The first day of the Nextv Ad Europe event focused on the latest developments in TV advertising, while the second and third days of the Nextv Series Europe conference focused on the trends, innovations and strategies driving the interconnected ecosystem of TV, telecoms and OTT services (over the top, services delivered directly to recipients over the internet). There were also topics such as the involvement of the TV and video industry in the metaverse or content personalisation. Victor Galand, an analyst at the organizing company Dataxis, presented the latest data on the development of the European TV and internet broadcasting market, which was followed by discussions with the main players of the European market during both days.

TV AND VIDEO REVENUES IN EUROPE ARE GROWING

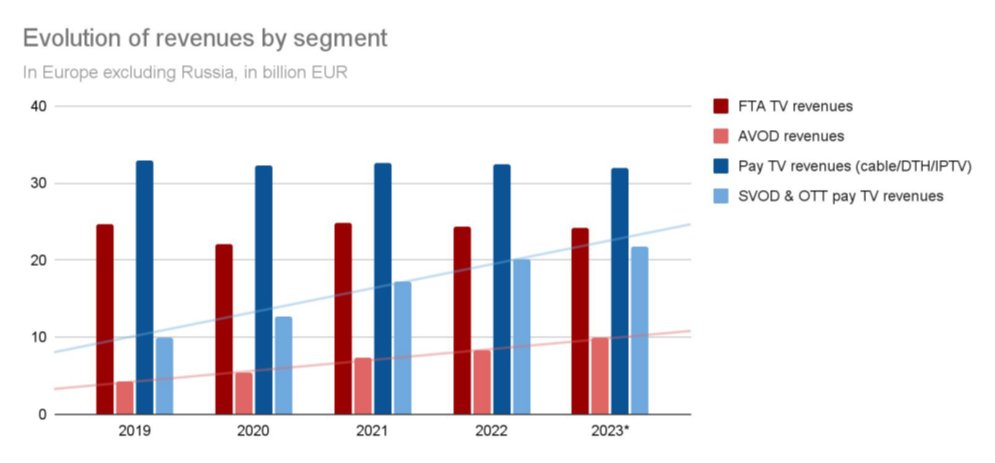

The TV and video industry generates €90 billion in the European market (Russia included), according to Dataxis. As the chart below shows, growth is being driven by both paid and unpaid VOD services, which have shown 25% growth over the last five years.

Source: Dataxis

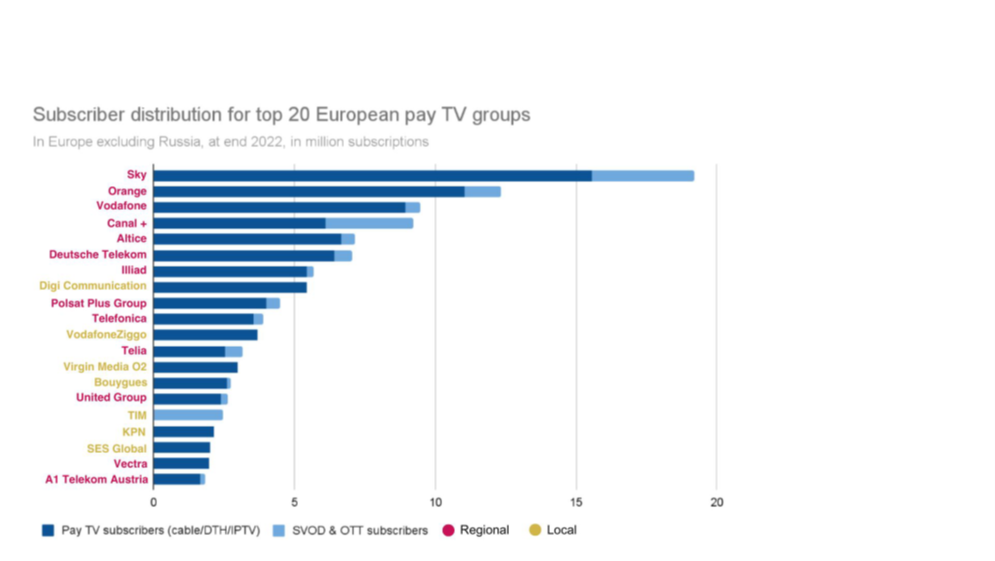

Source: DataxisThe highest volume of revenues comes from paid TV (cable, DTH, IPTV) and free-to-air TV. Meanwhile, paid TV revenues account for more than 60 percent of the top 20 European companies. These companies are well aware of the growth trend of digital services and are moving towards IP-based content distribution.

