A representative of the organizing company Dataxis presented fresh data on the European TV market and the evolution of advertising revenues. This was then followed by panel discussions between European TV and VOD operators, telco operators and representatives of the sponsors (media agencies or representative offices).

OVERVIEW OF THE TV AND VIDEO ADVERTISING MARKET IN EUROPE

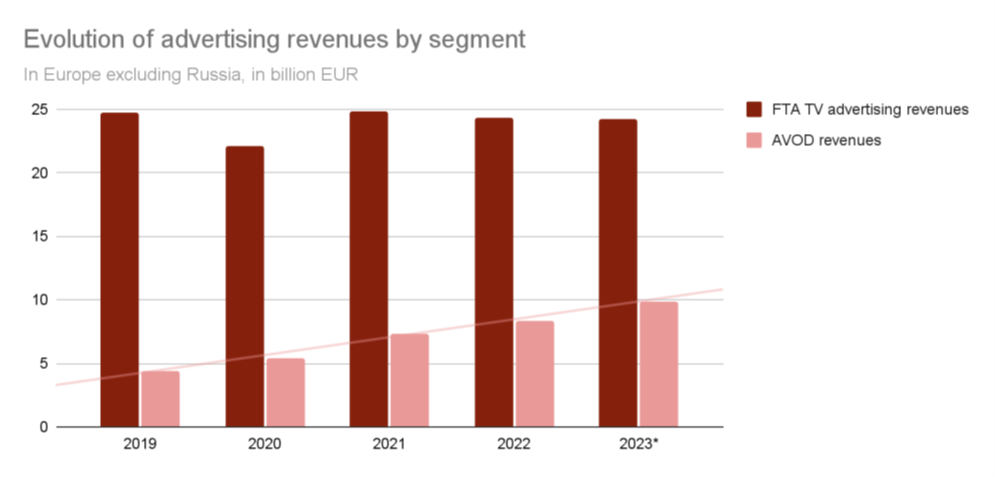

The opening presentation by a representative of Dataxis provided an insight into the European advertising market and the distribution of revenues among the main players. The European TV and video market generates more than €30 billion in advertising revenues, with VOD services that are supported by advertising increasingly contributing to the growth.

Source: Dataxis

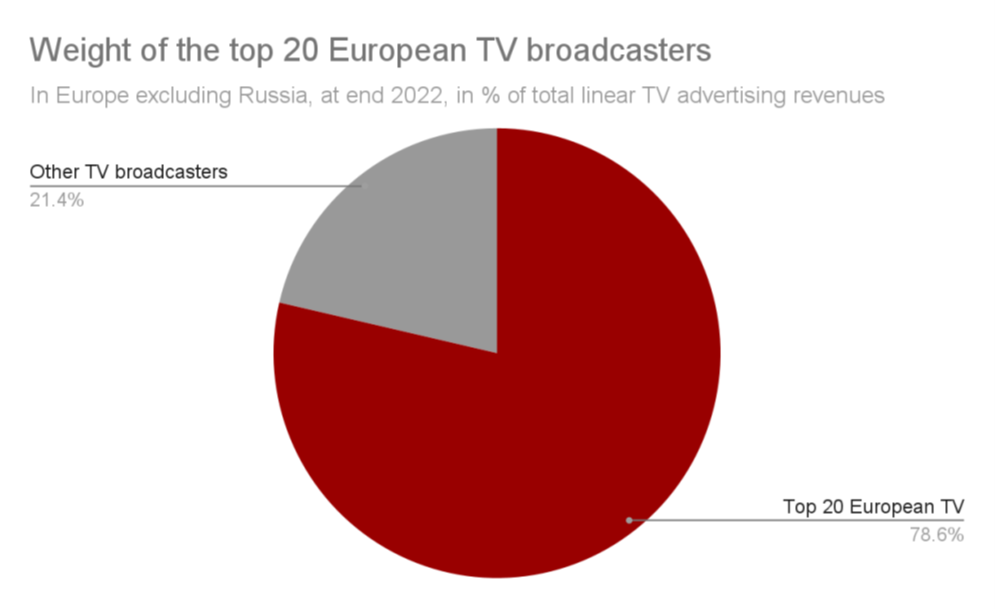

Source: DataxisWe continue to see progressive market concentration. Advertising revenues of the 20 largest European broadcasters account for almost 80 percent of the total advertising market.

