As part of a continuing examination of advertising effectiveness, ThinkTV has new research findings that explore the hot topic of audience attention.

The organisation sought to interrogate video platforms and the attention they command through the lens of advertisers’ audiences and to better understand how attention contributes to brand and business outcomes

Kim Portrate, chief executive of ThinkTV, told Mediaweek: “There has been a lot of commentary around attention with claims made about, ‘my platform is bigger than your platform’. What ThinkTV has done is look at attention through the lens of the younger consumer across video platforms to gauge its impact on effectiveness.

“We then went deeper to understand younger audiences’ attention results across different devices to get richer detail for advertisers about their consumer’s behaviours. We examined the ratio of ad attention for under 40s versus time spent on video platforms.

“We wanted to understand attention from the advertiser’s perspective, to know how their customers’ attention habits differ when they are using different screens.

“From a device point of view, we found under 40s are more attentive to Connected TV than to mobiles. This was interesting because we’re often told people under 40 are on their mobiles all the time. The truth is that when you look at effective attention for younger audiences, mobile-first may not be the right path to growth.

Portrate explained: “If you look at the behaviour of under 40s on mobile, you see they are more attentive when watching BVOD advertising content on their phone versus YouTube on their phone. Yet BVOD on Connected TV is stronger again.”

The researchers then did the same analysis with Facebook.

“Interestingly, Facebook attention is negligible with under 40s, and over 40s, on any device. It is the poor cousin by a country mile to YouTube and even further away from BVOD,” said Portrate.

“We feel it is time the industry starts to look at attention through the lens of what is important to advertisers as opposed to debating each other about who has a bigger platform.”

Research findings: Grabbing the audience by the eyeballs

ThinkTV head of research Steve Weaver told Mediaweek: “It is really important for us to talk about audiences and to understand not only where they are spending their time, but what they are paying attention to.

“While there has been data on attention and attention by platform, we are yet to clearly articulate how a platform’s environment gets advertising in front of consumers in the first place. We need to do this for comparisons of attention to be made in a more meaningful manner.”

Opportunity to see advertising

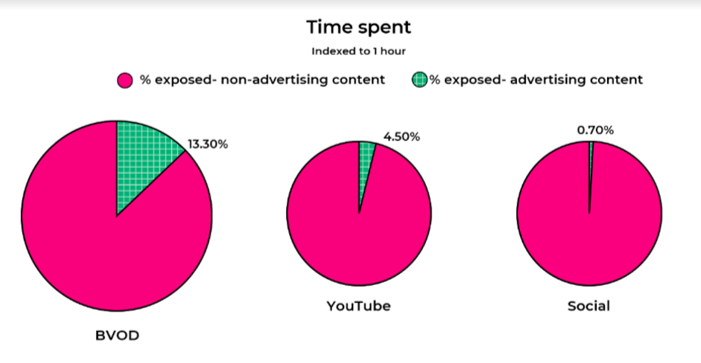

The first point the research details is advertising availability, the opportunity to see.

“Within an hour, how much opportunity to see an advertisement does a platform provide? While platform providers may say you must advertise with them because people spend so much time there, the more important question is how much opportunity is there for advertising to be put in front of that consumer to potentially look at and pay attention to?

“For a product like linear TV, it is a simple concept. Regulatory standards dictate how many minutes per hour can be shown to a consumer. So, watching for an hour will provide around 12-13 minutes of opportunity to see advertising. BVOD is similar to Linear TV. In an average hour of time spent on the platform, the audience has advertising in front of them for 13.3% of the hour which is about eight minutes.

“On YouTube, the corresponding time to see an ad in an hour is 4.5%. For Facebook, it is even smaller. Because of the way people scroll a feed, there could even be an hour where there is no opportunity to see an ad at all.”