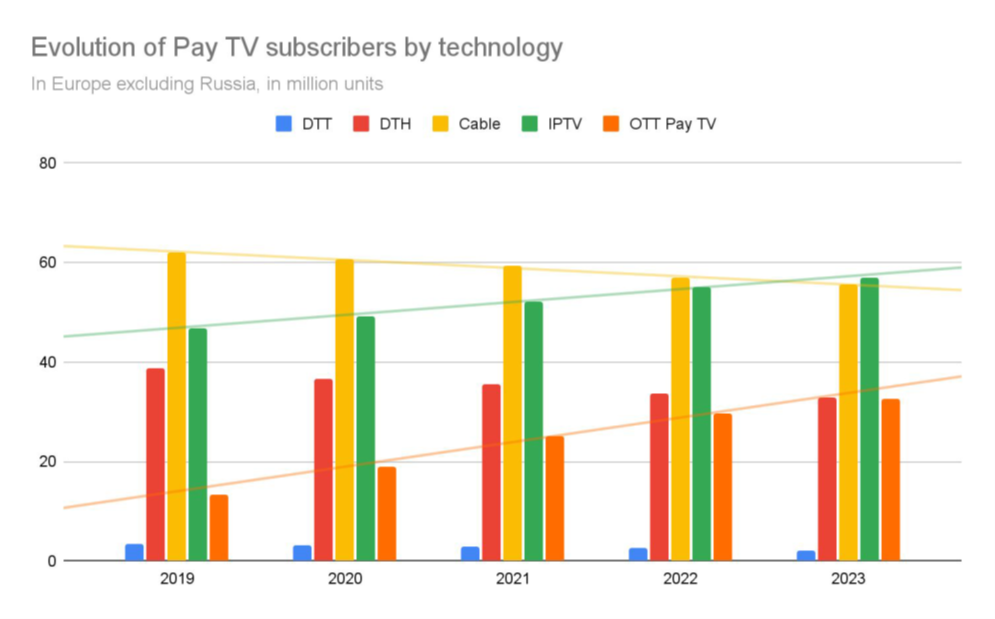

Source: DataxisThe paid TV market in Europe has a total of 180 million subscribers. Growth is, as we see in the chart below, again driven by IP-based content distribution.

Source: Dataxis

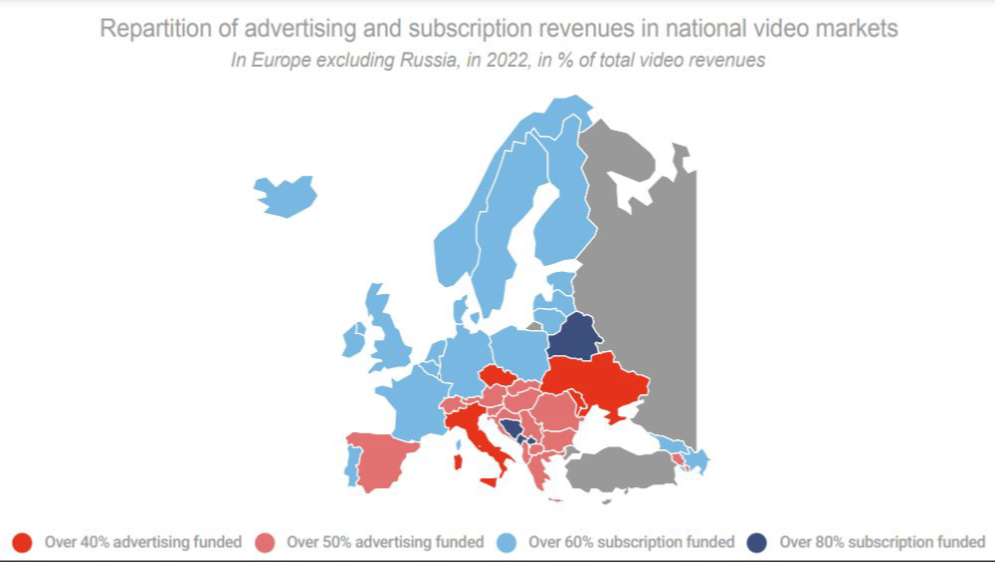

Source: DataxisSUBSCRIPTION REVENUE VERSUS ADVERTISING REVENUE

The different European markets differ in terms of the amount of revenue that comes from advertising or subscriptions. While in Central and Eastern Europe, as in the Mediterranean countries, a significant part of revenues is dominated by advertising, in Western and Northern Europe subscription revenues dominate.

Source: Dataxis

Source: DataxisHOW IS THE OTT SERVICES MARKET DOING?

In the European market, we are witnessing a growing number of players in the provision of OTT services and also a growth in the revenues they generate. At the same time, European consumers are increasingly equipped with smart TVs and streaming devices.