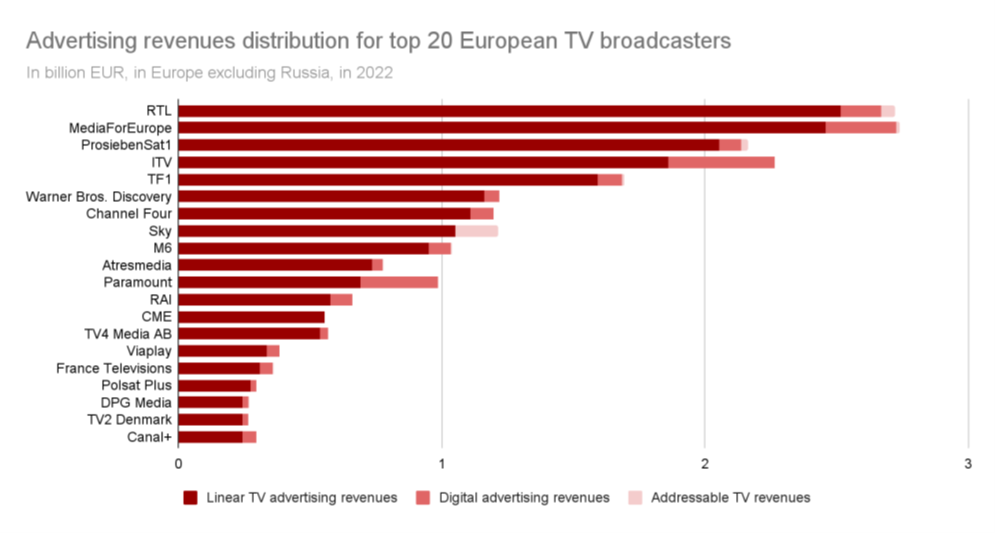

Source: DataxisAt the top of the ranking we find the large media houses RTL, MediaForEurope, ProsiebenSat1, ITV, TF1 and others, in whose portfolio digital advertising revenues already occupy a significant share. In addition to online advertising, revenues from addressable TV advertising are gradually increasing.

