These are the findings of a study by Hub Entertainment Research entitled TV Advertising: Fact vs. Fiction, which was conducted among 3,000 US consumers (14-74 years old) who watch at least one hour of TV per week. Hub Entertainment Research focused on several important questions in the survey:

- How much tolerance exists for ads? And how have viewer attitudes shifted over time?

- What is the impact of advertising strategy? What effects do delivery factors have on engagement?

- How do platforms compare? Which platforms are offering a great ad experience?

- What is the impact of live ads? What effects does the way of viewing have on ad tolerance and engagement?

The study aimed to help streaming services, media agencies, advertisers and distributors better understand how to present advertising that increases viewer engagement and satisfaction with streaming video. What are the key findings of the survey?

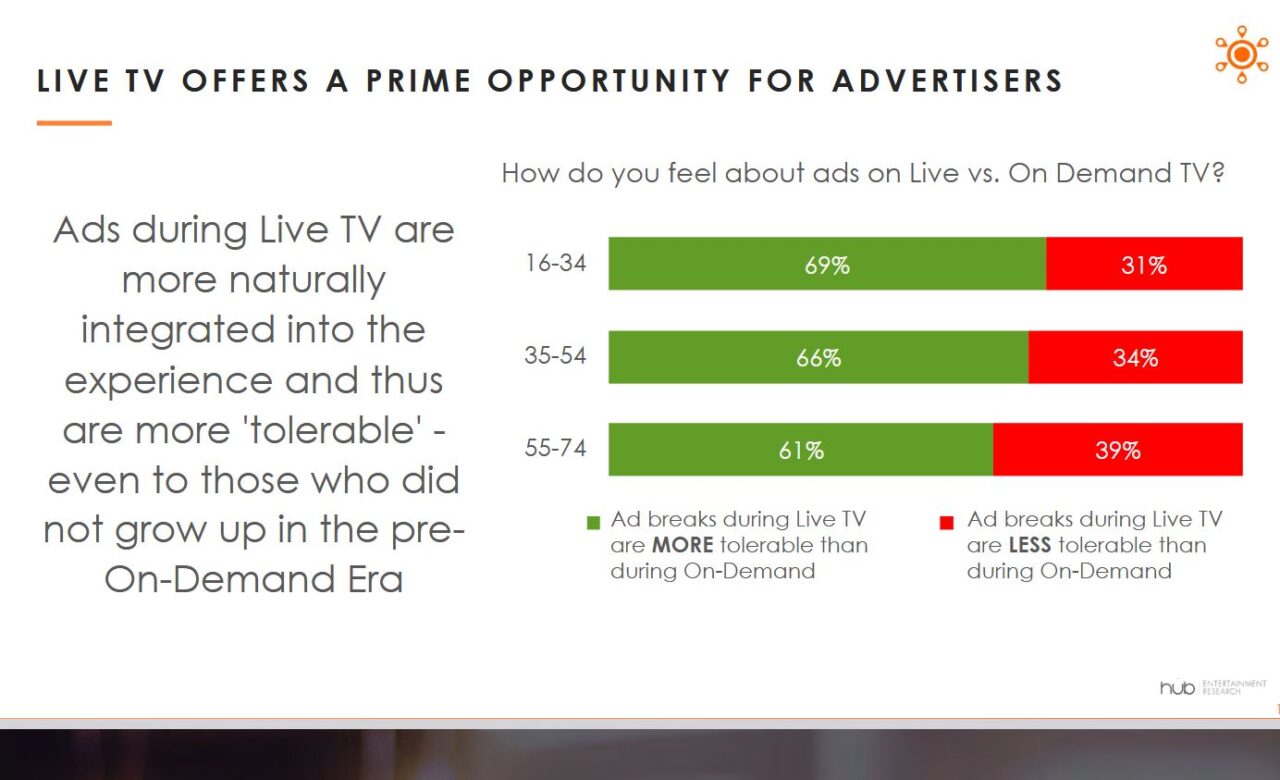

Nearly two-thirds of viewers see live TV advertising as more tolerable

Interestingly, 66% of respondents labelled ads during live-streamed events as “more tolerable” than ads that appear during on-demand content. That’s especially notable as the study found live-streamed events account for roughly one third of overall viewing time.

The acceptance of live-streaming ads was even greater for younger viewers. Of viewers aged 16-34, 69% said that ads during live TV were “more tolerable” than ads placed in on-demand content. When it came to viewers aged 35-54, 66% of respondents agreed with that statement, while 61% agreed in the 55-74 age range.

Source: Hub Entertainment Research

Source: Hub Entertainment ResearchAd breaks during live TV give many viewers a welcome opportunity to take a break during the programme. Over half of participants even agreed with the statement: “Ad breaks during Live TV give me a chance to take a break.” Especially for live sports broadcasts, ads are seen as part of the regular rhythm of the event.

