In brief

What emerges is a compelling case for re-thinking how advertising investmZobrazit příspěvekent should be approached and hard evidence of what businesses can trust to deliver growth. Following a profit-damaging drift to short-termism in marketing, ‘Profit Ability’ swings the spotlight back on to creating shareholder value. It provides industry benchmarks, based on empirical evidence across a substantial range of advertisers, for what businesses can expect advertising to deliver. It shows that advertising – TV in particular – should be used as a powerful investment for growth.

The study was commissioned by Thinkbox from Ebiquity and Gain Theory, who independently evaluate advertising performance and effectiveness for hundreds of brands. Using their databanks of existing, client-funded data, it analysed over 2,000 advertising campaigns across 11 categories to uncover the impact that different forms of advertising have on short-term profit (throughout the campaign and within 3–6 months of the campaign finishing), and then combined these learnings with results for profit generated over the longer term (up to 3 years on) to determine total profit return. Clearly, advertising also has an even longer-term impact beyond 3 years, but that is beyond the scope of this study.

WINNER – GOLD Trade Body Research, Media Week Awards 2018, WINNER – Best Trade Industry/Body Research, Media Research Group Awards 2018, WINNER – Grand Prix, Mediatel Media Research Awards 2019, WINNER – Best Custom Media Research Project – Trade Body, Mediatel Media Research Awards 2019

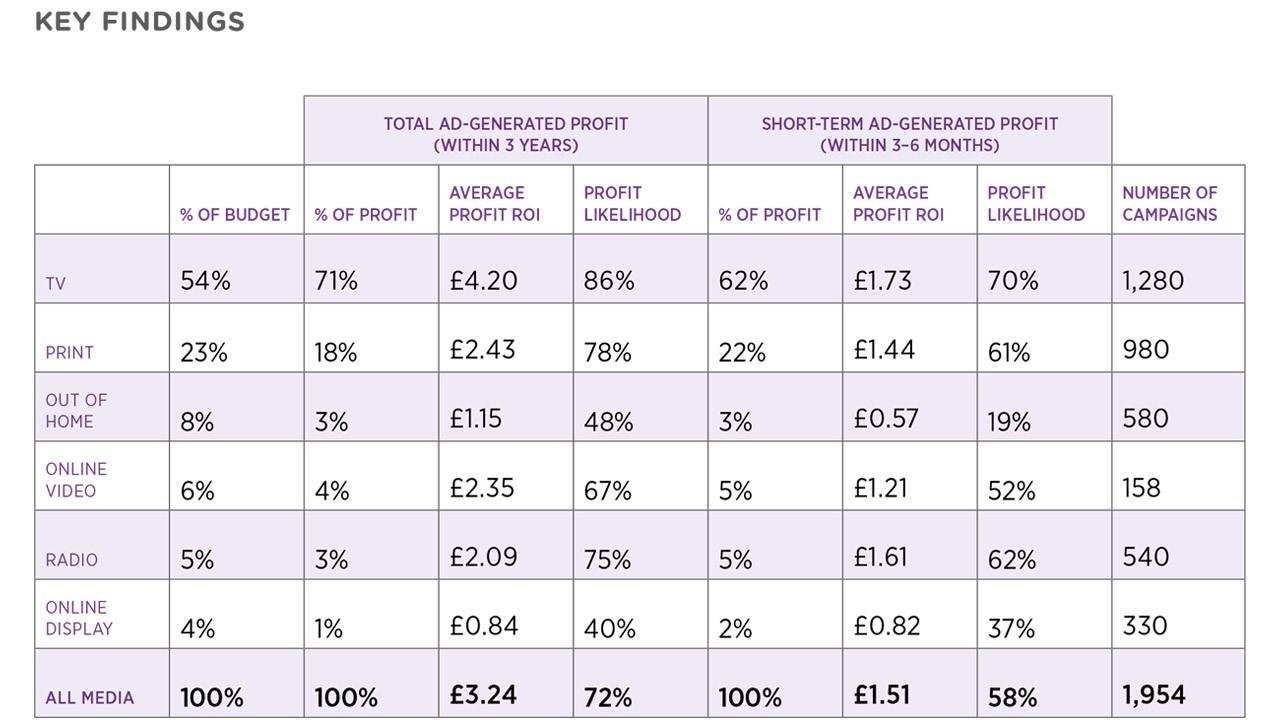

The key findings are:

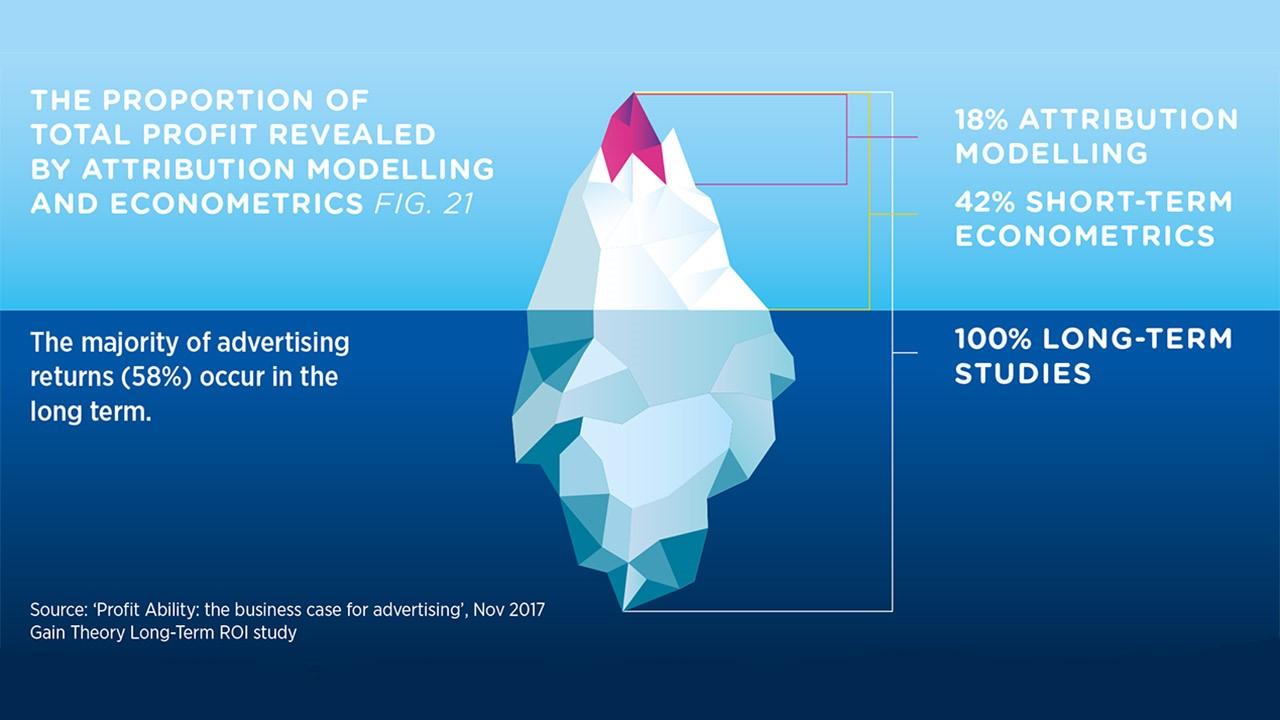

- 58% of advertising’s profit return is overlooked when ignoring the long term

Less than half of advertising’s profit impact happens in the short term. Businesses optimising their advertising investment based solely on these more easily visible short-term returns are hugely undervaluing the total profitability driven by advertising. They are not maximising the growth and value of the company

- Advertising is a powerful business investment

Looking at total profit return on investment (ROI) over 3 years, the average campaign delivers a profit ROI of £3.24 per pound spent. This varies by channel, but all forms of advertising, except Online Display, deliver profitable returns when you look at their long-term impact.

- Focus on volume and scalability

This study is unique because it moves on from only looking at ROI to position it within the context of the volume of investment and scalability of different media. It found that, in the short term, TV is responsible for 62% of all advertising-generated profit at an ROI of £1.73 for every pound spent, the highest of any media. In the longer term, TV advertising creates 71% of total advertising-generated profit at an ROI over 3 years of £4.20 for every pound spent, also the highest of any media.

- TV delivers scale of return

TV drives the most profit because its scale and popularity enable it to deliver efficient profit return at high volumes of spend. Businesses can increase investment in TV to a higher level than other media and it will continue to generate a profitable return before diminishing returns kick in.

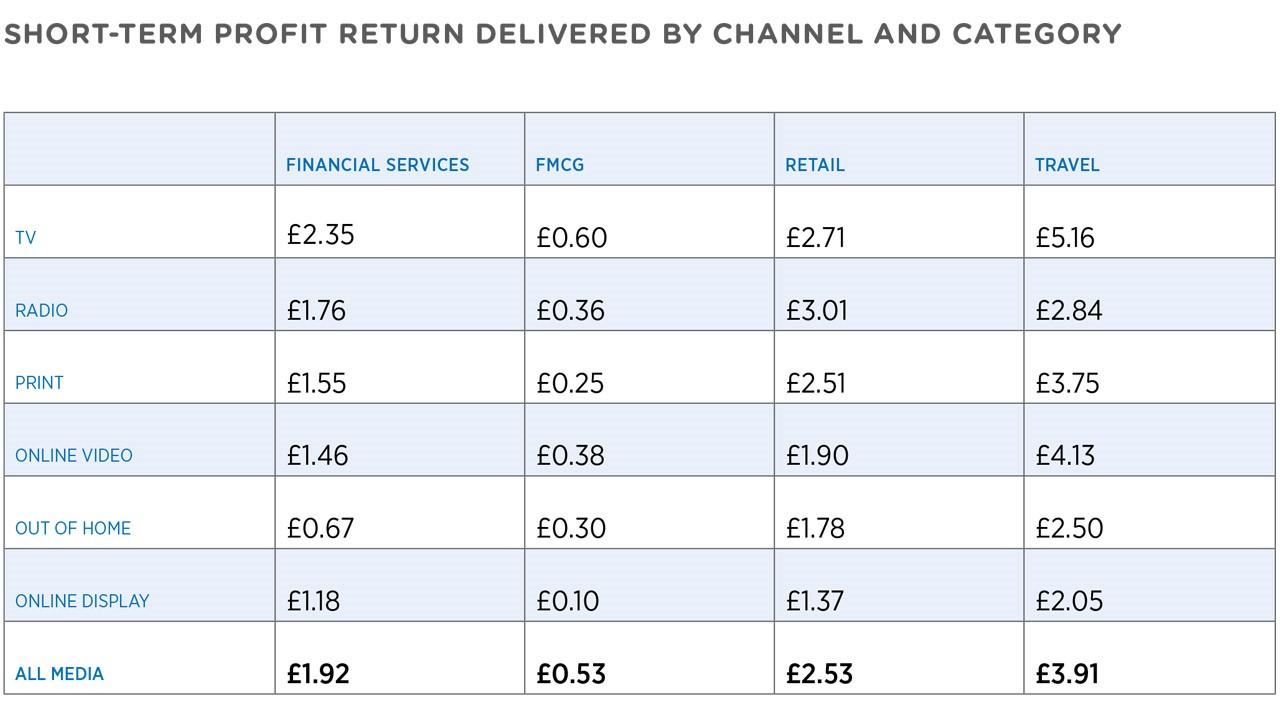

- Advertising-generated profit varies by category

As well as looking at overall advertising performance, the study also shows how different forms of advertising perform for different categories – Retail, FMCG, Financial Services and Travel – and how factoring in the long-term is crucial to understanding the impact advertising has on different categories.

- Advertising can be risk assessed

In the long term, 72% of advertising campaigns create profit. Advertising is a safe business investment. TV is the ‘safest’ medium as it is most likely to create advertising-generated profit, both in the short and long term. In the short term, 70% of TV advertising campaigns deliver a profitable return. During the 3 years after ad campaigns finish, this increases to 86% of TV advertising campaigns delivering a profitable return.

- It’s time to reassess the return that advertising can generate

Businesses can now reassess the potential return that can be generated by different forms of advertising. For example, the study concludes that advertisers may be missing out on maximising advertising-generated profit by under-investing in TV. Currently, TV accounts for 54% of advertising spend among Ebiquity’s database, yet it is responsible for 71% of total advertising-generated profit.

TV delivers 71% of total profit generated by advertising, at the greatest efficiency (a profit ROI of £4.20), and for the least risk.

