egta, the European organisation of marketers from the TV, media and advertising solutions industry, surveyed CEOs and top executives last year on the occasion of the 2024 CEOs’ & Top Execs’ Summit - TV & Radio Session. The CEOs’ & Top Executives’ Summit is egta’s flagship annual event. It brings together more than 200 top executives from TV and radio companies across Europe and beyond, responsible for content monetisation, revenue optimisation and advertising sales on behalf of major broadcasters.

About the survey

The 2024 CEOs’ & Top Execs’ Survey addresses questions that offer valuable insights into emerging trends, top opportunities and challenges, competitive dynamics, and revenue forecasts that impact egta members’ strategies and businesses. CEOs and top executives from 74 television companies in 32 countries participated in the survey. What were the key findings?

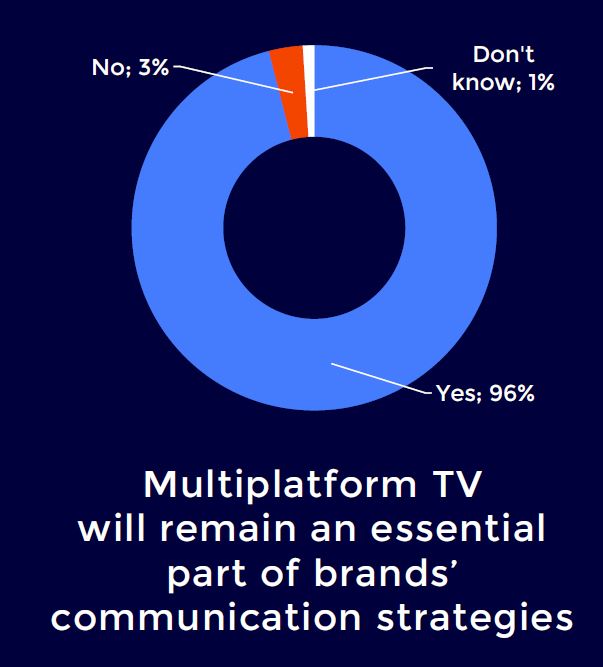

Multiplatform TV as a key factor of brand communication

Survey results show that 96% of CEOs and top executives believe that multi-platform TV will remain an essential part of brands’ communications strategies by 2030. Only 3 percent of respondents do not hold this view.

Source: egta 2024 CEOs’ & Top Execs’ Survey

Source: egta 2024 CEOs’ & Top Execs’ SurveyLaurent Bliaut, Deputy General Director at TF1 Publicité who began his tenure as the President of egta last year, said in an interview with egta’s TV Research Manager, Halli Oddsson, that we need to maintain reach and focus on improving the measurement of outcomes rather than just audiences: “Viewers are tuning in as frequently as before but for shorter durations. This consistent reach is what clients value most. In a landscape crowded with digital offerings and a long tail, the ability to provide quick and extensive reach remains our strength,” he said, adding that the ROI for TV is high compared to other media, and it is cost-effective too.

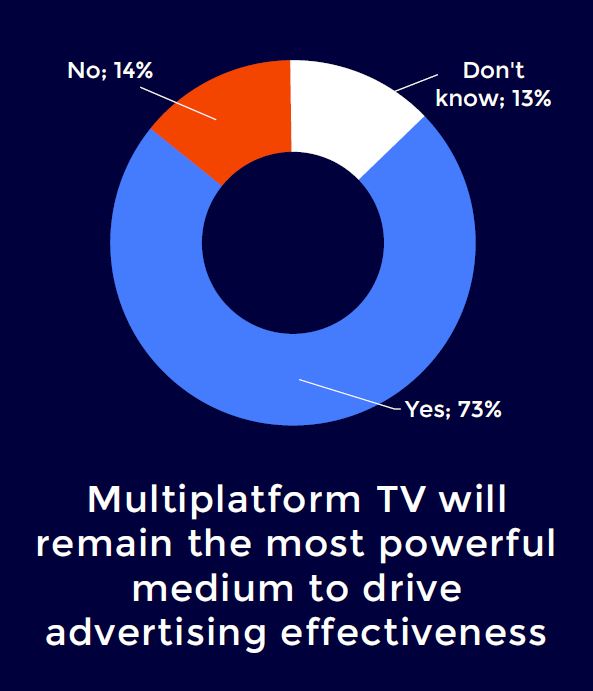

According to the survey, 73% of CEOs and top executives assume that by 2030, multiplatform TV will remain the most powerful medium to drive advertising effectiveness.

