Despite the proliferation of subscription streaming services in the streaming market, ad-supported streaming options continue to gain momentum, according to Horowitz Research’s "State of Viewing and Streaming 2021" report.

The findings call into question the perception that linear TV may have less of a role to play in the streaming world, which was initially dominated by SVOD services like Netflix that offered on demand content with no ads.

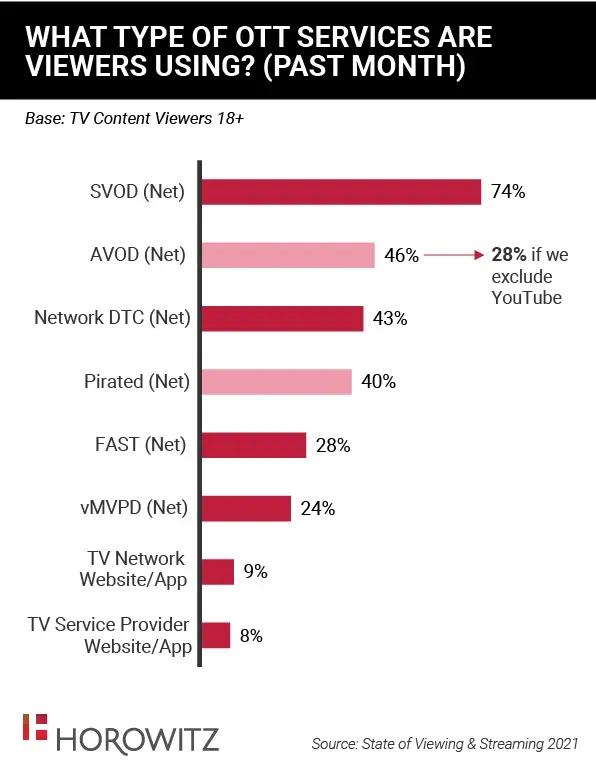

According to Horowitz, almost half (46%) of TV content viewers in the U.S. report used an ad-supported streaming service (AVOD) at least monthly, and a full 28% using a free ad-supported TV (FAST) service with ad supported linear channels in addition to their on-demand offerings.

Source: Horowitz Research

Source: Horowitz ResearchIn addition, consumers are using a wide range of ad-supported services with linear content. Pluto TV, Tubi, The Roku Channel app, and IMDb TV are the services consumers report using most often.

Ad-supported streaming services do not yet command the share of viewing enjoyed by subscription-based streaming services, a market dominated by original aggregators like Netflix, and a wide range of direct-to-consumer alternatives like Disney+, Peacock, and Discovery+, Horowitz reported.

However, the growth of these free ad supported TV services signals an important turning point for media companies struggling to adjust their business models to the streaming environment. Despite the explosive growth of streaming, linear (broadcast and cable) ad sales are still considered by most media companies to be their cash cow. This is due to the ongoing struggle to drive the same levels of revenue in the streaming environment, the report explained.

The Horowitz study also found that streaming is poised to eclipse traditional platforms in terms of share of viewing of long-form TV content.

Among consumers overall, the pie is split rather evenly: 35% of self-reported time spent is now spent on linear content delivered via a traditional service (cable, satellite, or over-the-air through an antenna), while 37% is spent on streamed content (the rest is spent on cable or satellite-delivered VOD, content that is DVR’d, or DVDs).

Among younger consumers, the picture is very different: a full 50% of time spent among 18-34 year olds is on streamed content, while only 18% of their time is spent with traditional, linear content.

As a result, the need to monetize TV content in the streaming environment as robustly as it had been monetized in the traditional environment is a matter of survival for media companies big and small in this new ecosystem, Horowitz explained.

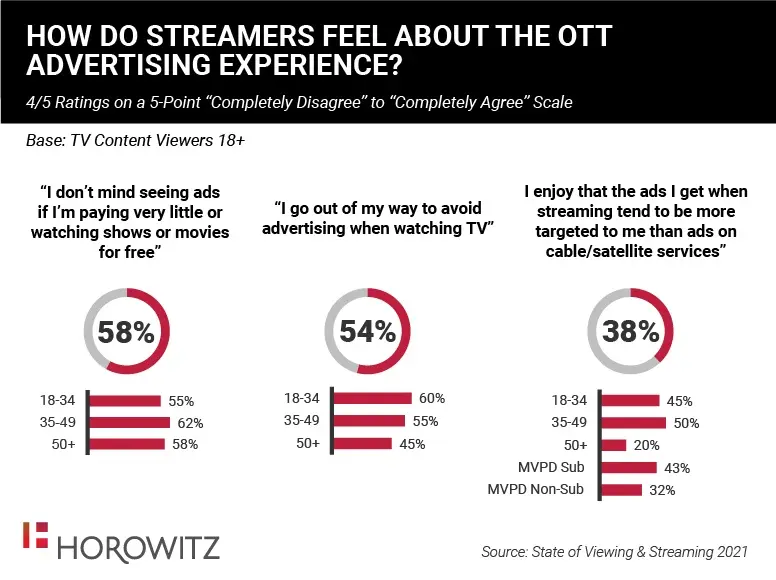

The good news is that consumers are very open to advertising in the streaming space—perhaps even more so than they were in the traditional, linear space, Horowitz found.

While about half of streamers go out of their way to avoid advertising when watching TV, there is more tolerance when watching content that is available for free (or at low cost). Six in ten (58%) streamers feel that ads are a fair “price” for being able to watch TV content for free (i.e., telling us they do not mind seeing ads if they are paying very little or watching for free). Moreover, almost 4 in 10 consumers are starting to notice- and appreciate—the more customized, personalized advertising experience they are getting through streaming.

“Consumers’ love for entertainment content—and their desire to get as much of that content as they can for as little as they can— hasn’t changed. The fundamentals of the industry haven’t changed,” notes Adriana Waterston, SVP of Insights and Strategy for Horowitz.

“What has changed are the expectations consumers have about how, where, and when they can consume the content they love, and the technology that exists to deliver those experiences. When delivered in the screen-agnostic, watch-anywhere, and highly personalized viewing experience of the streaming environment, we are seeing some consumers not just tolerating, but welcoming advertising, particularly when it is customized to their interests,” she added.

“State of Viewing & Streaming 2021” provides analysis of U.S. TV content viewers (people who watch 1+ hours TV/day), as well as key demographic and subscription segments. The survey was conducted online in May 2021 among 2,000 TV content viewers.

Source: Horowitz Research

Source: Horowitz ResearchSource: tvtechnology.com