Television industry marketing body ThinkTV has commissioned research from Kantar to help explain the options open to marketers if they need to trim budgets during 2023.

“If consumer spending contracts and inflation increases then marketers budgets can be put under pressure,” Think TV chief executive Kim Portrate told Mediaweek. “We wanted research to explain that if 2023 is a difficult year for the economy, and we think it might be, what can marketers do to get better value for their media.”

Portrate added the research was meant to help guide media spend so marketers could make choices between different channels. “We wanted to know the media multiplier effect so marketers could get more muscle from media without compromising the outcome. Kantar was able to identify the impact of individual [spends] on an outcome.”

Kantar head of media and marketing effectiveness Straford Rodrigues explained Kantar called on a database of 179 cross channel campaign studies. “We have measured actual campaigns that were in market to understand which media were contributing to brand outcomes. We wanted to know did it drive awareness, or the purchasing path that [the advertiser] wanted to achieve?

“The research covered about 180,000 individual survey responses. The responses covered a range of product categories from food and drink to utilities to retail etc. It also covered small to large brands with campaign ad spend on average just over $5m.”

Removing TV from the media mix will risk loss of brand impact

Removing TV from the media mix will risk loss of brand impactThe research investigated which media drives different parts of the brand funnel and how they worked together or as standalone media.

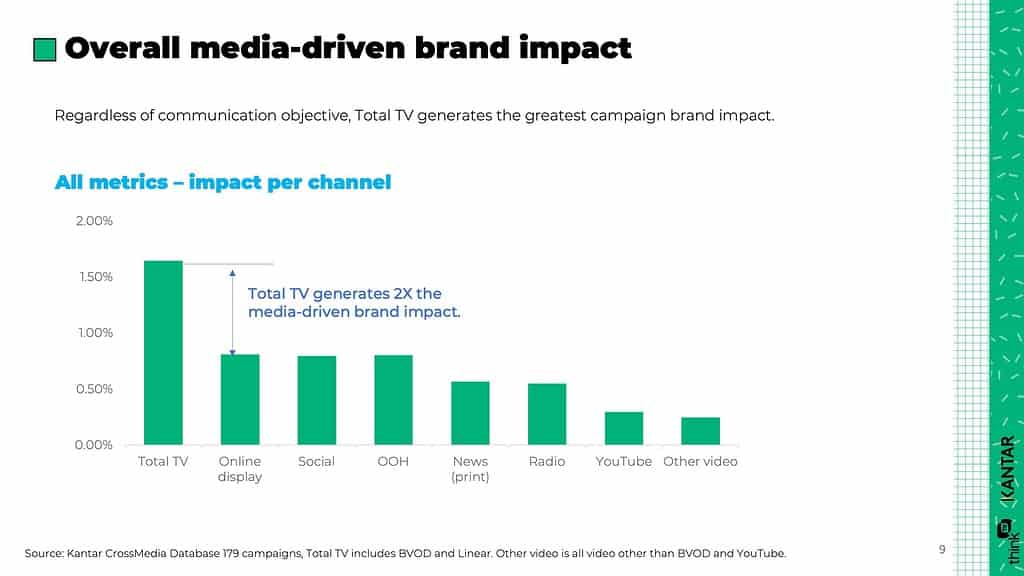

Rodrigues: “TV is doing a tremendous amount to drive the overall brand effects across the 179 campaigns. TV does a lot of this alone, but it does it a lot as well to set up the other media.”

Total TV delivers at the top and bottom of the marketing funnel

Total TV delivers at the top and bottom of the marketing funnel Total TV delivers at the top and bottom of the marketing funnel

Total TV delivers at the top and bottom of the marketing funnelRodrigues added Kantar data shows that total television delivers twice as much of the solus impact as the second best next medium.

