Regular viewing of international (non-English language) TV shows and movies has increased by 24% since the first quarter of 2020, among 18 to 64-year-olds in those countries. More than half (54%) of Internet users in these markets claimed to watch non-English language content “very often” or “sometimes”—up from 43% since the start of 2020. This is despite titles from primarily Anglophone markets like the U.S. typically making up the bulk of global streaming libraries, Ampere said.

Korean TV shows and movies have seen a 35% rise in frequent viewing in English-speaking markets in the last four years. Frequent viewing is up from 16% of 18 to 64-year-olds to 22% over the last four years, with titles including Squid Game and Parasite driving awareness of the high-quality shows and movies produced in South Korea. Netflix in particular has increased spend on TV shows and movies produced in South Korea.

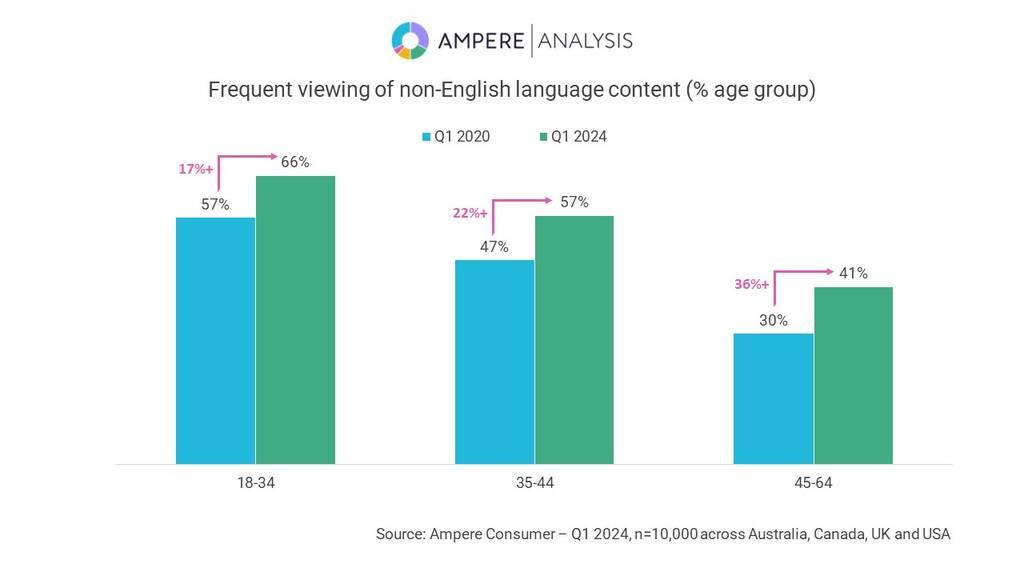

Foreign language content is particularly popular among 18 to 34-year-olds in English-speaking markets, with 66% of this age group regularly watching. However, growth is strongest among older age groups, with frequent viewing increasing by more than one-third among 45 to 64-year-olds in the last four years (up from 30% to 41%). The move towards foreign language content consumption by older consumers reflects growth in the adoption of streaming services, which offer greater volumes of international content than their broadcast counterparts.

When it comes to how viewers watch foreign language content, subtitling is most popular. More than one-quarter (28%) of people in English-speaking markets enjoy watching this way. In comparison, just under one-fifth (19%) enjoy dubbing.

The situation in non-anglophone markets is different, however, according to the researcher. While growth in interest in foreign language content is minimal, there is already a high baseline willingness to watch international content—with 88% of consumers regularly engaging with foreign-language TV shows or films.

The way foreign language content is watched also differs in some markets. In France, Germany, Italy, and Spain, there is a strong preference for dubbing, which is reflected in the availability of dubbed content in these languages on video services. Yet while certain markets show preferences for dubbed content, others—like the Nordic territories and the Netherlands—have a strong preference for subtitling. Ampere says this reflects a mix of the lower historical availability of TV shows and movies dubbed into local languages, but also—in many cases—strong English-language skills.

“The increased viewing of international programming in English-speaking markets shows that as content producers diversify production regions, viewers are ready and willing to transform their viewing habits,”

said Annabel Yeomans, Research Manager at Ampere Analysis. “This offers multiple advantages for streamers facing economic pressures. They can investigate markets with lower production costs and focus on productions in newer streaming markets to grow subscriptions while catering to their existing subscriber base. Developments in AI technology for subtitling and dubbing make it easier than ever for platforms to offer TV shows and movies on a global scale.”

Source: tvtechnology.com