In depth

Background

Something rather strange is happening in the world of advertising. Whilst we’re better equipped than ever before to create, plan, execute and measure the effectiveness of advertising, according to Binet and Field, our industry is in crisis.

The cause? An unhealthy focus on the short term driven by a long list of factors that, according to Enders Analysis, mount a real and ongoing risk to marketing effectiveness and therefore long-term profitability.

We need to change the narrative. By providing a solid business case for advertising, we can position it as a business investment that drives growth in both the short and the long term. We commissioned both Ebiquity and Gain Theory to do just that.

The research falls into three broad sections:

- The short-term impact of advertising (throughout the campaign and for a period of circa three months afterwards), carried out by Ebiquity.

- The long-term impact of advertising (up to three years following a campaign), carried out by Gain Theory.

- The total impact of advertising: a combined view across both the short and the long term.

Part one: the short-term impact of advertising

Methodology

Ebiquity employed their econometric expertise to analyse their database of over 150 clients to understand the impact of media investment in the short-term (within 3-6 months of a campaign finishing). This included econometric analyses covering 11 sectors and 1,954 campaigns that ran between 2014 and 2017 all drawn from Ebiquity’s existing database of client-commissioned studies.

Importantly, this analysis was not restricted to the best performers, but included the average performance across the vast dataset. Although this makes it more representative overall, this is a still a benchmark of advertisers with the means to econometrically analyse their advertising’s performance. It’s therefore not representative of the long-tail of smaller business. The analysis did not include online search as this is a demand-harvesting rather than demand-generating investment. For the same reason, the value of high street location or prime shelf space in supermarkets is not included in this study.

When reporting ROIs where sample sizes were deemed insufficient or provided an insufficiently robust representation in isolation, results were grouped. So, there are results against five sectors, while Broadcaster VOD (BVOD) and other forms of Online Video (YouTube, Facebook and the ‘long tail’ of online pre-roll and autoplay video ads) are grouped as one, and ‘Social’ is allocated either to Online Video or Online Display.

(Ebiquity’s methodology is further explained in a short film at the foot of this page)

Headline Findings

Advertising pays back in the short-term. Across all sectors and channels the average short-term profit return delivered by advertising is £1.51. This varies by sector, from £0.52 in FMCG to £2.49 in retail and £4.37 in travel. This reflects the relatively small size of individual FMCG brands compared to retail brands, for example.

TV delivers strong ROI for all sectors. The average short-term profit ROI for TV is £1.73 per pound spent, which is remarkably consistent with TV ROIs over the last decade. TV advertising delivered strong ROI for all the sectors analysed, with one exception, FMCG, which returns a negative ROI. However, TV still far outperforms all other forms of advertising for driving short-term ROI in FMCG. The low ROI for FMCG in the short term is a good example of why it is important not to judge advertising solely on its short-term performance. The same is true of the relatively poor short-term performance of Online Display and Out of Home.

