While many of the points raised in the series – that video enables an ‘audience-first’ approach, it attracts and converts the attention of consumers and allows brands to move consumers through the funnel – are true, to suggest only YouTube (YouTube) delivers this is, at best, cheeky and, at worst, untrue.

Research has long shown that video is effective for brands but not all video is equal so how does YouTube stand up against TV? Let’s look at some independent, third-party verified research to find out.

Audience first approach

To be successful advertisers need to follow the audience. And according to YouTube, that means advertising with them. But independently audited, publicly available OzTAM data suggests otherwise.

Unverifiable walled garden data suggests YouTube reaches around 20 million Australians a month. But OzTAM data shows Total TV can achieve that in a week.

And the velocity of the reach differs. While TV offers single-spot mass audiences, YouTube relies mostly on a cumulate build over time.

Take the example of the recent State of Origin broadcast which reached 6.1 million people and almost 1 million on Broadcaster Video on Demand (BVOD) alone.

The BVOD portion is key because it extends the reach of TV programs over multiple screens and devices. The latest reported week of viewing in VOZ shows 27 per cent of the population uses a BVOD service to view television.

Reaching under 44s

According to YouTube, to reach people under the age of 44 there’s only one place to be. Yet publicly available VOZ data again shows this isn’t the case.

Under 44s continue to watch Total TV, with an increasing amount watching via streaming and on-demand. In the last week of May, VOZ shows us that almost 5.5m 16-to-39-year-olds were watching their favourite TV programs.

Targeting capabilities

YouTube reckons it has cornered the market on targeting, but do you know what one of the most purchased target audiences is for digital buys? Demos.

Demos have long been TV’s bread and butter. And these days, Australian broadcasters also have a wealth of first-party data sets that allow for deeper granular targeting.

Whether you’re after demo, category or context, partnerships with the likes of FlyBuys, Ticketek, Mastercard, Quantium, Red Planet and Equifax mean broadcasters have some of the most enviable data-led targeting available in-market.

Attract and convert attention

As academics such as Professor Karen Nelsen-Field and Dr Duane Varan have shown, not all video is created equal with attention-based reach differing dramatically by platform.

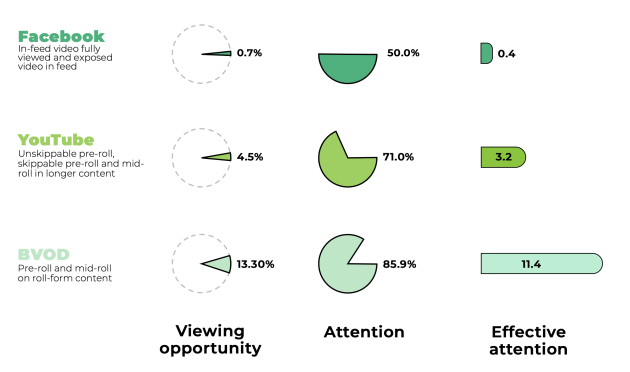

You could sum it up with this handy little formula: Reach x viewing opportunity x attention paid = platform effectiveness

Even with YouTube’s true-view options in-feed, in-search, in-display, mastheads, and bumpers, the opportunity for consumers to view ads remains limited.

For every hour of video consumed, only a percentage is given over to advertising. Available ad exposure time, or the amount of time consumers have an opportunity to see your brand, for broadcast TV is between 12 to 15 minutes of ads per hour. For BVOD it’s 13 per cent of each hour and for YouTube it is a teeny tiny 4.5 per cent.

Research lab MediaScience studied eye tracking, biometric and galvanic skin responses of audiences when they consumed BVOD versus YouTube and found when ads are in front of a viewer, the attention level is much higher for BVOD. In fact, 86 per cent of the time, people are paying attention to the ads on BVOD versus just 71 per cent for YouTube.

Short- and long-term business results

Now that we’ve got the basics back on track, we can look at the real reason advertisers choose video – to drive business results. Let’s start at the top of the funnel.

Analysis of 179 real-world campaigns by Kantar found that YouTube pales in comparison to Total TV when it comes to driving brand awareness, the first step on the path to purchase for many consumers.

And while Total TV is a good channel for branding, it’s also a powerful driver of bottom-of-the-funnel activation and performance campaigns, dwarfing the impact of YouTube despite the strong (perceived) performance of the platform.

As the consumer comes closer to purchase, retailers and e-commerce businesses have long used TV, in some form, to capture demand and drive acquisition.

While YouTube suggests it delivers superior search results compared to other channels, econometric modelling has proven TV’s unrivalled ability to drive search for e-commerce businesses like Australia’s tradie marketplace hipages.

Independent research by KPMG reinforces this. It found TV delivered a 39 per cent increase in branded search clicks. Likewise, MasterChef’s promotion of purple cauliflower for Coles got cash registers ringing increasing sales by an unfathomable 430 per cent.

What about ROI?

As brands look to move consumers through the path to purchase, ROAS (return on ad spend) needs to be front and centre in media choices.

Data from the Media Engine, powered by three years of raw sales and campaign data across 10 categories and 60 brands, shows that TV, BVOD, and premium video have significantly higher ROI than other channels including YouTube.

While YouTube makes a compelling argument for its long and short-term capabilities, once again independently verified and publicly available data shows not all video is created equal. Total TV remains the master of effectiveness in the videoverse, no matter which part of the funnel you’re looking at.

Source: adnews.com.au