An ad buyer considering connected TV has the option to buy from multiple sources, such as streaming device manufacturers, makers of smart TVs, content aggregators, programmatic ad exchanges and broadcast networks. This means the inventory is spread out in a way that makes it hard for any single channel, or provider, to deliver the kind of scale that advertisers are accustomed to with linear TV. So what’s the best way for marketers to deal with this issue? It depends whom you ask.

“The challenge if you go through a platform is you don't know exactly where your ads are running,”

said Mike Reidy, senior vice president of digital ad sales at NBCUniversal. “Yes, it could be connected TV inventory, but you don't know what network, you don't know what shows. So that's why we always tell our advertiser partners, if you start with the content publisher, you'll know not only what shows you're running against, but also which platforms you're delivering against in the connected TV ecosystem.”

However, Tom Fochetta, vice president of advertising sales at Samsung Ads, argued that rather than buying from multiple sources, ad buyers should look for products that have the ability to buy from multiple publishers through a single platform. With measurement being so bifurcated, inventory sources that sell access to multiple publishers can help ad buyers reduce the number of dashboards and measurement vendors they have to navigate.

Regardless of which approach advertisers use for buying connected TV inventory, piecing together an ad campaign in this field requires digital savvy and patience. This is because each connected TV inventory source has its own set of metrics and data-sharing policies. By comparison, TV advertisers are accustomed to relying on Nielsen ratings across large upfront inventory purchases.

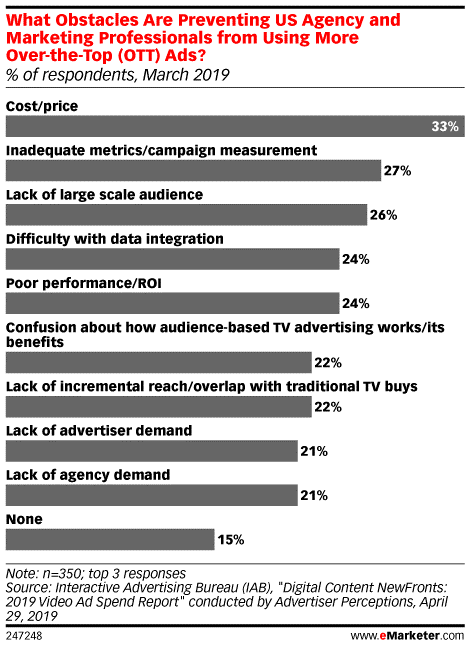

In a March 2019 poll of 350 US marketers conducted by the Interactive Advertising Bureau and Advertiser Perceptions, 27% of respondents said that inadequate campaign measurement was a top obstacle that prevented them from investing more in over-the-top (OTT) video ads. This was second only to cost/price.

(The terms "connected TV" and "OTT" are often used interchangeably in the ad industry. We define OTT as video that’s delivered independently of a traditional pay TV service, regardless of device. Connected TV refers specifically to video watched on a TV with internet connectivity. By these definitions, connected TV is a subset of OTT. Nevertheless, industry insiders and data providers often use the term OTT to refer to services that are geared primarily toward connected TV viewing.)

While the complexity of OTT and connected TV measurement stifles some marketers from investing more in those areas, others see measurement as an opportunity. Unlike with traditional TV advertising that has historically drawn from basic demographic data, connected TV measurement allows marketers to measure more granularly and tie viewing patterns to other online and offline behaviors.

Another issue with connected TV and OTT advertising is that it can be prone to ad fraud. While connected TV and OTT inventory demand is very strong, the supply of impressions is limited. This has created an opportunity for fraudsters to trick advertisers into buying inventory that does not really exist.

“One thing that would help with tracking video ad fraud is SSPs (supply side platforms) or content owners providing log-level data to advertisers,” said Marcus Pratt, vice president of insights and tech at ad agency Mediasmith. “That’s not something every advertiser or agency is necessarily going to want to analyze. But with some of the data that's contained within those logs, advertisers would be able to match that back to some of the characteristics and users they were targeting. That would be a first step to catch some of the more easily spottable fraud.”

The fragmentation in measurement and inventory sources can also make it more difficult for advertisers to avoid bombarding viewers with the same ad. This issue is not new to connected TV or OTT advertising, but it persists.

Source: emarketer.com