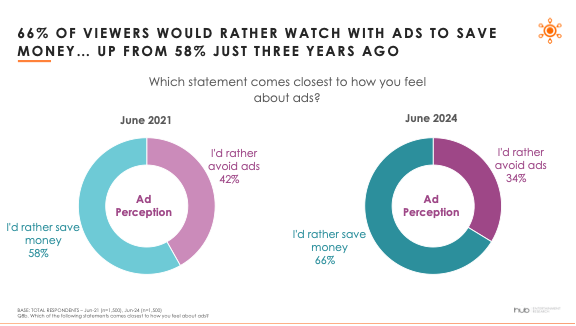

New data from Hub Entertainment Research found that two-thirds of TV viewers prefer watching ads if it saves on subscription costs. Over the past three years, the percentage of consumers expressing a preference for ad-supported subscriptions — if it saves them money — has increased to 66% based on a May survey of 3,000 U.S. consumers ages 14-74, who watch at least 1 hour of TV per week.

Hulu ranked tops among respondents familiar with streaming platforms offering lower-cost as-supported options, followed by Prime Video, Netflix and Peacock.

“Over the past few years, the video ecosystem has seen fundamental change, with nearly all of the formerly ad-free streamers adding a lower cost ad-supported tier,”

Mark Loughney, Hub senior consultant, said in a statement.

Loughney believes consumers have responded not by rejecting advertising or canceling subscriptions, but instead they are embracing the opportunity to save on their monthly subscriptions.

“By putting forth an overt offer of lower fees in exchange for watching a reasonable number of ads, the streaming services have given consumers a better value proposition,” he said. “As a result, the future of the streaming advertising marketplace looks very bright.”

Source: Hub Entertainment Research

Source: Hub Entertainment Research

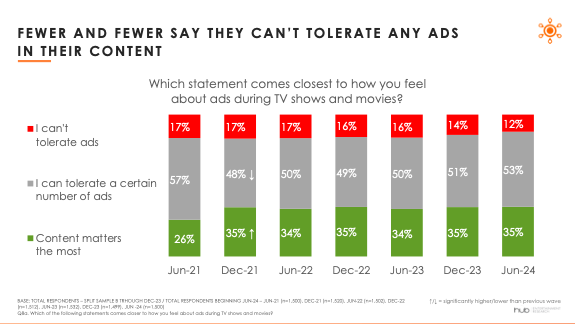

Source: Hub Entertainment ResearchConcurrently, the number of respondents who said they couldn’t tolerate ads dropped from 17% in 2021 to 12% in June 2024.

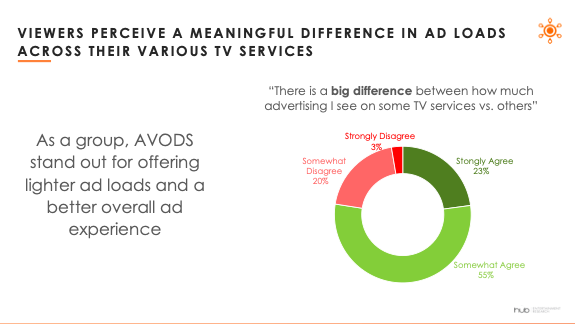

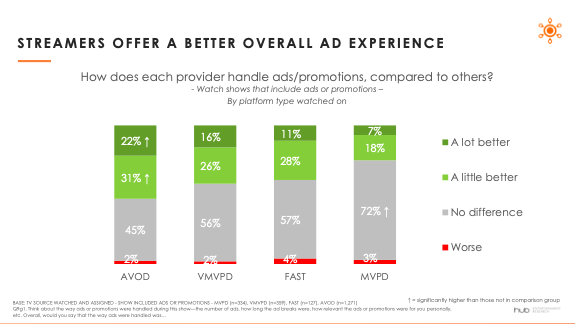

While consumers increasingly accept advertising in content as a way to reduce subscription costs, nearly 80% of respondents agreed that there are “big differences” in the amount of advertising presented on competing TV services. And among ad-supported streaming services, AVOD platforms are providing better ad experiences than free ad-supported streaming television and multichannel subscribers.

Source: Hub Entertainment Research

Source: Hub Entertainment Research Source: Hub Entertainment Research

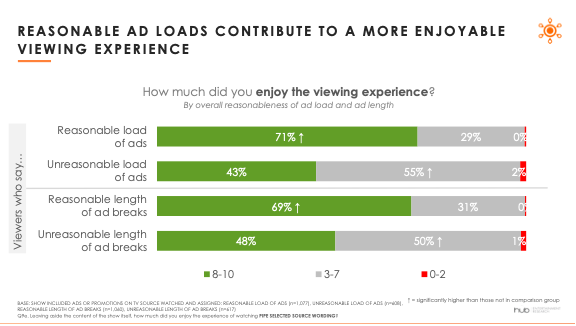

Source: Hub Entertainment ResearchHub found that the number of ads, as well as the length of the breaks contribute to how reasonable viewers rate the experience. And both factor into evaluations of the viewing experience.

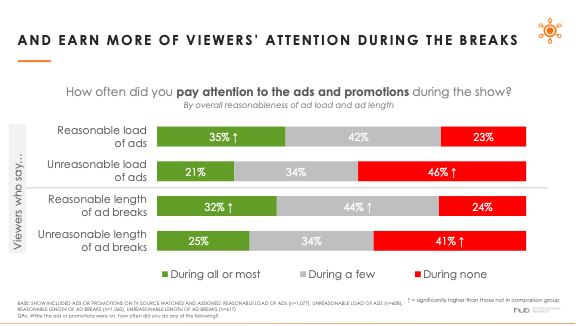

Reasonable ad loads are also instrumental in driving better outcomes for advertisers. When the breaks are shorter and contain fewer ads, viewers are significantly more likely to pay attention to the messages.

Source: Hub Entertainment Research

Source: Hub Entertainment Research Source: Hub Entertainment Research

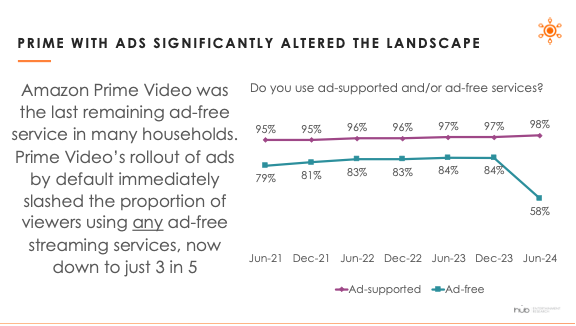

Source: Hub Entertainment ResearchThe launch of Amazon Prime Video with ads has had an immediate and substantial impact on ad viewing. The proportion of respondents saying they watch an ad-free SVOD tumbled since December from 84% to 58%, coinciding with the launch of advertising as the default on Amazon Prime Video.

Source: Hub Entertainment ResearchAlthough most of the major streaming services launched lower-cost ad-supported plans more than a year ago, substantial numbers of viewers remain unaware. A third or more of consumers say they don’t know about ad-supported offerings on Disney+, Paramount+, Max, and Discovery+, and a substantial minority incorrectly believe those services are strictly ad-free.

There is an obvious opening to grow the ad-supported tiers with marketing messages targeted to budget-conscious non-subscribers of these services.

Source: Hub Entertainment ResearchSource: mediaplaynews.com