Source: egta 2024 CEOs’ & Top Execs’ Survey

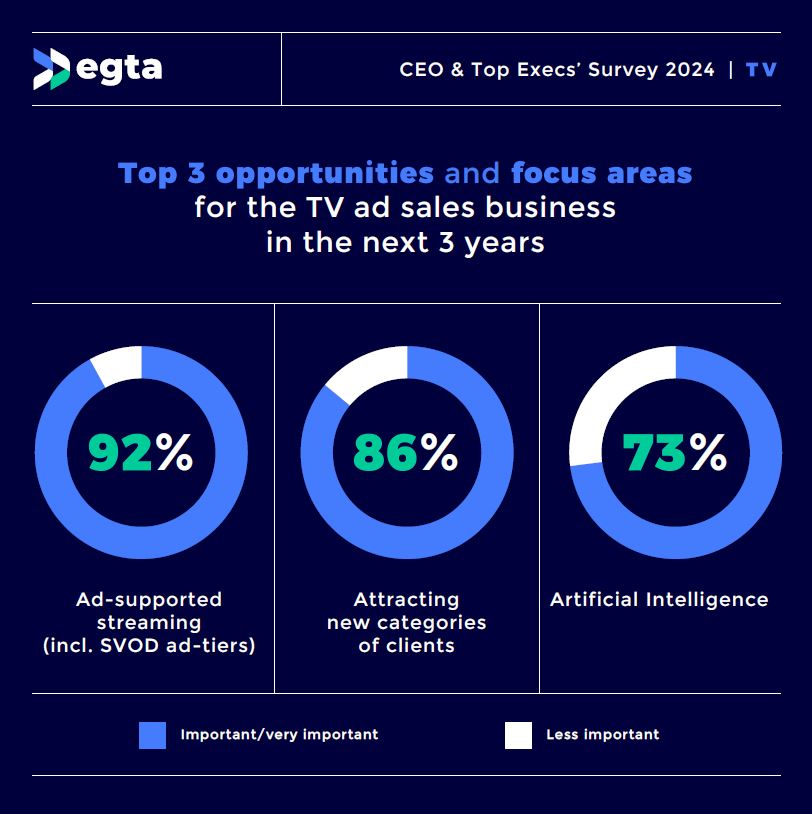

Source: egta 2024 CEOs’ & Top Execs’ SurveyKey opportunities for TV ad sales business

The survey identified three main opportunities to focus on over the next three years: ad-supported streaming (92%), attracting new categories of clients (86%) and artificial intelligence (73%).

Source: egta 2024 CEOs’ & Top Execs’ Survey

Source: egta 2024 CEOs’ & Top Execs’ SurveyOther development opportunities include:

• Addressable TV (72%),

• Partnerships and collaboration with other media companies (72%),

• Programmatic trading (70%),

• Data infrastructure (69%),

• SVOD (68%),

• Client self-serve platforms (planning, booking, reporting) (66%),

• Assisting advertisers in reaching all audiences through more inclusive and accessible advertising (65%),

• FAST channels (58%),

• Retail media (38%),

• Partnerships and collaboration with social media platforms (32%),

• Virtual reality and augmented reality (11%),

• Metaverse (7%).

