The Czech pay video-on-demand (SVOD) market may continue to grow in the next few years, at least until 2030. Lucie Oravčíková, digital director of the Nova Group, said this at a discussion held during this year's Karlovy Vary Festival (KVIFF). According to her, Nova is based on developments abroad and estimates that the Czech market is ten years behind the development of VOD in the US market and five years behind the Western European market.

"Penetration of SVOD services varies between countries, with 75% of the population in the US now having at least one service. In the Czech Republic it is 38%. While in America there has been market stagnation or a subtle decline in the last 2-3 years, nothing like that is coming in the Czech Republic. We expect the growth trend in our country to remain until penetration reaches 50%, which we predict will happen in 2030," she described. As penetration increases, the number of SVOD services per household is also expected to increase. This currently stands at 1.8 in the Czech Republic (source: Ampere Analysis), compared to 2 or more in Western Europe (exceeding 3 in Scandinavia). Nova estimates that in 2030 the number of services per household could be 2 to 2.5 in the Czech Republic.

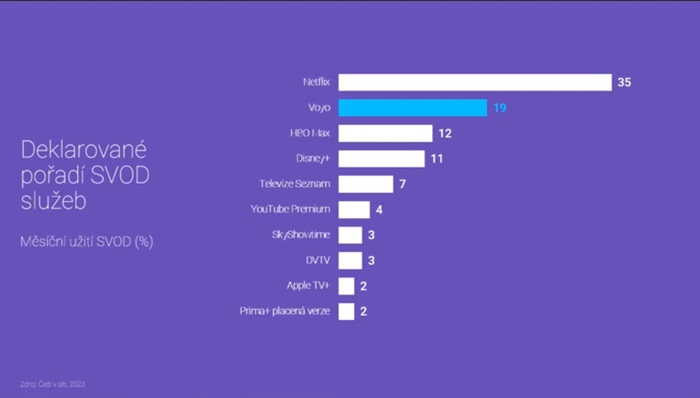

The local paid VOD service Voyo, which Nova operates, has become the second most used paid VOD service in the Czech Republic after Netflix, according to Kantar 's Czechs in the Net 2023 research. HBO Max and Disney+ are the top three and four respectively. Monthly usage of Netflix in 2023 was 35%, while Voyo and HBO Max were 19% and 12% respectively. Compared to 2021, Voyo grew the fastest, almost quadrupling.

According to Lucie Oravčíková,Voyo currently has more than 850,000 subscribers in the Czech Republic and Slovakia and is on track to meet its operator 's target of one million subscribers by 2026. At the same time, the average time users spend on Voyo is also increasing. The weekly average this year is almost 14 hours, compared to less than 8 hours in 2020.

Declared ranking of SVOD services (%), source: Czechs in the Net 2023, Kantar. From L. Oravčíková's presentation at KVIFF

Declared ranking of SVOD services (%), source: Czechs in the Net 2023, Kantar. From L. Oravčíková's presentation at KVIFFAccording to Kantar managing director Petra Průšová, the growth of the video-on-demand market has not stopped after covid. The Czechs on the Net study shows that 49% of the population used VOD weekly last year, which was 14 percentage points higher than in 2021. But she pointed out that only half of VOD viewers pay for their own viewing access. "A quarter of users watching VOD have someone else's subscription and the other quarter share accesses," she added.

Ivo Andrle, CEO of the Kviff.tv platform, and Eva Pjajčíková and Diana Tabakov from iVysilani.cz spoke about services aimed at selected audience groups. While Kviff.tv targets film fans, to whom it wants to present selected film content according to qualitative criteria, Czech Television is working with iVysíání to reach different audience groups, now especially young adults who do not watch linear television as much. "We are not increasing the amount of content for the dominant target group, but we are looking for the least affected target groups and trying to create additional content for them," they said. The range of shows on iBroadcasting.com is intended to work with a "public service algorithm" that does not aim to enclose users in a "single bubble".

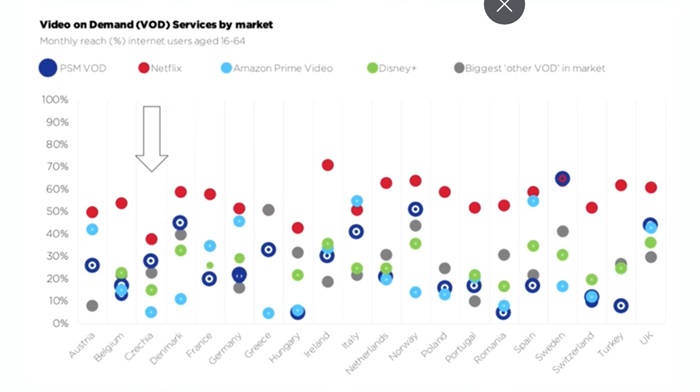

Data from the EBU (European Broadcasting Union) shows that in the 16-64 age group, iVysilani is close to Netflix in monthly reach per user (iVysilani.cz is free to access, not via subscription, ed.), but in the younger 15-24 age group, the distance between Netflix and iBroadcasting is greater, and iBroadcasting is on a comparable level to Disney+ in this category. A comparison of VOD usage in the Czech Republic with other countries also shows that the Czech market is more conservative and "TV-like".

Use of VOD services in different countries. Source. Grey colour = in the case of the Czech market Voyo

Use of VOD services in different countries. Source. Grey colour = in the case of the Czech market VoyoThe Kviff.tv platform, which merged with Aerofilms following Rockaway 's entry into the Karlovy Vary festival, profiles itself as a niche market service, which it sees as its advantage. "The advantage of our customers is their loyalty, which is linked to a consistent supply of quality films. Kviff.tv does not exist alone, it is part of a world where the Kviff brand is worked with all year round and in different variations," Ivo Andrle explained. The community that Kviff.tv builds manages to double every year, he added. Most recently, distribution has expanded with the linear Kviff.tv Channel, which has been available to tune into Vodafone TV since the beginning of July.

Source: mediaguru.cz