One thing we can all agree on is video advertising is a highly effective way to communicate with consumers. There’s something about telling your brand’s story through emotive moving pictures and sound that packs a punch.

Despite what you might hear or read, not all video is created equal.

Total TV - that’s the combination of linear broadcast and Broadcaster Video on Demand (BVOD) - has the jump on its competitors for a host of reasons.

To save time when wondering where to invest in video advertising, we’ve gathered the top 10 reasons why Total TV is better than online video substitutes.

Total TV has unbeatable reach

Advertising 101: to build brands, you need to go big. Professor Byron Sharp says so in his book, How Brands Grow. What you want, in advertising speak, is reach. And that’s where Total TV has you covered.

Total TV reached a whopping 83.1 per cent of the Australian population each month across the first half of 2022. Meanwhile, YouTube (YT) only gets to 77.1 per cent of Aussies 14+ in an average month, according to Roy Morgan.

High-velocity reach versus fragmented audiences

Not only does Total TV reach tons of people, it does it quick as a flash.

YT, on the other hand, is too fragmented to achieve the same level of reach in a similar amount of time. The reason is because TV audiences are consolidated around channels and programs while over on YT, the sheer volume of content means fewer people are watching the same thing at any one time.

Total TV is the champion of time spent

In June this year alone, Aussies feasted on more than 1.4 billion hours of linear TV with an additional 117 million hours of BVOD each week. The consumption of BVOD shows no signs of slowing with an annual growth rate of 20.7 per cent. Meanwhile, over on YT, consumption sits at around 30 million hours a month, according to data from Roy Morgan.

There’s more opportunity to see with Total TV

For every hour your audience consumes video, realistically, there’s only a percentage of time when they will be exposed to ads. For linear broadcast TV, regulations cap this at 12 to 15 minutes of ads per hour. For BVOD, 13 per cent of each hour offers up the opportunity to see ads. Compare that to YT where the opportunity to see is a teeny tiny 4.5 per cent.

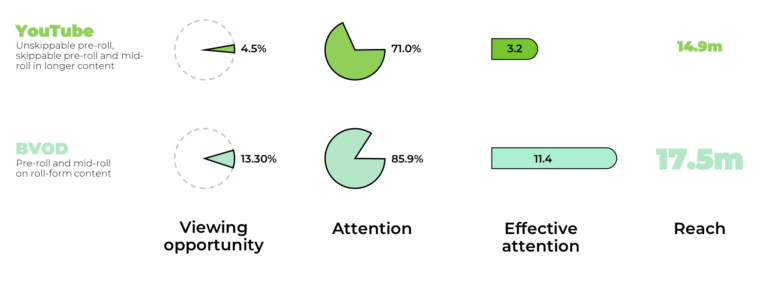

BVOD commands more attention than YouTube

If you want to compare apples with apples, there’s no better comparison than the attention paid to ads on BVOD versus YT.

Research lab MediaScience studied eye tracking, biometric and galvanic skin responses of audiences when they consumed BVOD versus YT and found when ads are in front of a viewer, the attention level is much higher for BVOD than YT.

How much higher, you ask? Well 86 per cent of the time, people are paying attention to the ads on BVOD versus just 71 per cent for YT.

Total TV commands more in-home viewing than YT

TV is the king of at-home video viewing, according to OzTAM data, with Total TV commanding 74.7 per cent of in-home viewing while social video only captures 9.9 per cent.

And it’s the master of advertising-supported at-home viewing

If we’re talking ad-supported in-home video - the kind that matters to advertisers the most - we’re looking at 88.3 per cent for Total TV and only 8.4 per cent for YT.

Ads on Total TV are more effective

If you bundle all this up: the opportunity to see ads, the attention paid to them and the reach, the end result is ads on Total TV are better remembered compared to YouTube.

Research by MediaScience found a 27 per cent uplift in the memory of ads on BVOD versus YT with BVOD clocking 52 per cent versus just 41 per cent on the tube of you.

And if the video you are watching on YT is short (think less than 10 minutes), the memory comparison swings even more in BVOD’s favour with BVOD boasting 52 per cent memorability versus 35 per cent for YT. That’s a 49 per cent uplift.

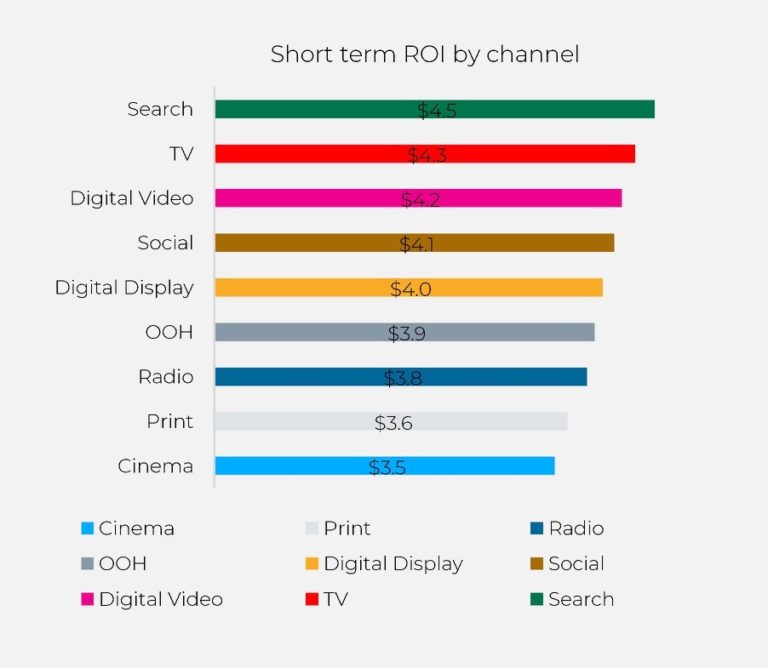

Better ROI

YT is often used for short-term activation style campaigns so you’d want it to deliver superior short-term ROI.

Calling on three years of campaign data from GroupM, the Media Engine has crunched the numbers on how it fares over a three-month period. While YT returns $4.20 for every dollar spent, Total TV returns $4.30. And if you look at long-term ROI - aka, campaigns running over 6 months or more - TV has no peer returning $18.30 for every $1 spent versus $13.20 for social video.

Total TV gives you more opportunity to scale

If you run a video campaign that’s a success, you’re going to want more. If you’re on a good thing, stick to it, right? But depending on the platform, it may not be possible to scale up if you want to take it to the next level.

The reason for this is diminishing returns. Our friend the Media Engine has crunched the numbers on this too and what it found was if you try to spend more on YT to build reach, you’ll blow your frequency and instead get diminishing returns.

Total TV, on the other hand, offers far greater scale with return remaining strong for longer than any other video format.

Source: mumbrella.com.au