There are also some interesting data on audience attention. Offering incentives to watch advertising is the best way to get it, with 50% of respondents citing this as a successful tactic. This is closely followed by measures to limit ad load: shorter ad breaks (49%), shorter ad length (47%) and running a single ad during a break (46%).

Ads requiring viewer engagement had lower scores. Games, interactive ads and ads containing product links were rated as likely to engage viewers by only 31%, 22% and 21% of respondents, respectively. Ads with a pause also had low ratings, at 23%.

The main way to attract viewers’ attention is to present fewer ads in shorter breaks.

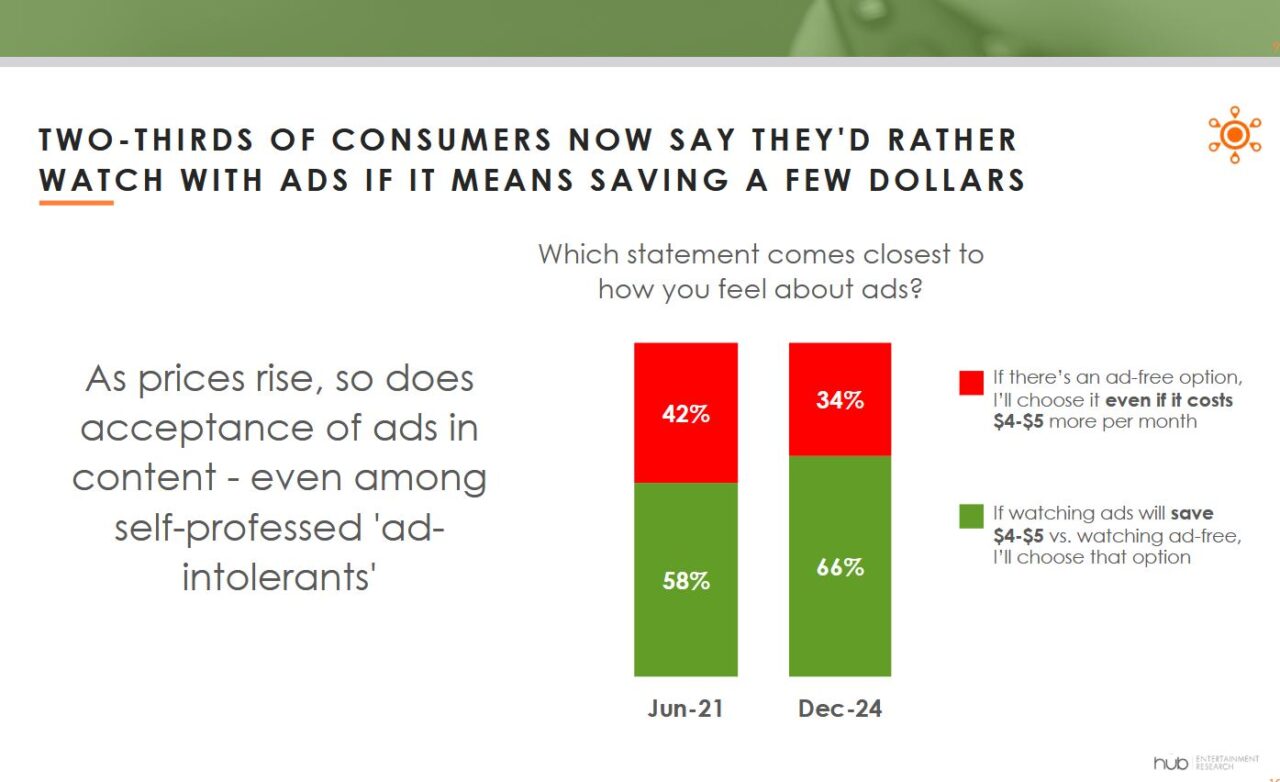

Accepting ads in exchange for a reduced subscription fee

With more and more TV services introducing ad-supported offers, viewers are gradually getting used to and accepting this reality. The number of consumers who say they do not tolerate TV advertising is decreasing. Two thirds of consumers are open to watching advertising if it reduces their subscription costs, while acceptance by viewers who ‘hate’ advertising has increased from 30% to 42% in three years.

Source: Hub Entertainment Research

Source: Hub Entertainment Research“Over the past three years, it’s clear most viewers prefer watching ads if they can save on TV subscriptions. More recently, we’re seeing that even the most ad-intolerant consumers are deciding the trade-off of watching ads for lower costs is worthwhile,” said Mark Loughney, Hub Research senior consultant. “There is plenty of good news here for streaming services and their advertisers. Most consumers think the amount of advertising is reasonable, especially in live viewing. As streamers add more live content, especially sports, advertisers will have greater opportunities to reach more viewers who are paying full attention to their messages.”