Source: Dataxis

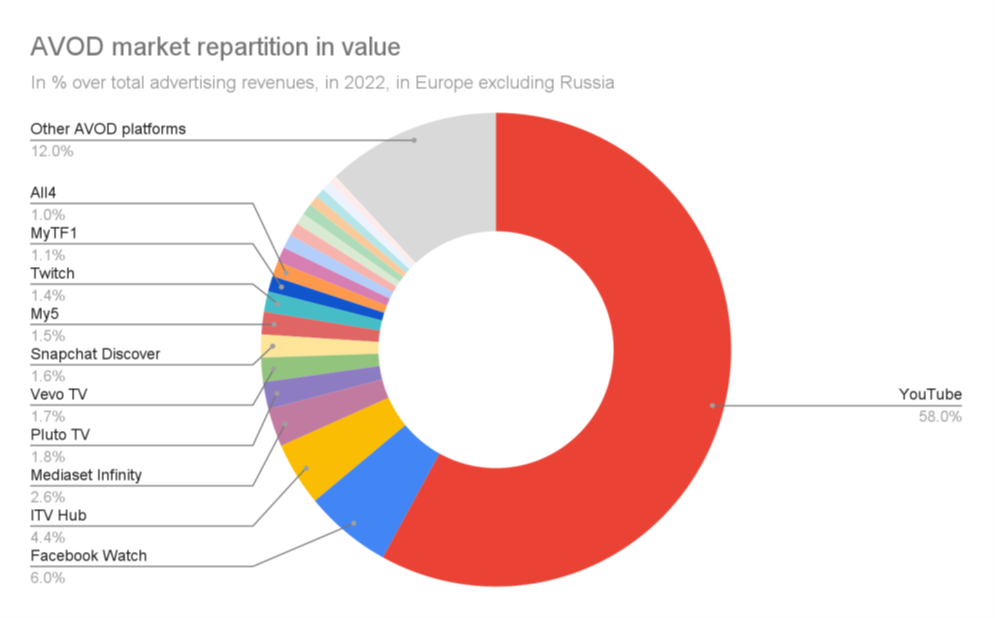

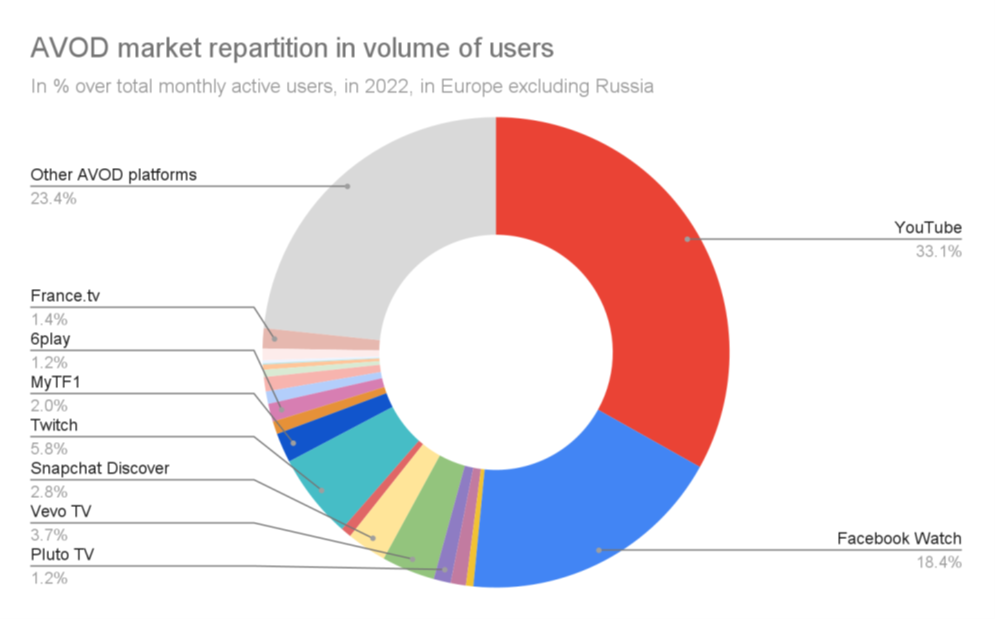

Source: DataxisThe digital advertising market is still dominated by YouTube in terms of ad volume, but BVOD services are performing well thanks to premium ad prices.