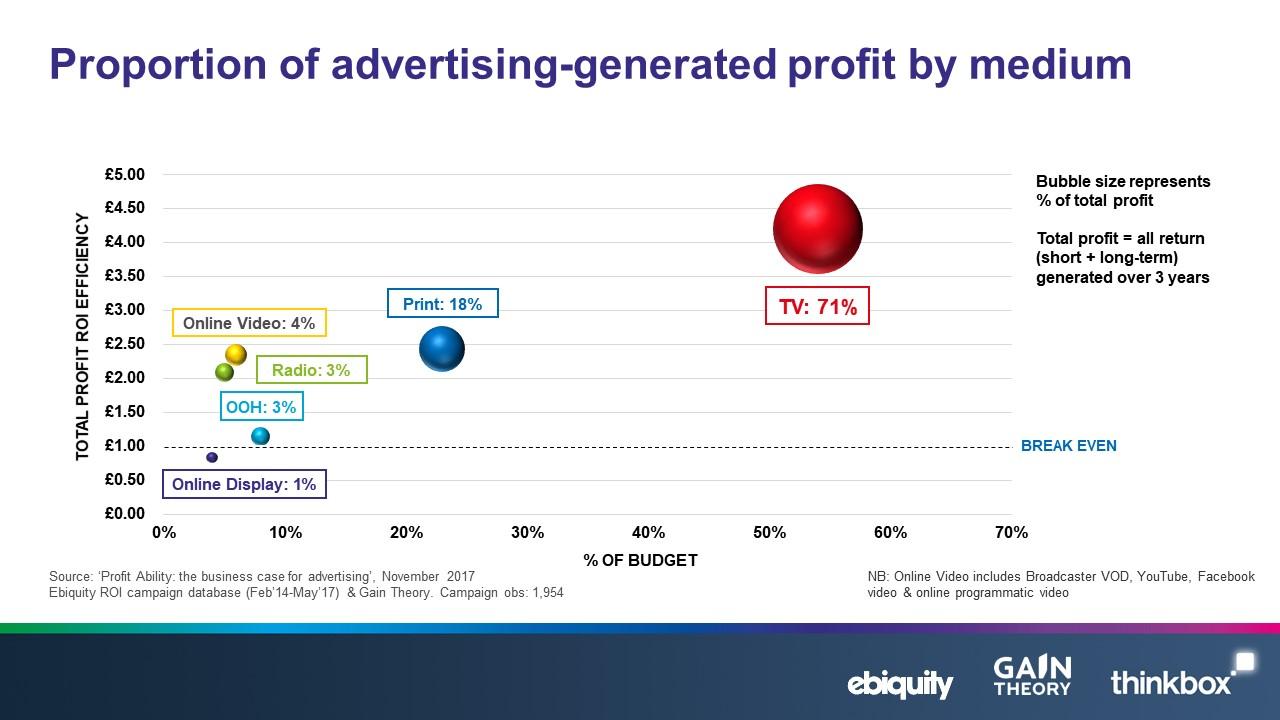

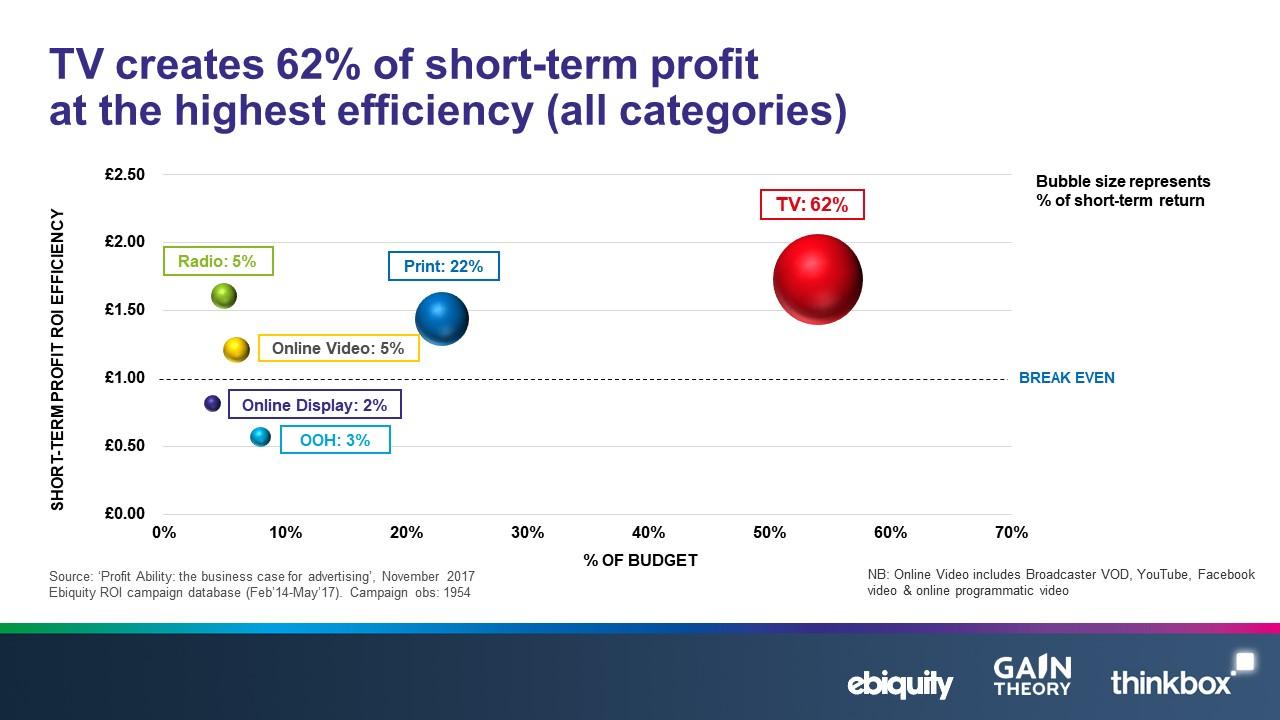

Responsible ROI considers the volume of profit. As the latest Binet and Field study for the IPA proved, we must use ROI responsibly by positioning it within the context of volume of spend. We know that the easiest way to increase ROI is to decrease spend – but this usually has a direct and negative impact on volumes of profit. And, of course, profit is the end-game of advertising.

The following chart displays the average short-term profit ROI of different media channels alongside volume of spend. The bubble size represents the % of total profit generated by that channel. TV was found to have the highest short-term ROI generating £1.73 for every pound spent. This is remarkably consistent with findings for the last 10 years, where the ROI figure for TV has been between £1.70 and £1.80, depending on cost inflation/deflation. When taking into account the volume of return we can see that TV accounts for 62% of advertising generated profit in the short term. This is followed by Print (22%), Radio (5%), Online Video (5%), Out of Home (3%) and Online Display (2%). So, TV not only delivers a strong ROI, it does so at scale, and the story was similar when we looked at short-term volumes of profit in different sectors.

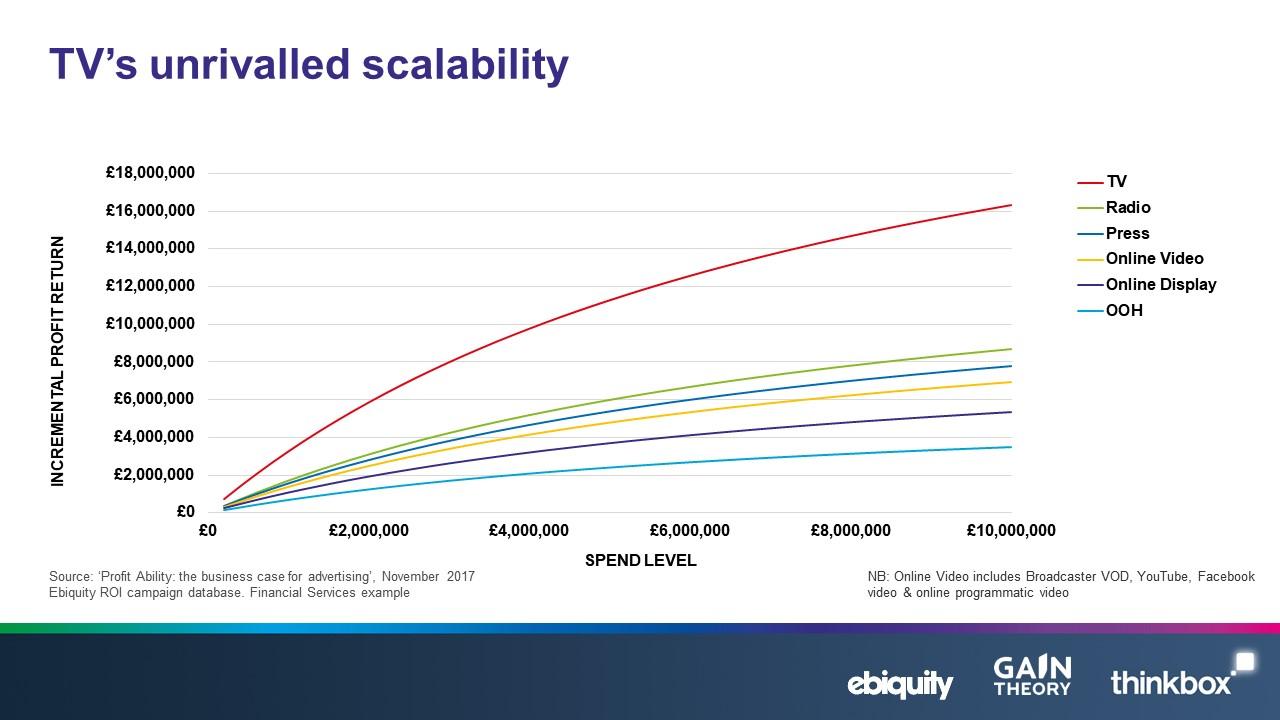

TV delivers scale of return. TV doesn’t drive the largest volume of profit because it receives the highest volume of spend. It drives the highest volume of profit because it can deliver efficient profit return at high volumes of spend – i.e. there’s a high threshold for the point of diminishing returns. See the chart below that uses a financial services campaign as an example of the diminishing return curves by channel.

