The media industry is undergoing fundamental changes and is at a crossroads, according to a new report from Deloitte, Digital Media Trends 2025. Consumers are increasingly dissatisfied with the value of paid streaming services (SVOD), with nearly half (47%) saying they pay too much for content that does not match the price. This dissatisfaction is reflected in the fact that 60% of consumers would cancel their service if the price increased by $5.

At the same time, free ad-supported services (FAST) are becoming increasingly popular, especially among Generation Z and millennials, where more than two-thirds of respondents subscribe. More than half of SVOD subscribers (54%) also said at least one of the services they pay for is ad-supported by ads, an increase of eight percentage points from 2024.

Deloitte's report shows that content on social platforms is more relevant to Gen Z and millennials than traditional TV shows and movies. 56% of Gen Z and 43% of millennials find social media more relevant and feel a stronger personal connection with social media creators than with TV personalities or actors. Social platforms also have a significant impact on purchasing decisions, with 63% of Gen Z and 49% of millennials saying that ads or product reviews on social media have the most influence.

Gen Z spends 54% more time - approximately 50 minutes more per day - on social platforms or watching user-generated content than the average consumer, and 26% less time - approximately 44 minutes less per day - than the average consumer watching TV and movies.

Social video platforms offer a seemingly endless array of free content that is algorithmically optimized for user engagement and advertising. They have advanced advertising technologies and artificial intelligence that connect advertisers with a global audience, now attracting more than half of U.S. ad spending.

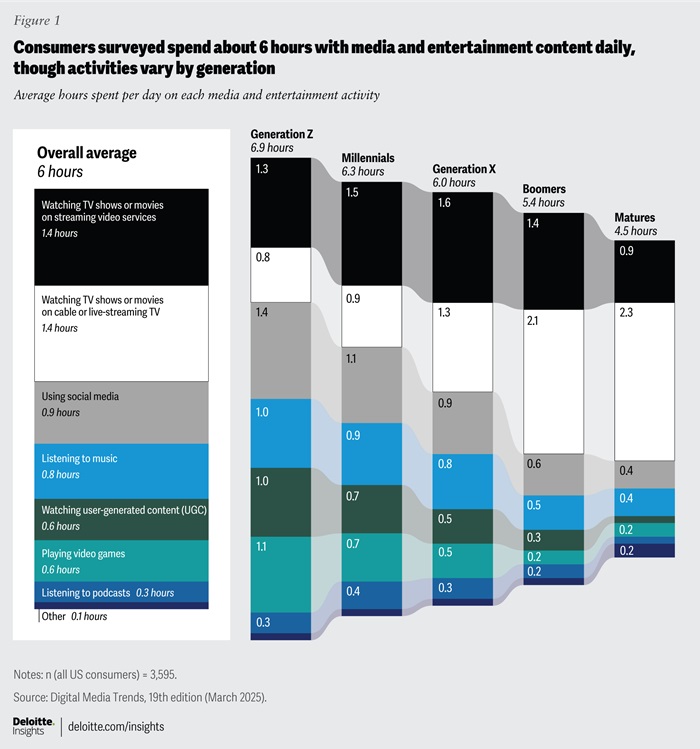

A survey of U.S. consumers shows that media and entertainment companies compete for attention for an average of six hours a day. Meanwhile, each user is likely to have a different mix of watching video-on-demand, user-generated content (UCG), social media, games, music, podcasts, and possibly other forms of digital media that make up their entertainment time (see chart below).

Average time spent on each media activity by generation; Source: Deloitte

Average time spent on each media activity by generation; Source: DeloitteConsumer sensitivity to streaming service price increases is increasing. On average, they consider a price of $14 per month (about $320) to be "right" for ad-free services, while the current market average is $16. Prices above $25 are considered too high. For ad-supported services, the ideal price is around $10, while a price above $19 is considered too expensive. According to the survey, respondents are not increasing spending on subscriptions, and many report fatigue from having to manage several different subscriptions.

Traditional studios and streaming services thus face challenges in providing engaging content and value to users. While streaming services initially disrupted the cable TV model, they are now facing similar pressures as prices rise and perceived value declines, especially among younger viewers. Older generations are more likely to retain a cable or satellite subscription, but 23% of Gen Z members and 18% of millennials who have cable TV plan to cancel their subscriptions in the next 12 months, compared to 8% of the older generation (60+).

"The data is clear: Entertainment providers should embrace innovation and flexibility to survive. That means understanding the nuances of younger audiences, using technology to personalize content and advertising, and finding new avenues for distribution and monetization. The status quo is probably no longer an option," says Doug Van Dyke, vice chairman, Deloitte LLP and U.S. telecom, media and entertainment sector leader.

Further details of the Deloitte report can be found here.

Source: mediaguru.com