Source: Dataxis

Source: Dataxis Source: Dataxis

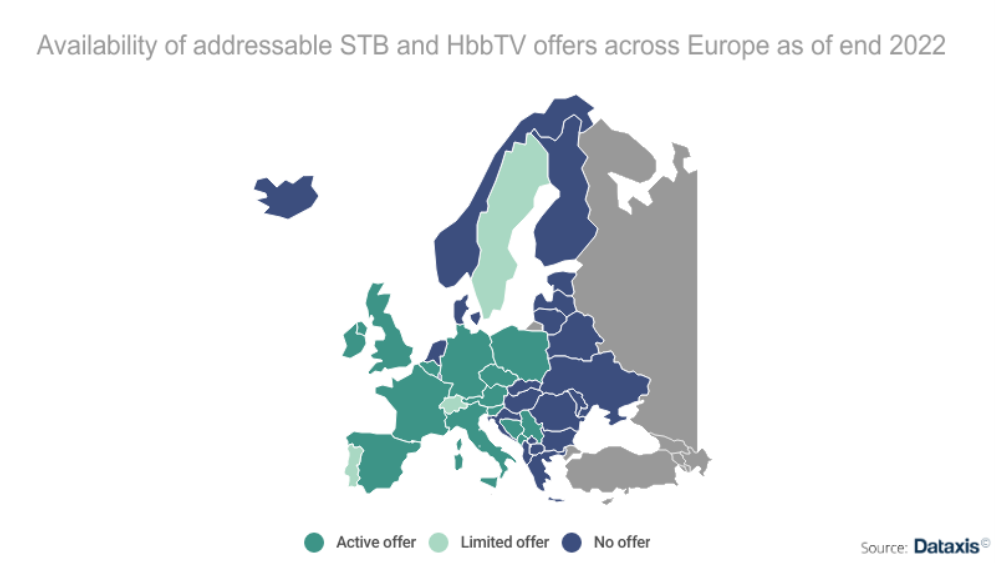

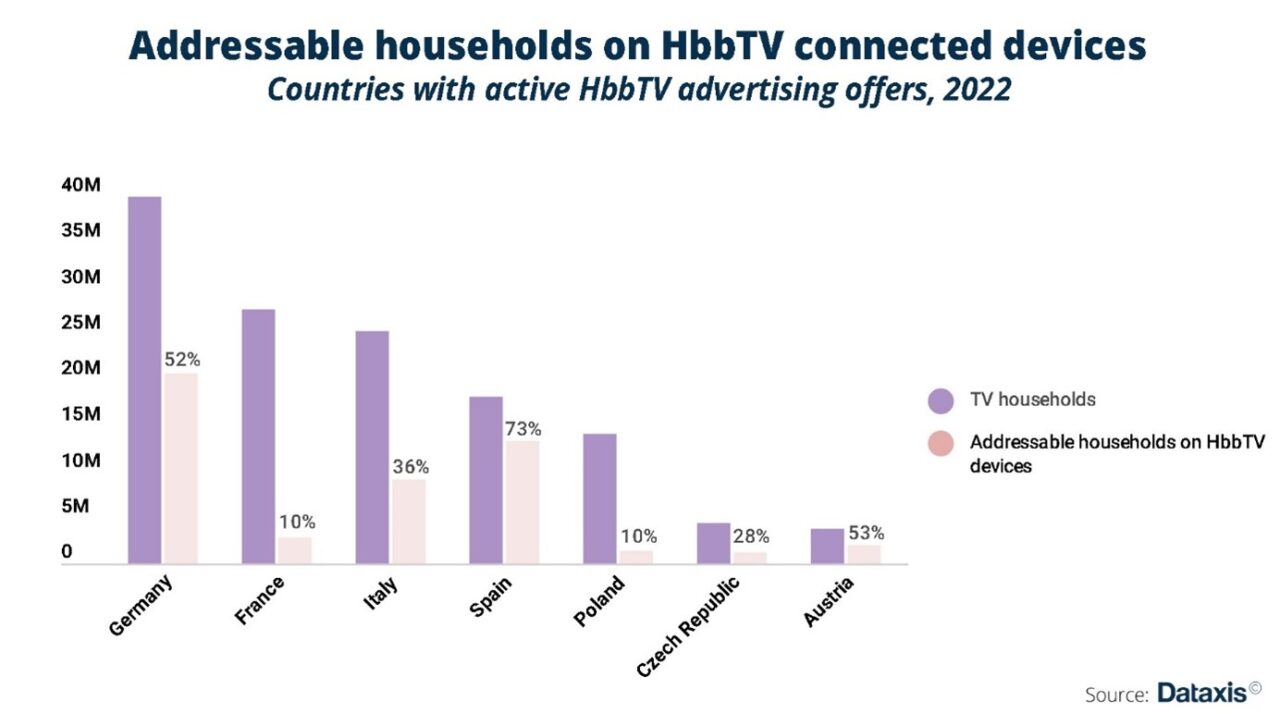

Source: DataxisAs mentioned earlier, more and more broadcasters are using addressable TV advertising, allowing them to target a selected part of the audience thanks to data from set-top boxes or HbbTV broadcasts. Through this, TV stations monetize premium ad space and take advantage of advanced big screen targeting.