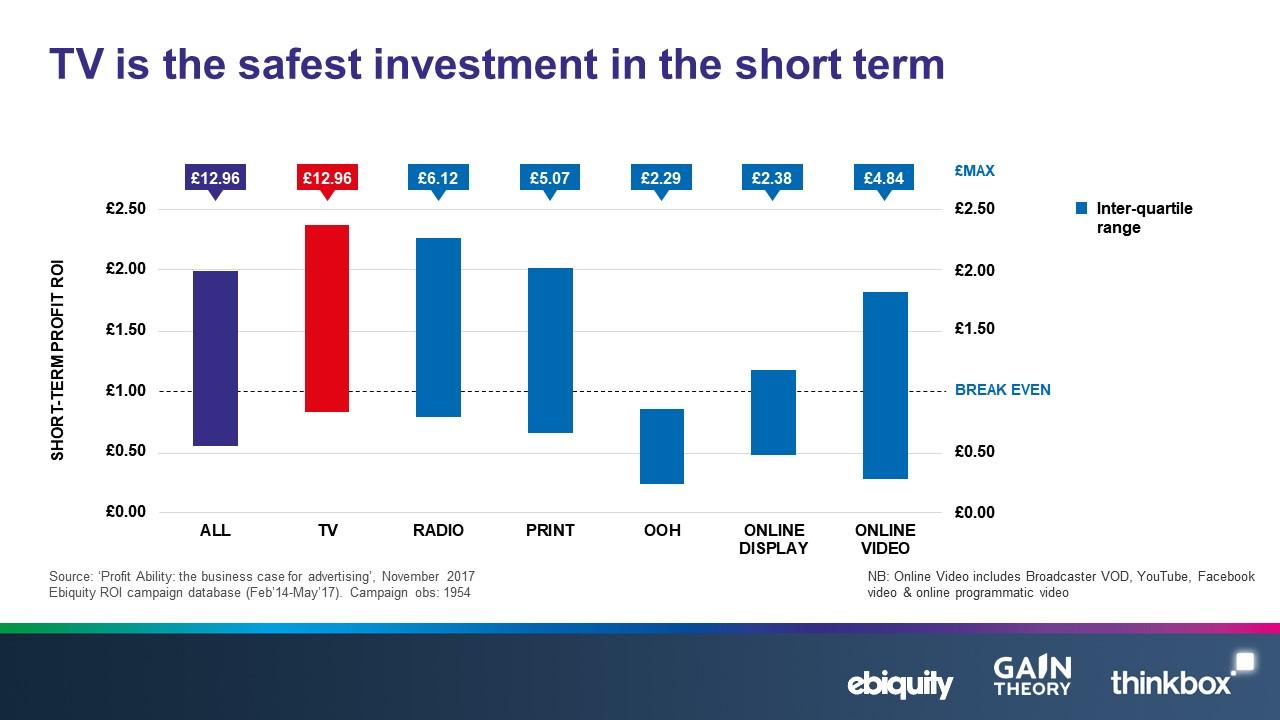

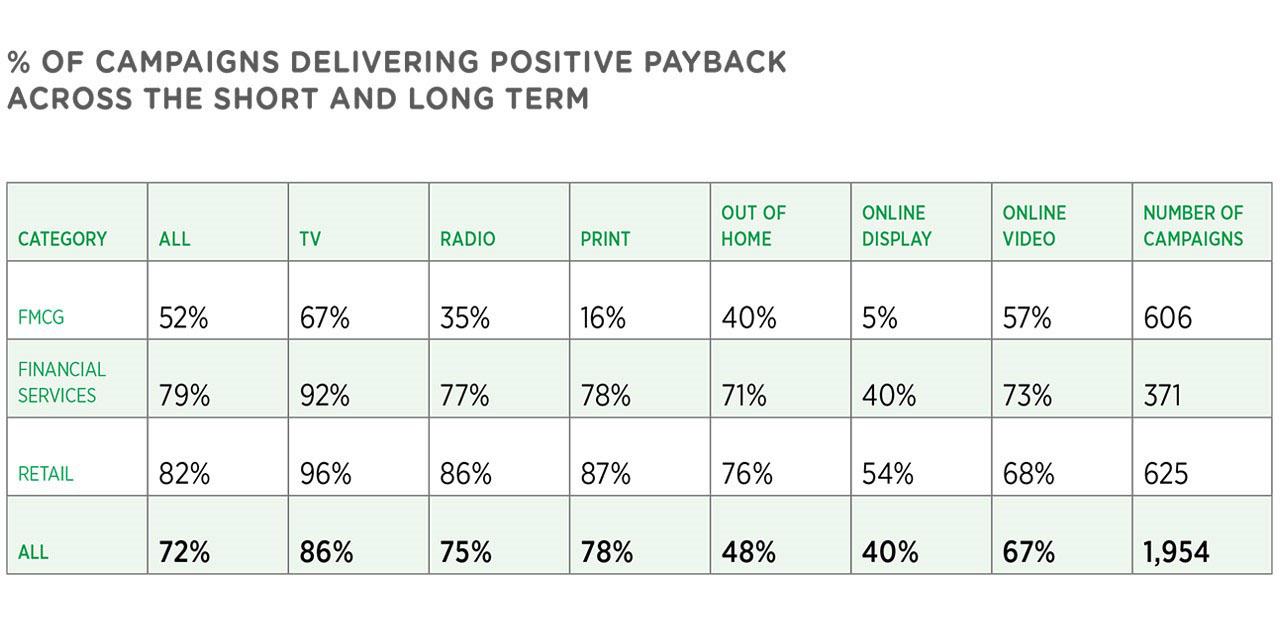

TV is the ‘safest’ (lowest risk) short-term investment. Whilst average performance is a useful benchmark for advertisers, it doesn’t hold much sway with the finance team. They care about profit return but they also care about risk. By examining the proportion of campaigns by different forms of advertising that made a profit for the advertiser, Ebiquity and Gain Theory identified the relative safety of different advertising investments.

