Linear TV is pursuing a slow decline, both in terms of viewing time and revenue generated, in the most advanced media markets worldwide. In Western Europe, it is still nonetheless the largest audience driver for video content.

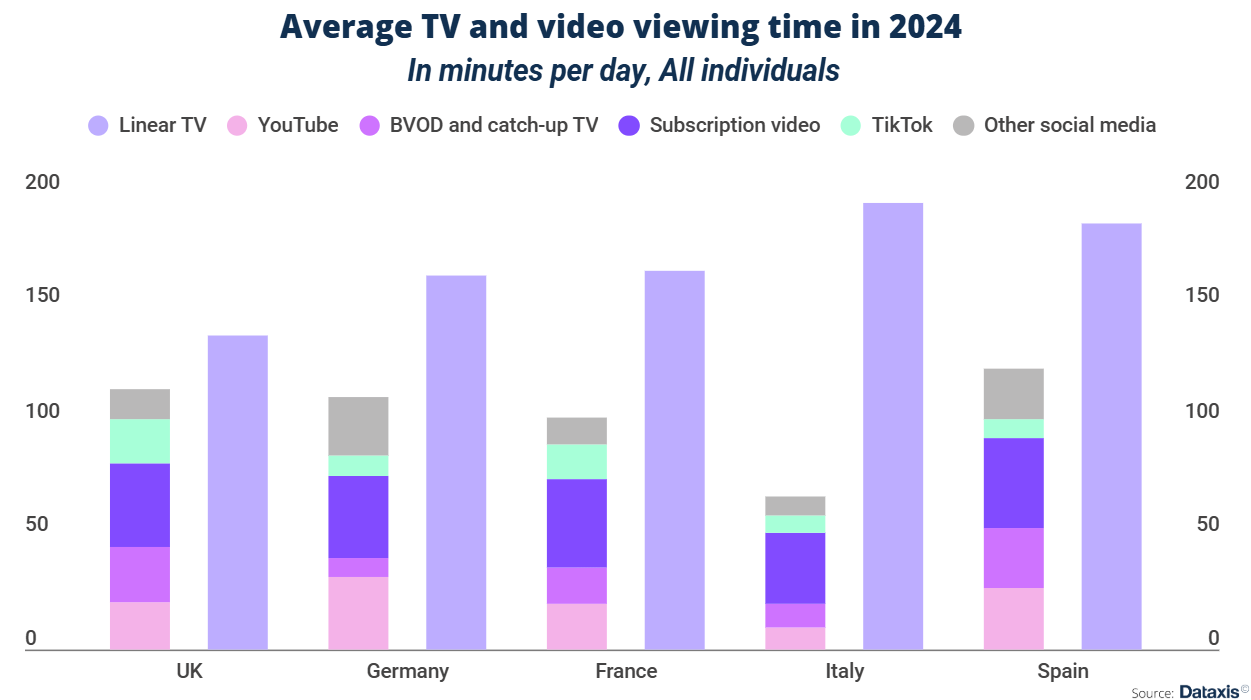

As a reference, audiences in the US spent on average 2h 30mn watching linear TV last year, which is about 15mn more than in the UK, but 15mn less than in France and Germany, and 30 and 40mn less than Spanish and Italian audiences respectively. The main difference between Western European and North American viewing habits comes from streaming and social media: digital video consumption surpassed broadcast TV in 2023 already across the Atlantic, while TV remains a key audience driver in the continent.

In 2024, TV accounted for around 60% of video consumption in France, Germany and Spain, and up to 70% in Italy. In the UK, a market where streaming services have largely stacked up and in which broadcasters have been at the forefront of the transition toward digital platforms, this figure drops to 55%, but this is still way ahead of streaming (under 25% for subscription video and BVOD combined).

Source: Dataxis

Source: DataxisDespite its relative resilience, TV is nevertheless getting distanced by digital video across all European markets. Audiences across France, Germany, and Italy watched TV 45mn less on average in 2024 than 5 years ago. In the UK, this drop is even more significant with a 55mn gap in daily TV viewing time between 2019 and last year. Spanish TV has been more resilient and only saw a decline of less than 30mn over the same period.

Meanwhile, subscription OTT consumption is entering relative stagnation when compared to other digital video segments: it only progressed by slightly more than 2% in the UK year-on-year, against 4% in Spain and Germany. This figure progresses faster in France and Italy. Over the same period, all 5 markets have seen double-digit growth in BVOD consumption, reflecting a strong shift from their domestic audiences towards consuming TV content on digital platforms, yet still unable to compensate for the loss in viewership experienced by linear TV channels

Source: Dataxis.com