Edition Five of The Payback Series from ThinkTV aims to show how to maximise return on investment by choosing channels with the ability to deliver positive ROI as well as short and long-term sales.

Speaking to Mediaweek, ThinkTV director of research Steve Weaver explained: “In the past we have put ROI on the map. More businesses should be thinking about the impact of a campaign in terms of how to improve the sales result. We don’t want to focus too much on the ROI number itself, as opposed to focusing more on the sales growth of a business.”

The latest findings offer media investment insights for advertisers planning a media spend starting at $500,000 through major investments of $100m or more.

The Payback Series is an Australia-first study that analysed the campaign performance of 60 brands with a combined annual media spend of $450m. The data examined was all pre-Covid.

Five Payback Series studies have been conducted since 2017 with the latest edition produced in partnership with GroupM Australia and global marketing effectiveness consultancy Gain Theory.

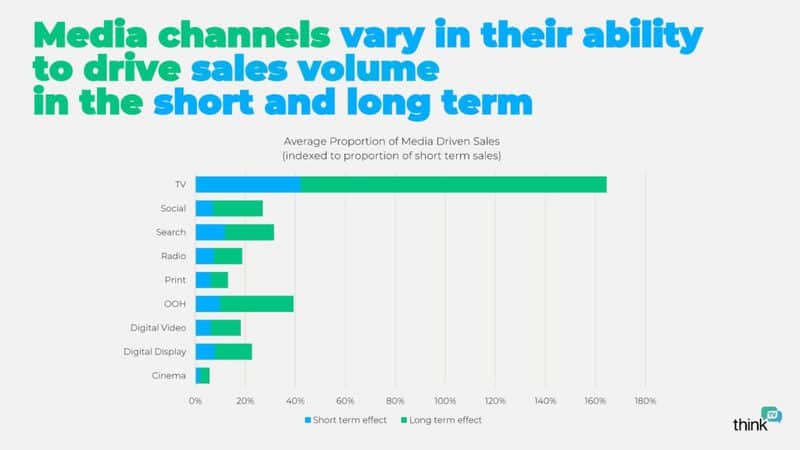

The headline finding is that for media buyers focusing on efficiency, TV gives a far better return on continuing spend.

The findings also highlight that TV has three times the growth opportunity than the next best option. When examining the average proportion of media-driven sales, TV was well ahead of the pack in short term and long-term effect. The next best, but some way behind, in short term was Search. Next best long term was Out of Home.

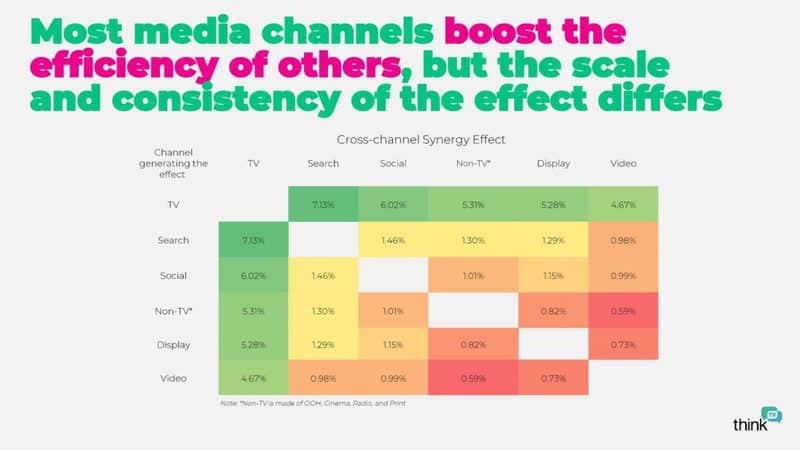

The best cross channel combination is using TV with Search.

The research analysed all the media channels and notes that out-of-home spend works best if the media budget is $5m or more.

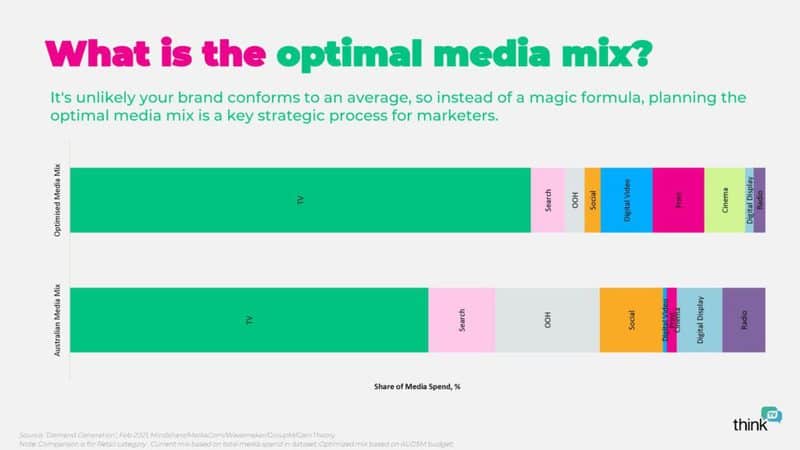

The optimal media mix indicates different percentages of TV spend. For $1m and under it is 40% or less, from $2m to $10m it is close to 50%, dropping lower again as the spend increases. Note that the dollar spend doesn’t drop on larger budgets, just the percentage of the total budget.