TV was found to be the medium most likely to create advertising-generated profit both in the short term and the long term. In the short term, 70% of TV advertising campaigns delivered a profitable return.

It should be noted that many of the negative profit ROIs will have come from the FMCG sector, which rarely sees a profit returned in the short-term, but the strong performance of TV, radio and print is evident.

When it comes to Online Video, the range of effects is very wide and likely a result of the mix of video formats used within the individual campaigns; campaigns that largely consist of low cost video with low view-through rates won’t perform, whilst campaigns consisting of high quality pre-roll VOD – e.g. Broadcaster VOD – that generates high view through rates will achieve better results.

Part 2: The long-term impact of advertising

Methodology

Like Ebiquity, Gain Theory conducted an analysis on their own pool of advertiser data (2014–2017, 29 advertisers across 504 campaigns). They measured the longer-term impact of the effects of advertising on the future base of sales. Using a technique called ‘Unobserved Component Modelling’, Gain Theory could model the impact of a moving base of sales. This differs from standard econometrics where the base is assumed to be flat. This analysis allows advertisers to understand the impact their advertising has in the longer-term.

It should be noted that the margins of error for this type of analysis become wider as the time-period assessed in the model becomes longer. There isn’t a perfect means to assess the effectiveness of advertising in the long term. However, by taking an aggregated view across over 500 campaigns, this analysis brings us closer than ever before to understanding how advertising drives profitability over the longer term.

(Gain Theory’s methodology is further explained in a short film at the foot of this page)

Headline Findings

By ignoring the longer-term effects of advertising, we’re doing it a massive disservice. If we rely purely on online attribution models, the impact on our planning and optimisation are severe. Just 18% of total return is visible through attribution modelling. If we optimise based on less than a fifth of our total return, we’ll hugely underestimate the potential profitability of our advertising and are likely to slash budgets to the detriment of our overall effectiveness.

