Advertising spending is growing globally, expected to increase 10.5% year-on-year this year to reach $1.07 trillion. This is according to a study by WARC, which compiled data from 100 markets around the world.

"The global advertising market has doubled in size over the past decade, with advertising investment growing almost three times faster than the rest of the market since 2014," says James McDonald, WARC's Director of Data, Intelligence and Forecasting. Moreover, ad spending is expected to continue to grow over the next two years - 7.2% next year and 7% in 2026 - to reach a total of $1.23 trillion.

From a regional perspective, North America will see the largest growth (+8.6%), mainly driven by political campaigns. Advertising spending there will rise to $348 billion this year. APAC will see 2% growth to $272 billion and Europe 5% to $165 billion.

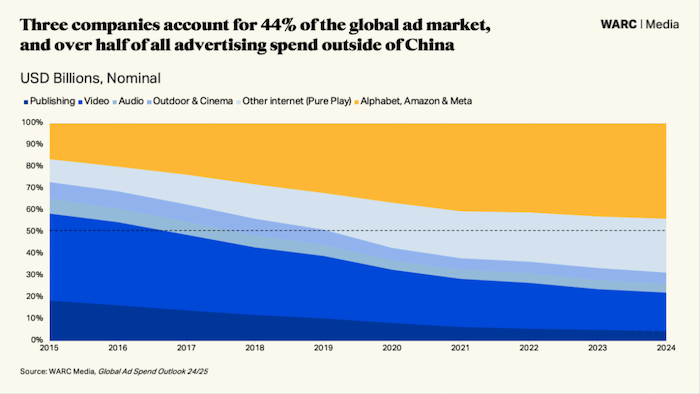

Less than half of the spending will be swallowed up by the trio of giants

As much as 43.6% of total spending this year will be claimed by a trio of tech giants - Meta, the company behind social networks Facebook and Instagram, Amazon and Alphabet, the umbrella company behind Google. Their share will rise to 46% in 2026.

Social media takes the biggest slice of ad spending, according to the study, raking in $241.8 billion and overtaking search advertising for the first time last year. In total, they account for 22.6% of the share and are expected to reach 23.6% in 2026. Meta takes most of this (62.6%), followed by Bytedance, the company behind the TikTok and Douyin apps (20.1%).

Search advertising claims a 21.8% share of total ad spend and is expected to reach a total of $223.8 billion this year. Its share has been growing consistently since 2013. However, further developments will be influenced by changes in purchasing decisions due to the impact of social commerce as well as the development of AI search. Google accounts for more than four-fifths of search spend (84%).

A quarter of ad spend (25.3%) goes to traditional media types such as print, radio, linear TV, cinema and outdoor.

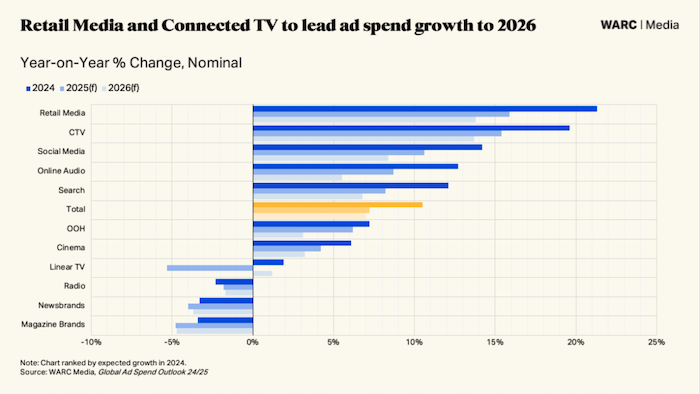

Future growth will be driven by retail media and CTV

Over 14% goes to retail media, which takes in a total of $152.6 billion, twice as much as in 2019. The biggest global player is Amazon, which holds more than a third of total retail ad spend (36.6%), exceeding a two-thirds share if China is not counted.

CTV is projected to have $35.3 billion in ad spend this year, a quarter of the size of the linear TV market, according to WARC. By 2026, CTV is expected to account for nearly a quarter (23.9%) of all video ad spending at $46.3 billion. Netflix is the largest streaming service provider with 277.6 million users, but it is unlikely to make more than $1 billion from advertising this year. By comparison, advertising on YouTube, which does not define itself as CTV, is expected to exceed $36 billion.

Source: mediaguru.cz