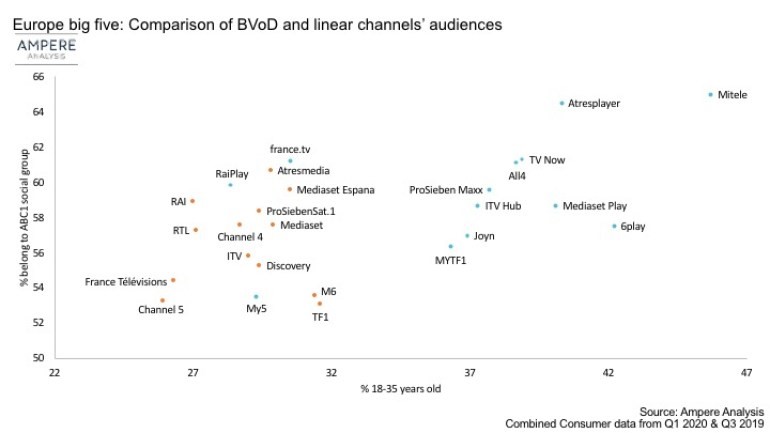

A new study by Ampere Analysis has found that broadcasters’ VOD audiences tend to be both younger and more affluent than those watching linear television. This has contributed to an increase in digital only commissions.

Ampere believes investment in online services is essential to ensure that commercially funded groups can offset the anticipated declines in broadcast revenue resulting from the ongoing transition to online viewing.The problem for broadcasters is that their share of the advertising cake was in decline even before the coronavirus crisis. Ampere does not expect ad funded online video revenue to offset the systematic decline in linear advertising revenue in the near term.

“Broadcaster Video on Demand (BVoD) platforms were initially designed for TV catchup viewing, but in recent years broadcasters have been investing in technical enhancements and original content to beef up their services to attract a young demographic,”

said Léa Cunat, Senior Analyst, Ampere Analysis. “We anticipate that the shift to digital marketing will be accelerated if the behaviours consumers have adopted during lockdown persist following the reopening of economies.”

Ampere points to BVoD users are generally younger and more affluent than those of linear television. It says that European services such as the ProSiebenSat.1 and Discovery platform Joyn and France Télévisions, where 30% of its new shows are destined for VOD are leading the way.

The UK is listed by Ampere as Europe’s leading BVoD market, although the most popular service is BBC iPlayer which is ad-free. ITV Hub, All4 and My5 are the leading ad supported platforms in the local BVoD market with a heavy focus on catch-up, although Channel 4’s platform All4 continues to promote a deep catalogue of boxsets.

Source: broadbandtvnews.com