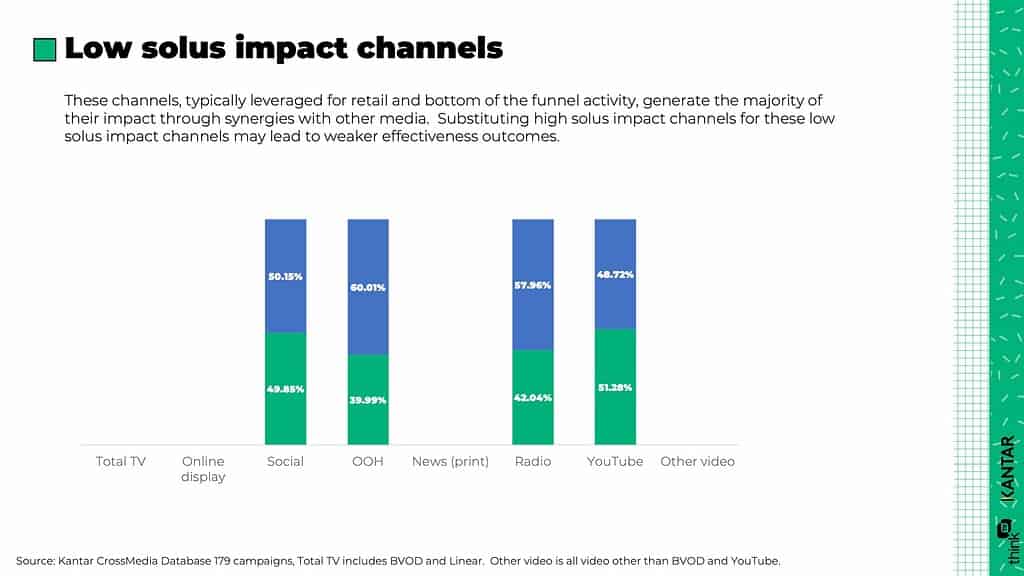

‘Some media platforms are much more reliant on media multipliers than others. On average, TV delivers 66% as a standalone. It also works well with other media to amplify further. To be heavily reliant on more interaction type channels does increase the risk of weaker outcomes.”

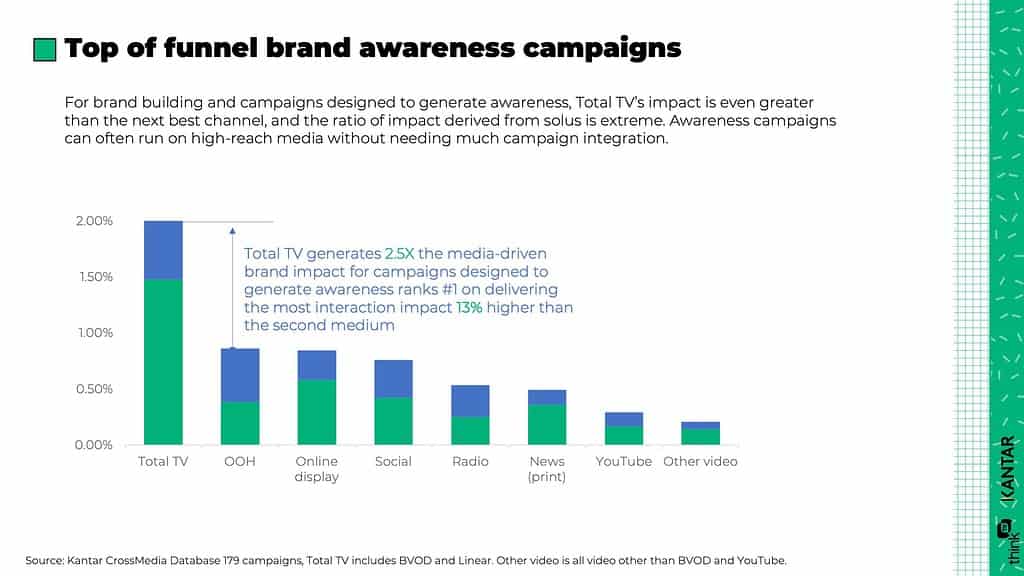

Awareness brand impact

Rodrigues: “Television is miles ahead of any other channel and it is doing a lot on its own versus the next best channel. Television does the best job as a standalone with 73% of the total awareness impact, versus outdoor where the majority of the impact comes from a reliance on other channels.

Outdoor is a great awareness builder, but it is less than half of television and it relies on other channels to work well.