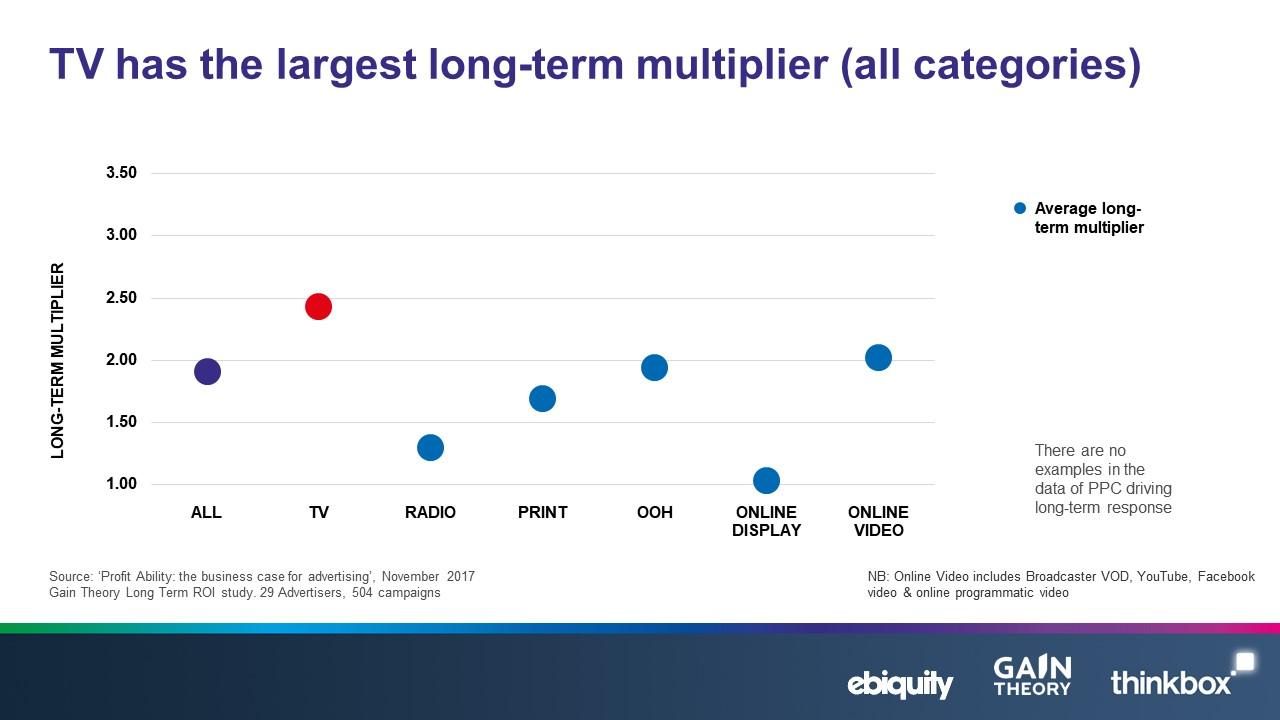

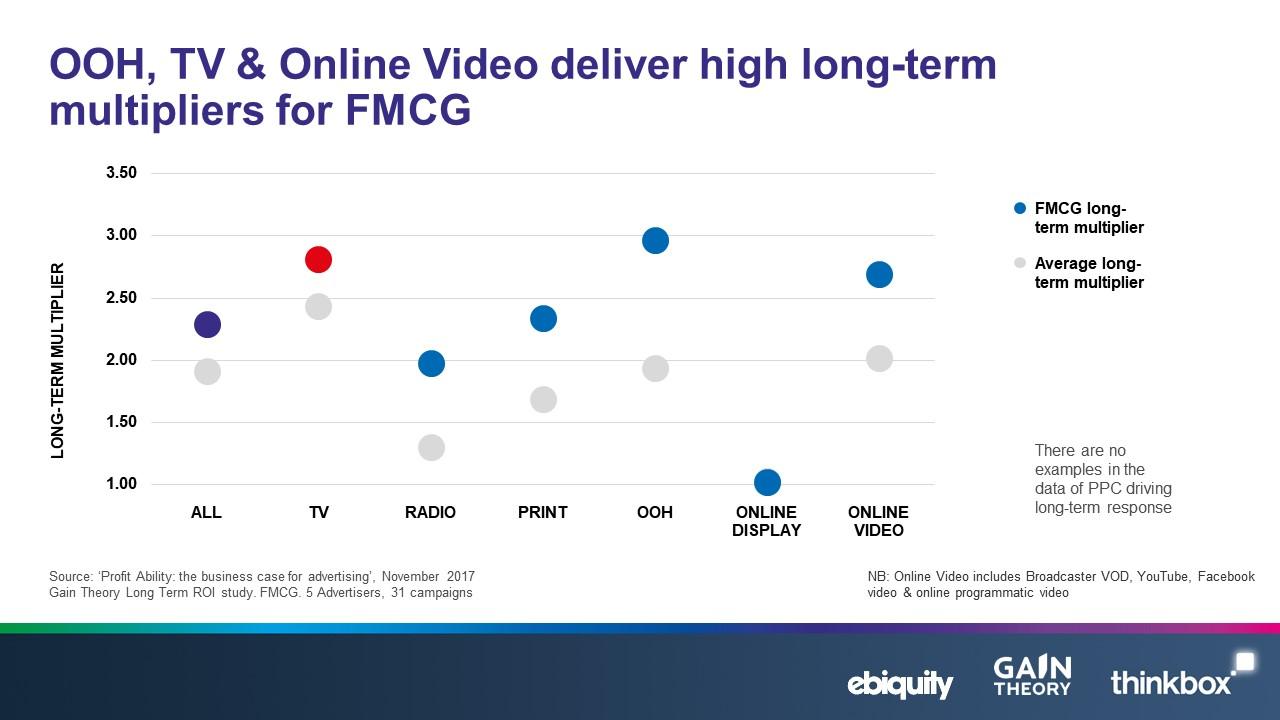

On average, advertising delivers a long-term effect that is 1.9 times greater than the short-term effect. Gain Theory’s analysis examined the ‘long-term multiplier’ to advertising impact across media channels. The long-term multiplier is a definition of how much additional impact a business can expect to see in the long term versus the short term.

Across all clients, the ‘Long Term Multiplier’ is 1.9 x the short-term effect. Put simply, if your short-term profit ROI is £1.50 for every pound spent, then you’d expect to receive £2.85 back in the long term.

TV delivers the highest ‘Long Term Multiplier’ TV had the greatest long-term multiplier with 2.4, well above the average, with online video not too far behind. This is likely to be down to the power of AV when it comes to building brands. The media that are generally used for activation in the short term (such as radio and online display) generally don’t tend to deliver any visible effect when you look beyond the early impact.

Categories which struggle to deliver short-term ROI can often see the greatest effects in the longer term FMCG, is a prime example of this. This notoriously tough category generates some of the strongest long-term effects. TV, Online Video and Out-of-Home all deliver multiplier effects of more than 2.5 times their short-term effect. This highlights the importance of looking at the bigger picture when it comes to understanding the effects of advertising on the bottom line.

TV is the safest investment for long-term profit generation. Just as in the short term, looking at total profit success during the 3 years after ad campaigns finished, 86% of TV advertising campaigns delivered a profitable return, higher than any other media investment.

The total impact of advertising. The final stage of this study was to bring together our findings to offer a more complete picture of the impact advertising has on the bottom line. Gain Theory’s analysis of long-term multipliers coupled with Ebiquity’s analysis of short-term ROI and profit volume gives us the total ROI and total profit volume generated by different forms of advertising over the longer term of 3 years.

Advertising works. The main finding is straightforward: advertising is a business investment that works. The average advertising campaign delivers a total profit ROI of £3.24. This table summarises the key findings by media channel, including total profit volumes, ROIs and profit likelihood over time.

By factoring in the long term, we found that TV advertising is responsible for 71% of total advertising generated profit at an average profit ROI over 3 years of £4.20 for every pound spent, the highest ROI of any media. TV is followed by Print (which accounts for 18% of total advertising-generated profit), Online Video (4%), Out of Home (3%), Radio (3%), and Online Display (1%). (See chart and table above, in Executive Summary).

Short-term gain can lead to long-term pain if the effects of advertising aren’t measured properly.

As we plough through this period of economic uncertainty, data that takes the bigger picture into account is crucial for holding up advertising budgets in circumstances where cuts might be executed for short-term gain.