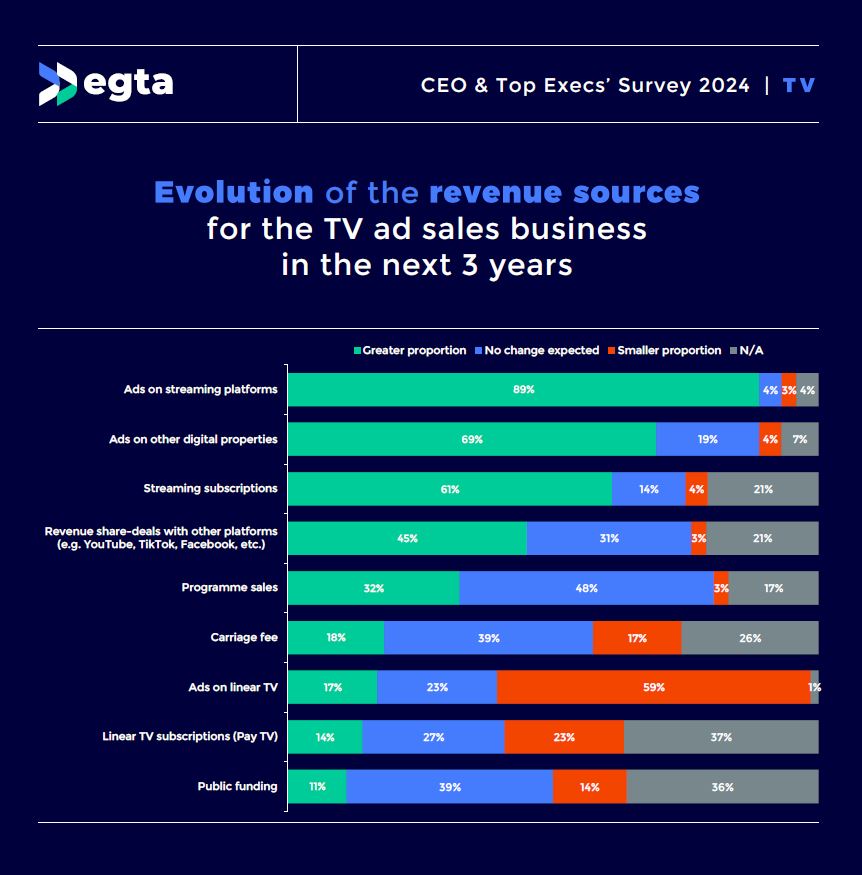

Evolution of the revenue sources for the TV ad sales business in the next 3 years

In the survey, top executives predicted that streaming revenues on average would increase from 9% in 2024 to 20% of total revenues by 2027, while linear TV is projected to decline from 83% to 70%. Laurent Bliaut commented on the projected decline in linear TV. “The future of linear TV will vary by country, as media consumption habits differ significantly across regions. It is very important to communicate to advertisers and agencies that the situation in Europe is not comparable to the United States. This is essential as many of our major clients are US-centric and assume that linear TV is declining fast as in the US.”

He went on to say that in countries like France, linear TV is still at 70% (compared to 50% in the United States) and there is similarly high consumption of linear TV in other countries like Italy, Spain and others. This means that even if there is a decline, it will not be as rapid or massive as in the U.S.

Source: egta 2024 CEOs’ & Top Execs’ Survey

Source: egta 2024 CEOs’ & Top Execs’ SurveyFuture challenges

According to Bliaut, it is essential to speak with a unified voice on audience measurement. One of egta’s primary roles in the coming months and years, he said, will be to ensure that all members are implementing cross-platform measurement solutions in their respective markets, taking into consideration the new egta Industry Charter.

In his opinion, we should consider our relationship with global players such as Netflix, Disney+ and Amazon. “These companies resemble us more than platforms like YouTube. They sell premium content with quality ad insertion. What they sell is nothing better than what we do, it is of equal quality but priced at a premium. We need to think strategically about how we collaborate with these players, as it can benefit everyone,” he said. “TV is still big. It is the biggest. What other platforms can deliver 90% reach in one week? We must be proud of ourselves and rethink how we tell our story,” concluded egta’s President, expressing his view of the results of 2024 CEOs’ & Top Execs’ Survey.

About egta

egta is the European trade association for marketers of advertising solutions across (multiple) screens and/or audio platforms, with the aim to help its members protect, grow and diversify their business around content edited and broadcast on a linear basis by their TV channels and/or radio stations.

egta’s members are media sales houses that commercially exploit the advertising space of commercial and public television and radio stations in Europe and other countries. The importance of egta lies in the diversity of its members: they are independent media sales houses or commercial departments within TV or radio companies. They include large companies and medium-sized companies in smaller markets.

Source: egta.com, linkedin.com/pulse