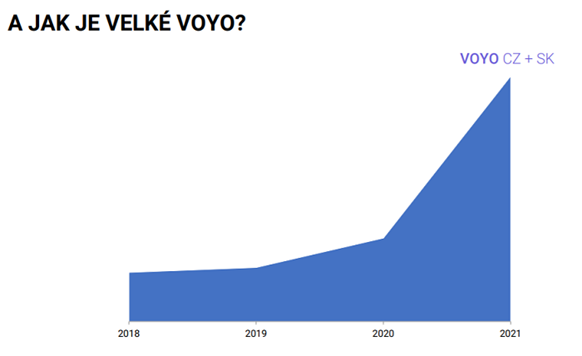

The number of subscribers to the pay video platform Voyo has been growing as planned, said the Head of Digital of CME and TV Nova, Daniel Grunt. In September, Voyo even exceeded its planned goal. However, Grunt did not disclose how many subscribers Voyo has at the moment. He only showed as chart to participants of the Czech Internet Forum conference (CIF 2021) without any figures, showing that compared to last year, the number of subscribers has approximately tripled (the last known figure for 2019 was about 30 thousand subscribers).

HOW BIG IS VOYO?

Development of Voyo subscribers, source: presentation of D. Grunt at CIF 2021

Development of Voyo subscribers, source: presentation of D. Grunt at CIF 2021According to the data presented, Voyo sees 88% active users per week who on average view more than ten hours a week. Previews account for 27% of audience, and 57% of viewing occurs through smart TVs. Unaided brand awareness of Voyo is 49% now (Netflix 47%) and the top of mind awareness is 29% (Netflix 30%). “It is the first step, this does not mean that people pay us,” he said. However, awareness supports service search, added Grunt.

Voyo has declared several times that its goal is to achieve one million subscribers in Czechia and Slovakia within five years. Voyo wants to be the most powerful player for the local premium content. But it is not going to compete with Netflix. “We want to operate side by side and rank among the top three SVOD services with Netflix and Disney+,” repeated Daniel Grunt.

Nova invests in the production of content intended for Voyo only and in a number of foreign acquisitions. It also develops its Voyo Originál offer where shows produced just for Voyo will concentrate. At the moment, the miniseries shot or being shot are Případ Roubal and Jitřní záře; other series are under preparation. Next year, a total of 12 titles is to be produced just for Voyo and in 2025, 30 programmes are expected to be made for Voyo only.

“We expect that 20% of Czech households will pay for some SVOD service by the end of the year, and within five years, the Czech SVOD market will at least double. In Scandinavia, 46% of households pay for SVOD services and in 2026 the proportion should increase to 80%,” said Daniel Grunt. He estimates the size of SVOD services in the Czech market at CZK 1.7 billion and the number of subscribers at 700 thousand. The size of the AVOD market is estimated at CZK 1.8 billion.

According to Nova’s experience, one household pays for 1.2 SVOD services on average in the Czech Republic. By 2026, the number of bought services should double.

Source: mediaguru.cz