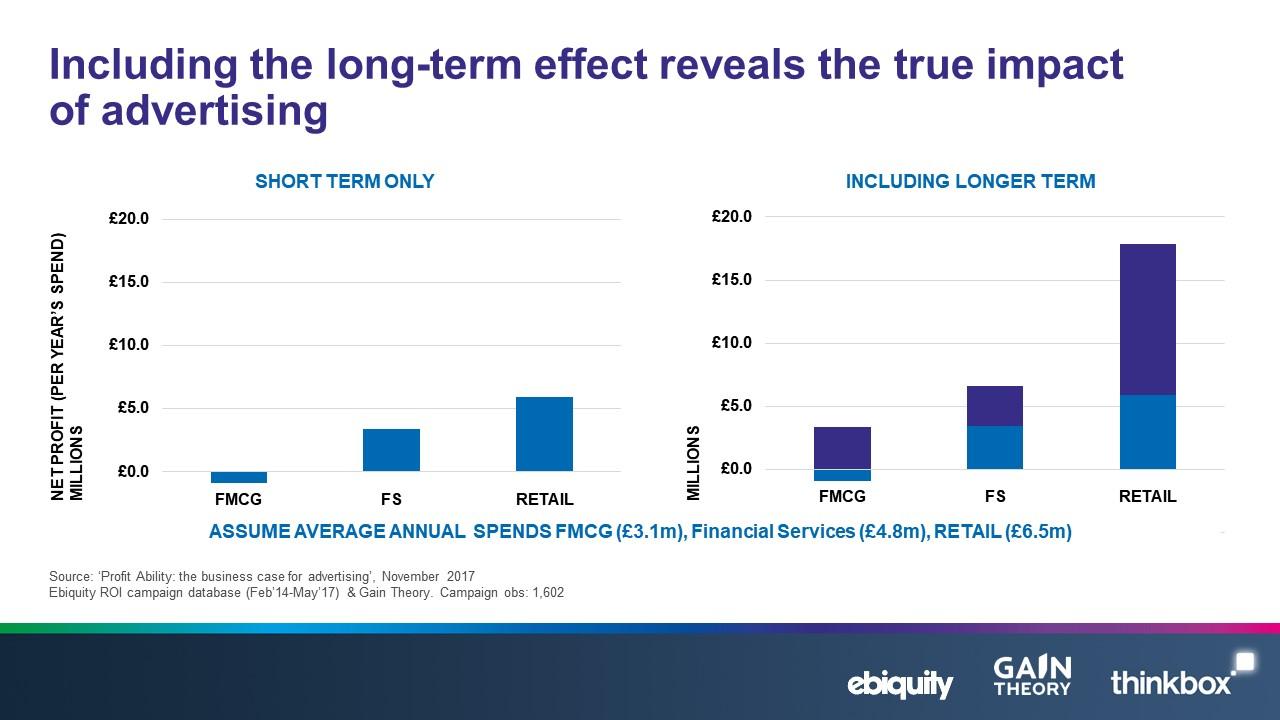

FMCG and retail are two great examples. The data reveals how FMCG brands become profitable and how vital advertising is for retail in driving high volumes of profit when you take into account the longer-term effects of advertising.

TV is the ‘safest’ advertising investment. The short-term analysis established that TV is the lowest risk investment for advertisers, with 70% of campaigns delivering profitable return in the short term (see p.16). There is an even stronger case for TV – and for some other media – once the longer term is built in.

Looking at total profit success during the 3 years after ad campaigns finished, 86% of TV advertising campaigns delivered a profitable return followed by Print (78%), Radio (75%), Online Video (67%), Out of Home (48%), and Online Display (40%).

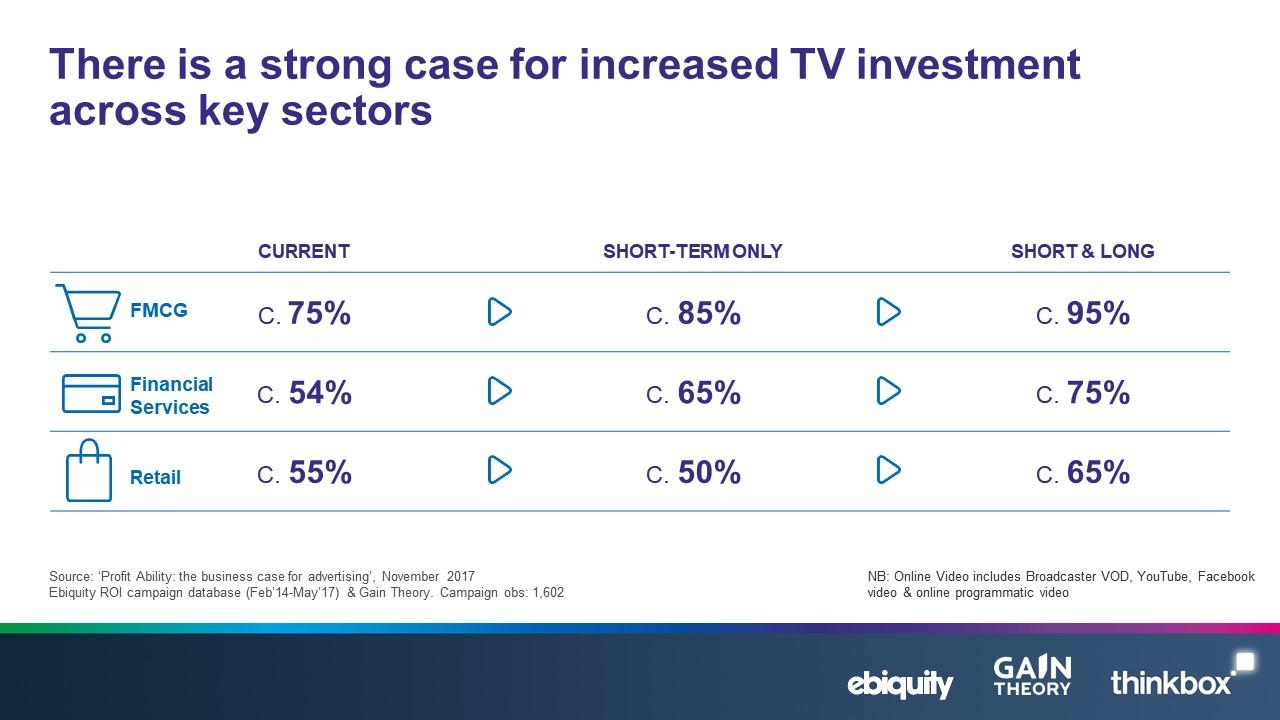

It’s time to reassess the return that advertising can generate. With this data to hand, businesses can now reassess the potential return that can be generated by different forms of advertising and optimise for the long term.

For example the study concludes that advertisers may be missing out on maximising advertising-generated profit by under-investing in TV.

Currently, TV accounts for 54% of advertising spend among Ebiquity’s database, yet it is responsible for 71% of total advertising-generated profit.

Here is Ebiquity and Gain Theory’s view of how considering long-term pay back as well as short-term payback would change the way you optimise TV spend in 3 key sectors to deliver the greatest returns to the business.

By right-sizing TV investment based on the findings in this study, there is the potential to create an additional £450m in profit. This represents around about a 12% improvement in advertising-generated profit.

What this study shows is that investment in advertising, with TV at its heart, isn’t just good for brands – it’s good for business.

Conclusion

‘Profit Ability’ has aimed to shift the emphasis away from the ROI number ‘arms race’ to a more responsible approach that talks about the scalability of ROI by media channel, and the impact that this has on profit generation. This is arguably more business-relevant.

In a world of big data and advanced analytics, the lure of the easily accessible stat or number can be overwhelming. Too often the easy measures are skewed towards the short term. One of the key aims of this study is to provide something of a correction: to move thinking and measurement from short to long term, to focus on what drives fundamental.

Methodology films

Short term

Nick Pugh, Director at Ebiquity, talks us through their data set and methodology, analysing the impact of media investment in the short-term (within 3-6 months of a campaign finishing).

Long term

Matthew Chappell, Partner, Gain Theory explains how they quantified the long term returns of advertising, and how unobserved component modelling builds on what we can learn from mix market modelling (econometrics) and attribution modelling.

Source: thinkbox.tv