Source: Dataxis

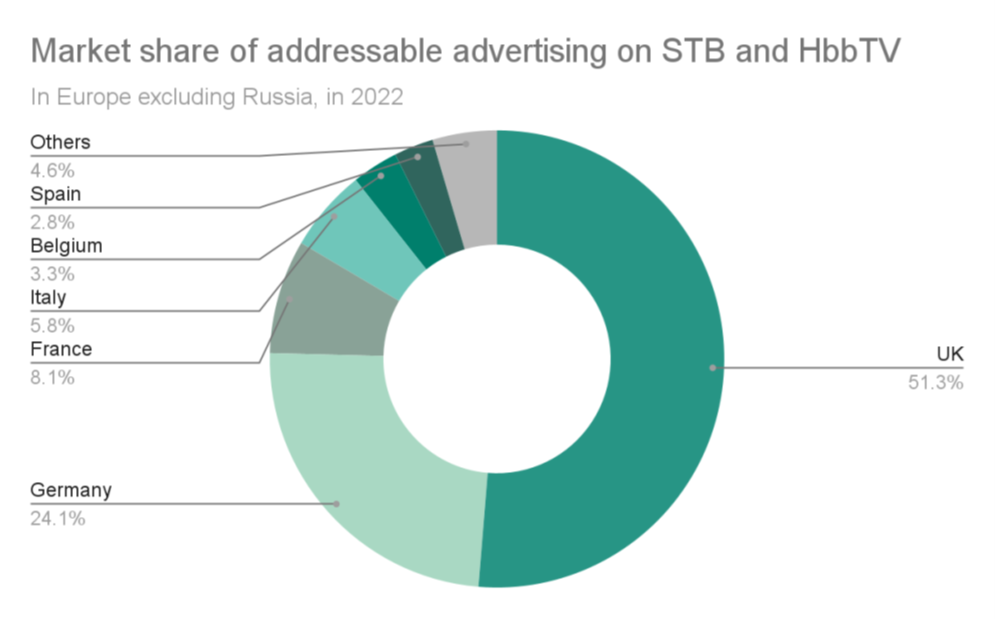

Source: DataxisThe UK is the dominant market, accounting for more than half of addressable advertising revenues in Europe, with Germany accounting for almost a quarter. However, in many European countries addressable advertising is not yet used at all, mainly due to technological limitations or advertising market constraints.

