The streaming world, which has been the subject of so much attention in recent years, will face new challenges. While the number of people streaming is still increasing, albeit at a lower rate than in previous years, streaming companies are having more difficulty getting people to pay more for their services. With the growing number and scope of streaming services, a form of market saturation has begun to take hold. Global subscriptions to over-the-top (OTT) video services will grow to $2.1 billion in 2028 from $1.6 billion in 2023, representing a 5.0% CAGR (compound annual growth rate). However, global average OTT video subscription revenues will increase only slightly: from USD 65.21 in 2023 to USD 67.66 in 2028, according to a new PwC report on the media and entertainment industry trends from 2024-2028.

The stagflation effect is already forcing leading streaming companies to change their business models and find new sources of revenue beyond subscriptions, according to PwC. As a result, the big global players (Disney+, Netflix and Amazon Prime Video) have already introduced "hybrid subscriptions" where viewers watch a certain amount of advertising. The introduction of the ad-supported viewing option is often accompanied by other measures to increase revenues. These include restrictions on password sharing or investment in additional content such as live streaming of sporting events. The aim is to attract subscribers and advertisers.

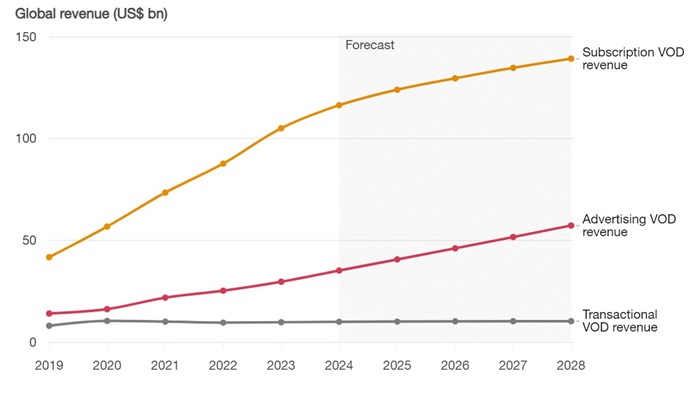

PwC therefore forecasts that subscription revenue growth (SVOD) will plateau and that, in contrast, global VOD advertising revenue (AVOD) will continue to grow at a double-digit rate (CAGR of 14.1%) until 2028. By 2028, advertising will account for around 28% of global streaming revenue, up from 20% in 2023.

Streaming revenue trends to 2028: subscription (SVOD), advertising (AVOD) and transactional model (TVOD); Source: PwC

Streaming revenue trends to 2028: subscription (SVOD), advertising (AVOD) and transactional model (TVOD); Source: PwCThe business model transformation within OTT services also includes consolidation activities. In mature markets, operators are returning to bundling and major players are reviving the types of offerings familiar from cable. In the US, Disney and Warner Bros. Discovery (WBD) have teamed up to offer a package consisting of Disney+,Hulu, Max, and Disney, WBD and Fox Corp. have launched a "live sports package" called Venu Sports. Comcast, in turn, is offering its TV and broadband customers a service called StreamSaver, which combines Peacock, Netflix, and Apple TV+.

Source: mediaguru.cz