers more involved in the creative decision-making process.

Similarly, functions related to complex TV campaigns, such as optimization and measurement, are beginning to be handled in-house by marketers. This allows them to reduce costs on the one hand and increase transparency in campaign decision-making on the other.

Agencies that want to cope with the change in status can offer marketers more options to optimize campaigns on the fly, through automated or self-service tools.

Source: egta Total TV Advertising Trends with Altman Solon, altmansolon.com