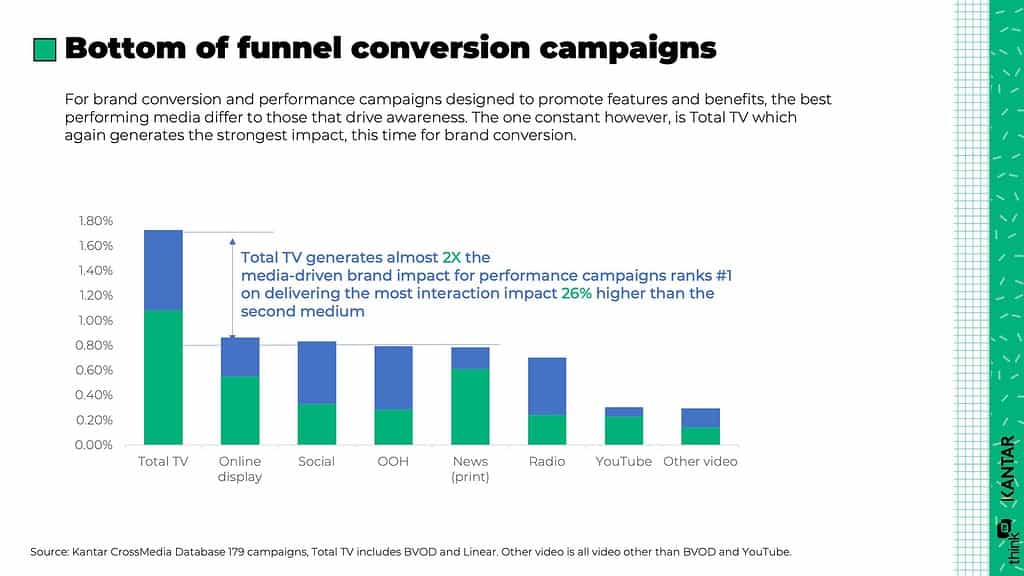

Bottom of the funnel (looking at consideration or intent)

Rodrigues: “Some channels move around a little, but the one constant we see is total television generating the strongest impact at the bottom of the funnel.

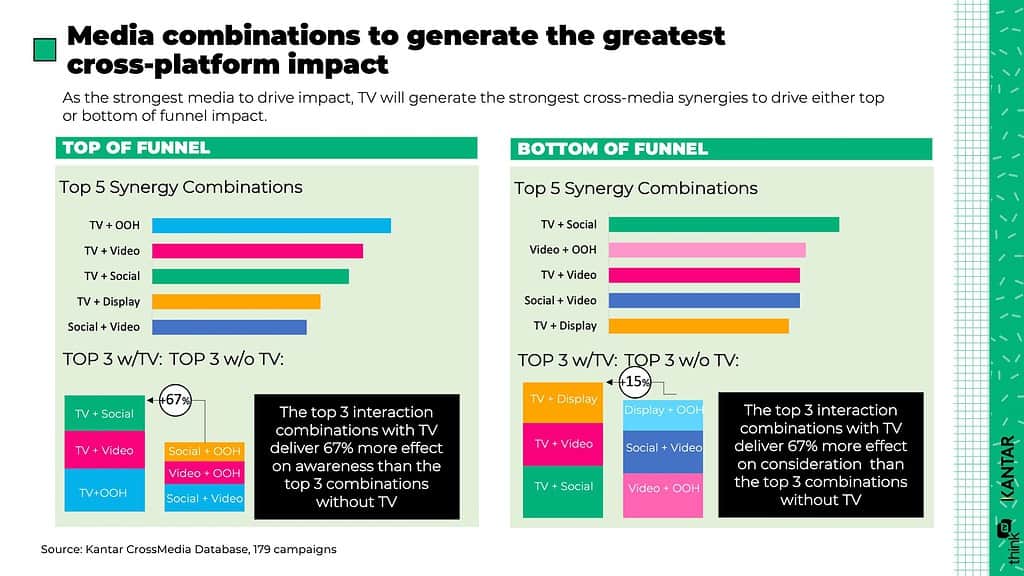

“We have one slide that looks at which combinations of media drive outcomes. If you look at awareness, the combinations that best drive awareness is underpinned by television. It works well with outdoor, video, social and display.

“When we combine and stack up those interaction effects versus the top three channels that do not feature television, one of which is social and video, we see that in building awareness, television’s interaction with other channels sits at 67% more than the top three without television.

“This highlights television’s key role to build awareness and amplify other media.

“When you combine the top three, it’s a little more balanced versus the non-TV combinations, yet TV still wins out.

“TV remains the workhorse driving brand impact across the funnel for campaigns. It works well on its own, but also at setting up the other media to work hard as well.”

ThinkTV on Kantar research

ThinkTV’s Portrate commented: “The key thing for us is that we know marketers are under pressure, and we know they still want spend money in media. So how can we help them to make sure they have the most effective media.

“Television is great on its own, but it’s even more valuable in the mix making other advertising mediums even more effective.

“If you are a marketer and your budget is under pressure, we would say here is some data you can take a look at. It might be able to help you make some decisions about where you should place your bets.

“We understand the market reality if something has to be cut. The data from Kantar suggests that TV would be the last thing you would cut.”

When asked about what media should perhaps be cut, Portrate replied: “Out-of-home…out-of-home is heavily reliant on other media to make it effective. For people who don’t drop out-of-home, make sure you have a television campaign before moving to a secondary visual medium. It depends on the campaign objective.

“If you are looking for brand awareness you need television to drive that awareness or the traffic if you want a brand to be top of mind before consumers head into a store. In that case, potentially substitutable media would involve things that are closer to purchase. You could cut social.

“Ultimately a properly planned media schedule, where you understand the role of the channels put in place, will deliver a better outcome which ultimately will show in a contracting budget environment what you could substitute to drive the same outcome.”

Source: mediaweek.com.au