Payback over time

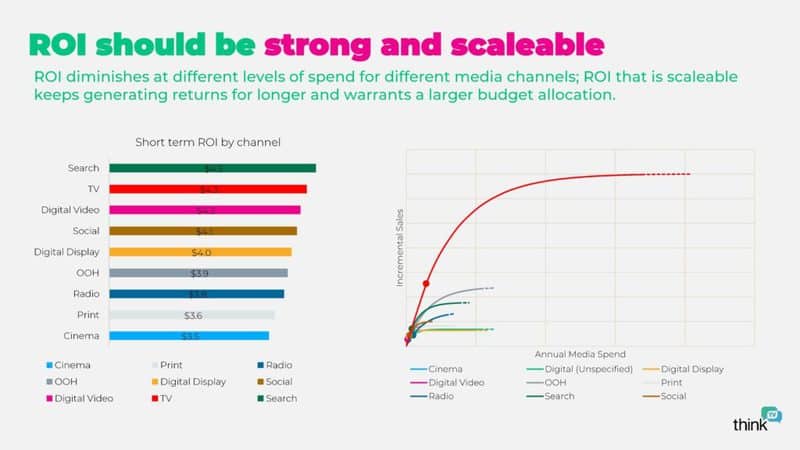

While most media channels deliver positive ROI, some channels generate sales for longer periods making the return on investment more valuable as the channel drives greater and sustainable business growth.

ThinkTV CEO Kim Portrate said of the results: “ROI is about the last thousand dollars you spent; scale-ability is about the next thousand dollars.

“If you invest in cheap channels based on ROI, and those channels don’t generate the right volume of sales before you start to see diminishing returns, you’re never going to grow brands. Other channels will be needed to make your media spend work the way it should.”

Specific findings

- Channels drive markedly different levels of demand. For example, where campaigns allocate, on average, around 18% of spend to out-of-home, this spend accounts for less than 16% of media-driven sales. TV, with an average of more than 50% media allocation, delivers more than 50% of media-driven sales.

- Channels with strong ROI may not sustain sales volume over campaign investment periods. For example, search has the strongest ROI but is one of the weakest media selections when it comes to generating sales beyond short-term timeframes.

- The rate of return for media channels differs and so too does the potential for sales growth. The rate of incremental sales for TV reduces more slowly than any other channel. This means increased investment in TV will improve ROI over time.

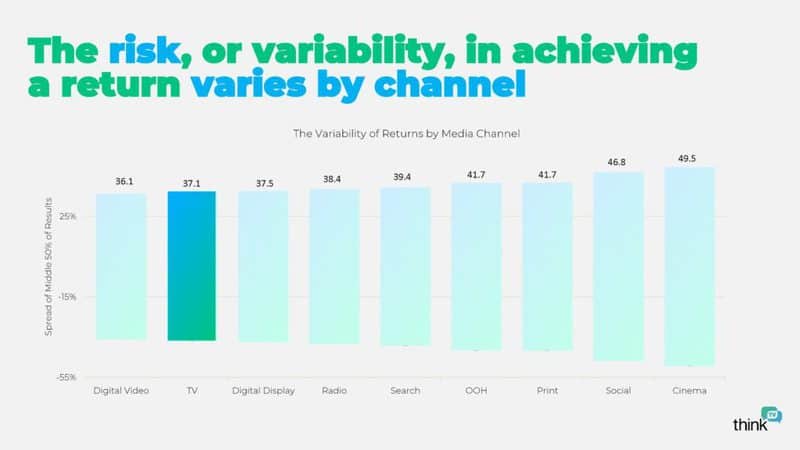

- The risk in achieving a return varies by channel with digital video the least risky channel and cinema the most. There is not a huge difference in the risk ratios, but the other one that stands out as higher risk is Social.

Unlike share portfolios, a higher risk media mix does not necessarily deliver better efficiencies or growth.

Portrate added: “Marketers have long been chasing the best return on investment for their campaign spend, but the research shows efficient ROI may not always be effective ROI.

“While ROI is important to all brands in all categories, not all ROI is equal. This research suggests a much-needed reassessment of channel selection is required to ensure campaigns are being optimised for maximum ROI and maximum sales impact over both short and long-term timeframes.

“And that’s where TV comes into the equation. TV has the strongest media-driven incremental sales of any channel and the capacity to scale up with the only limit the size of the viewing audience. With an average monthly reach of more than 20 million people, TV is hard to beat.”

Market impact of Covid: ‘TV is a real workhorse’

When asked about the turbulent market conditions in the past year, Portrate told Mediaweek: “Pre-Covid, TV offered significant certainty you are going to get the greatest return. TV is a real workhorse. What we have seen over the past 12 months is that doesn’t change with Covid. TV in the past has demonstrated less risk, more scale and better returns. We would only expect that would continue through and beyond Covid.”

Weaver added: “With disruption from Covid and lockdowns comes change in behaviour. It is a significant event that forces people to do things differently. When forced to vary your habits, you are open to change. It is an important time to have strong brand presence. There are more FMCG brands on TV this past year. They are spending money on mass-reach to keep awareness high.”

Source: mediaweek.com.au