Source: Dataxis

Source: DataxisTHE BENEFITS OF HAVING LINEAR TV AND THE INTERNET IN ONE

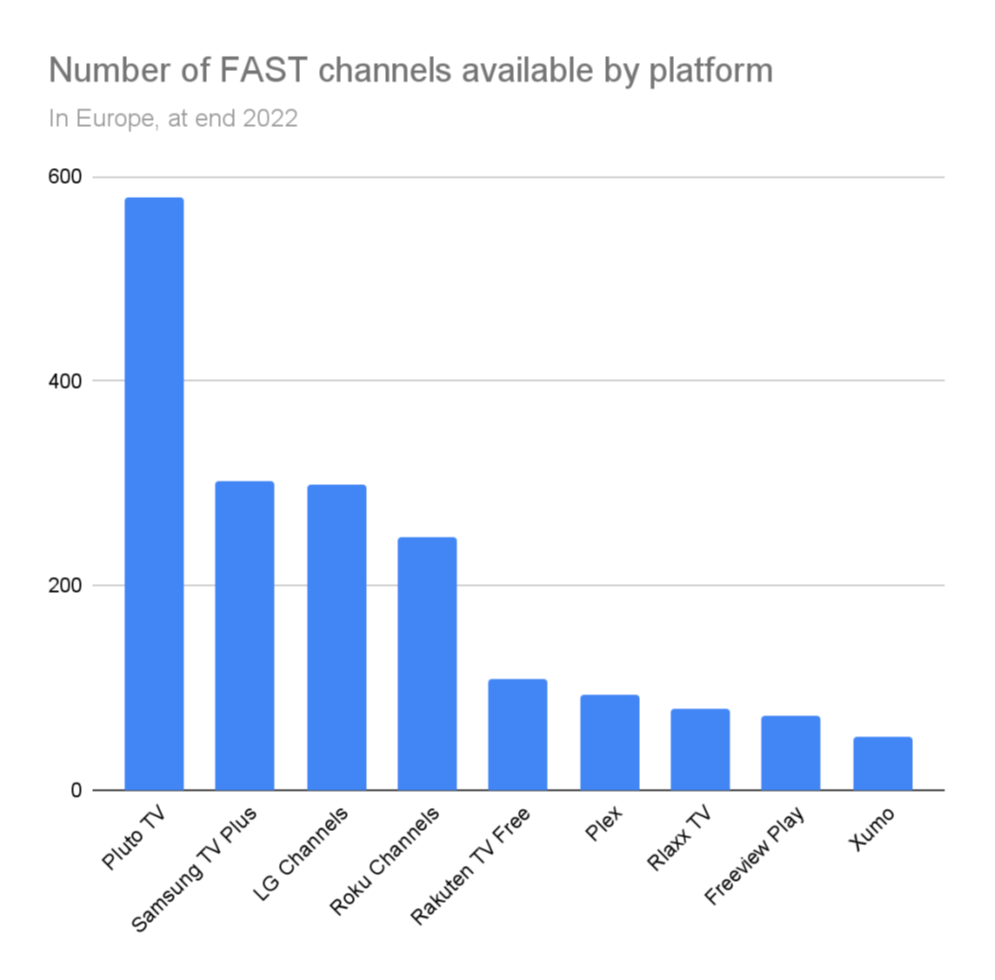

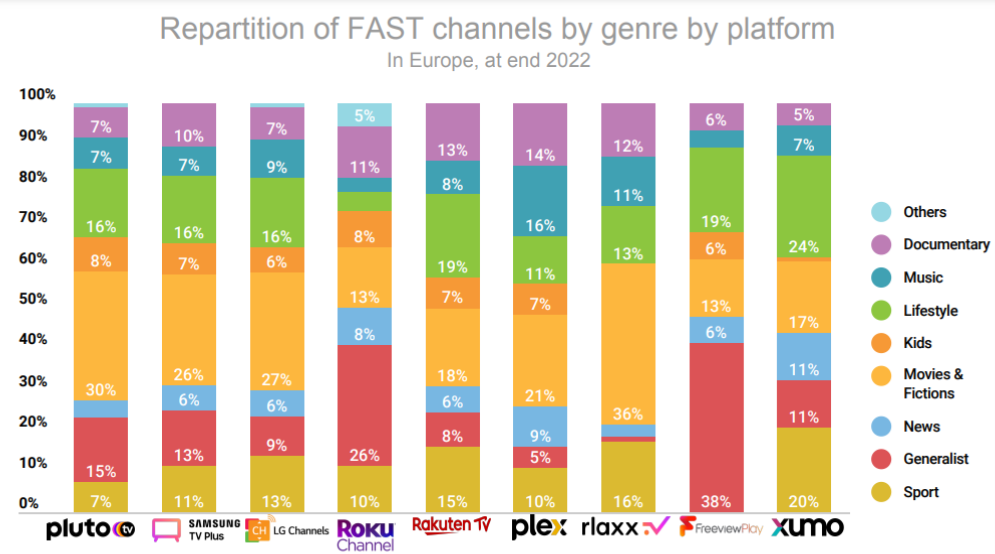

FAST channels - free-to-air linear broadcasting over the internet built on advertising revenue - are increasingly gaining ground in the European digital advertising media market. These platforms combine the advantage of internet distribution and traditional linear TV broadcasting and open up new revenue opportunities for distribution platforms and content providers.

While a few years ago there was a clear shift away from linear TV towards VOD services due to the vast offer and the ability to watch selected shows at a time that suits the viewer, we are now seeing a return to linear programming as the price of video subscriptions increases. As a result, we are seeing increasing competition between smart TV manufacturers and paid TV and online service operators.