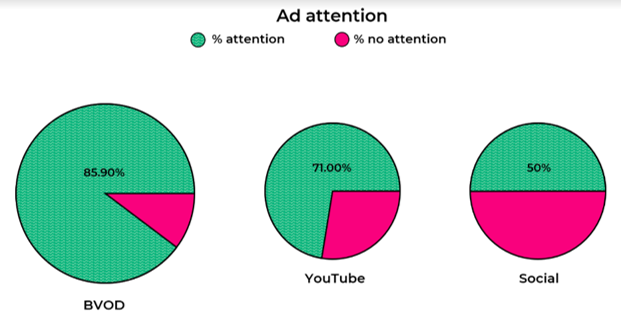

Ad attention

The research then looked at the proportion of time where people actually pay attention to an ad that is able to be seen.

Weaver said: “For BVOD, for the eight minutes that an ad was available to be seen, people had their eyes on the advertisement 85% of the time. For YouTube that dropped to 71% and for Facebook it dropped to 50%.

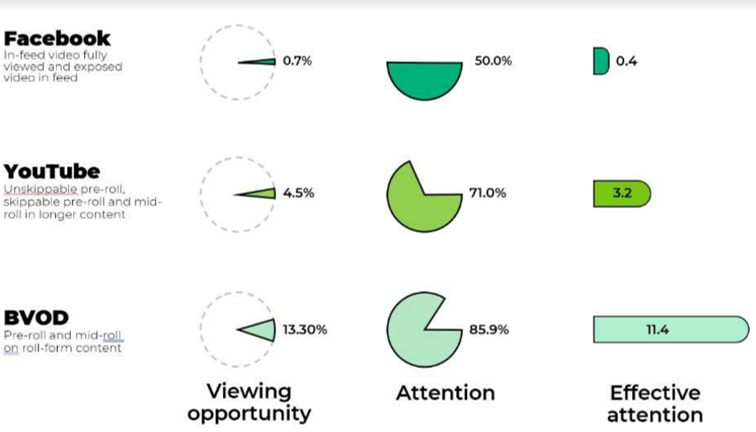

“But to better understand what was happening from an audience perspective, and to give context to the value of that audience member back to a publisher, we combined the opportunity with the attention.”

With BVOD, the availability of an ad to be seen in one hour is 13.3% while the average time people pay attention when it is viewable is 85%.

“If you combine those two numbers you get what we refer to as an effective attention score of 11.4.”

Weaver notes this is simply a calculation of 85.9% of 13.3%.

“We are using that calculation to compare audiences across platforms and screens.”

Effective attention comparison

All the different results are important, and all play a role in what will deliver an effective outcome for an advertiser, explained Weaver.

“For Facebook, they publicise the strength of their platform via mobile, but the opportunity to have advertising exposed across mobile and desktop is largely the same. There is not a lot of opportunity for the advertiser to be front and centre for an audience to look at an ad.

“It does, however, perform quite well on mobile for ad attention. Yet, given the opportunity of ad exposure is small, the effective attention it can generate is poor by comparison to other platforms.”

Next up was the Google-owned digital video platform: “YouTube on mobile has larger opportunities to get a publisher’s inventory in front of audiences, but there are quite distinct differences in ad attention. Mobile and desktop viewing is similar in terms of attention paid. But on Connected TV ad attention is very strong.”

“With BVOD it has consistent levels of attention across all screens. It does operate strongly on a mobile, and even better on other screens.”

“Consistency in the findings between attention and sales figures show TV is stronger than social and digital video platforms,” said Weaver. “As Karen Nelson-Field has said, attention is an early proxy for sales. Using our own historical sales research, we can see that seems to be the case.” Weaver was keen to point out attention does differ by platforms, screens and demos. “Our message to the industry is to make sure your media choices have the best opportunity to generate business success.”

Portrate added: “What we are trying to do is simplify things by providing an index that explains the attention of the audience.

“We want to remind people why we are all here – to get consumers to buy something from a brand. We need to put the consumer front and centre of the attention conversation.”

Source: mediaweek.com.au