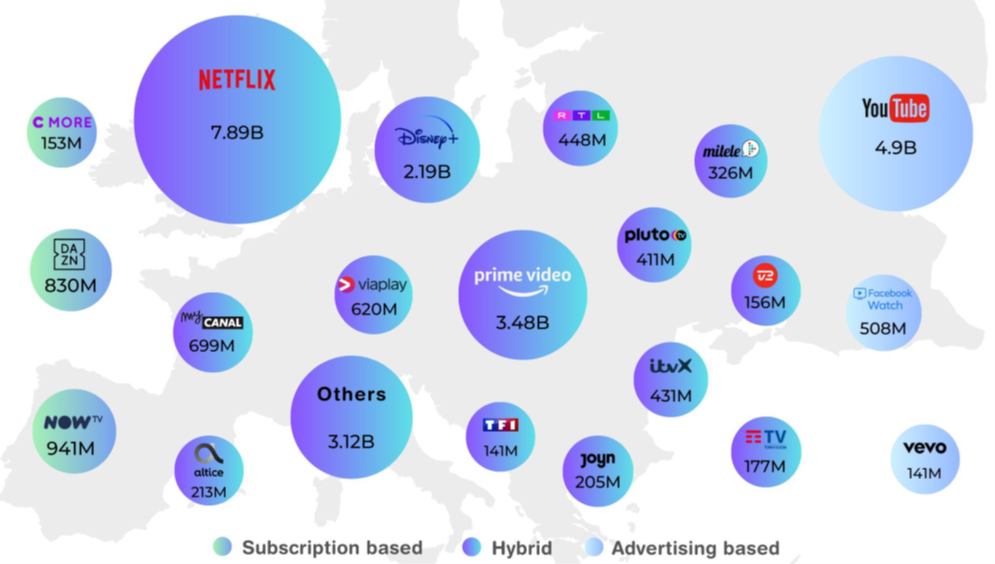

OTT revenues by platform, in Europe excluding Russia, during 2022; Source: Dataxis

OTT revenues by platform, in Europe excluding Russia, during 2022; Source: DataxisThe largest OTT service providers in the European market are US-origin companies - Netflix, YouTube, Amazon Prime Video and Disney+.

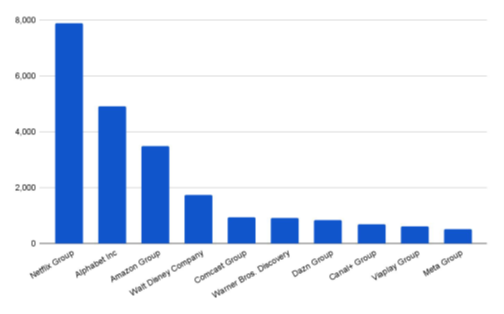

Top 10 revenue generating OTTs (AVOD, SVOD and

Top 10 revenue generating OTTs (AVOD, SVOD andOTT pay TV) - Europe excluding Russia, during the year 2022, in million euros; Source: Dataxis

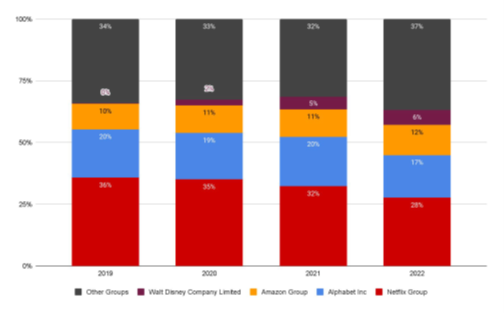

Netflix and YouTube (owned by Alphabet) still remain significantly dominant players in the market, but their market share is gradually declining due to the arrival of new multinational players (such as Disney+) and local services. Over the last five years, their aggregate share has fallen by less than ten percentage points to 45% (data as of the end of 2022), according to Dataxis data.

Top 4 OTTs revenue market share In Europe excluding Russia, in million euros; Source: Dataxis

Top 4 OTTs revenue market share In Europe excluding Russia, in million euros; Source: DataxisTHE MAIN WEAPONS ARE LOCAL CONTENT AND SPORTING EVENTS

European broadcasters are also trying to adapt to the evolution of the OTT services market and are responding with their content strategies.

Peter Wassong from Deutche Telekom confirmed the rising costs of content as well as the high competition in the offerings of other operators or video services. "Sometimes we therefore have to reject interesting but expensive content," said Peter Wassong.

As agreed by representatives of a panel discussion dedicated specifically to content strategy, the main drivers of paid content are sports and local content. Exclusive rights to the biggest sporting events are usually held by the biggest players in the market, so it is not easy to succeed in such a highly competitive environment.

That is why a large number of broadcasters rely on local production to get as close as possible to viewers in a given country. It is important to consider that what works in one market may not work in another, which is why multinational players do not invest as much in local production and if they do, it is in larger markets.

According to Silvia Majeská, programme director at Nova Group, which operates both linear broadcasting and the Voyo VOD service, the entire TV group focuses on local production, which drives TV ratings and subscription growth on Voyo. At the forefront of viewer interest are long-running series, talent shows, crime series, drama formats and more. It also pays to create local versions of international formats that are popular. Czech viewers prefer Czech films, series and reality shows in prime time.

Also, according to the experience of Tatjana Pavlovičová from United Media, a media company operating in Southern and Eastern Europe (55 TV stations in 8 countries), the same programmes tend to be successful in linear broadcasting and VOD. In these markets, for example, soap operas are popular programme formats, which are not as popular further west.

"Sport works great on sports-oriented and full-format stations, but it is a very competitive sector," agreed Tatjana Pavlovic. In countries such as Greece, Serbia and Croatia, which are football nations, some sporting events achieve more than 50% market share in free-to-air broadcasts, and no other type of programme attracts as many viewers, according to Pavlovičová.