Platforms providing FAST channels are popular in North America. For example, Samsung TV Plus offers more than 250 free channels in the US, available on both Samsung smart TVs and Samsung Galaxy smartphones. It is gradually expanding its offer in European countries.

Source: Dataxis

Source: Dataxis Source: Dataxis

Source: DataxisTHE COMMON GOAL IS TO ATTRACT A YOUNG AUDIENCE

At the Nextv Ad Europe conference, representatives of European broadcasters and operators shared their experiences in innovating their advertising strategies. One of the common goals across markets is to attract and engage young audiences.

In order to do this, traditional broadcasters are using their VOD services specifically, which young people are used to consuming. As Francesco Barbarani of Rai Pubblicita (the media representation of the Rai group of TV and radio stations) said that one option is to include episodes of a popular series first in the online broadcast. This has brought them an additional 10 million viewers outside of traditional TV broadcasts and a big increase in viewers under 45. Based on the data that TV stations can gather about viewers in the digital environment, they can then also adjust their TV broadcasting strategies.

Iva Dohnálková of the Czech station TV Nova also confirmed advertisers' interest in younger audiences. The TV station is also trying to offer formats that might interest them in its HbbTV broadcasts, which it has been developing for a long time. HbbTV also opens up new advertising opportunities for smaller advertisers thanks to local targeting options.

Source: Dataxis

Source: DataxisFlorian Moritz from Swiss advertising sales company Goldbach highlighted the benefits of Smart TV, which has been growing significantly for the last four years. According to him, 50% of Smart TV users welcome advertising as they can access content for free through it.

"People are prepared to accept advertising if they get some sort of benefit in return,”

said Florian Moritz.

ADDRESSABLE ADVERTISING IS ALSO AN OPPORTUNITY FOR TELCO OPERATORS

The so-called addressable advertising, which enables targeting of audiences on the big screen, is also an interesting opportunity for telco operators entering the advertising business. For example, Liberty Global or Canal+ Group have experience with it.

According to Emanuelle Godard of media group Canal+ Brand Solutions, the company has been offering addressable advertising on its platforms since 2022. In France, 700 advertisers (out of a total of 2,000) have already launched an addressable TV campaign since then, and addressable advertising can reportedly reach 25% of households in linear broadcasting.

This provides operators with interesting audience data that can enrich traditional TV viewership data. For example, it offers information on viewers' buying behaviour - what programme and adverts they watched, what time of day works best, and can then optimise ad deployment.

Also, according to Rana Yanay of telecommunications company CETIN (part of PPF Group), addressable advertising is the future of television and revenues from it will grow, although not all markets are ready for it yet. At the same time, he said, there is an ongoing political debate between telcos and broadcasters about who will have the main influence and control the market. CETIN has launched a TV platform built on top of Android TV, which it plans to offer to all IPTV operators.

At the same time, Rana Yanay also highlighted the possibilities of getting large volumes of data from digital broadcasting and setting the right direction on how to handle it.

"We are facing a big challenge and a number of new opportunities to work with this data, but the players don't seem to have come together and set standards in this direction. The line with the 'Big Brothers' is really thin,”

said Rana Yanay.

PROGRAMMATIC ADVERTISING IN THE TV ECOSYSTEM

One of the panel discussions also addressed the topic of integrating programmatic advertising strategies into the TV ecosystem. Czech market representatives Eduard Krečmar from Publicis Groupe and David Bauckmann from Impression Media presented the adaptation and development of programmatic advertising in the Czech market. Since its beginning in 2016 to 2017, domestic publicisers have quickly adapted the necessary technologies and online advertising is now completely available programmatically. Video is experiencing a big boom and the domestic market is thus struggling with a sell-out of advertising space. The downside of online video is that it is of fluctuating quality.

According to Eduard Krečmar, TV advertising works well and achieves even better results if it is complemented by online formats on other platforms that appeal to light TV viewers